Discover How to Apply for the Zilch Credit Card Online Today

In today’s fast-paced world, managing your finances can feel overwhelming. With a plethora of options available, finding the right tools to help you navigate your financial journey is essential. One innovative solution stands out, promising to enhance your purchasing power while offering flexibility and control. This approach caters to those who value convenience and seek to simplify their spending habits.

Imagine having a versatile instrument at your disposal that allows you to make purchases instantly, without the need for physical cash. This modern alternative not only helps in budgeting but also rewards responsible usage. It’s an empowering choice for anyone looking to make smarter financial decisions, enabling them to take charge of their economic future.

With the digital landscape evolving, the process of obtaining such a financial tool has become remarkably straightforward. You can seamlessly navigate the necessary steps from the comfort of your own home, eliminating the hassle of traditional methods. As we delve into the details of this innovative option, we’ll uncover the benefits, requirements, and everything else you need to know to get started on your path to financial empowerment.

Benefits of Using Zilch Credit Card

Exploring the perks of utilizing an innovative financial solution can unveil numerous advantages that enhance your purchasing power. This option allows you to manage your expenses more effectively while enjoying various rewards and conveniences that traditional methods simply can’t match.

One of the standout features is the seamless integration with your digital life, making it easy to track spending in real-time. This capability keeps you informed and helps avoid unpleasant surprises when the bill arrives. Additionally, many users appreciate the flexibility in repayment, which makes budgeting smoother and less stressful.

Moreover, rewards programs tailored to your purchasing habits can significantly boost the value you receive from everyday transactions. Whether earning points on groceries, dining out, or shopping, these benefits translate into savings or special offers that can enhance your lifestyle.

Another notable aspect is the enhanced security measures that provide peace of mind. With robust fraud protection, users can feel confident knowing their financial information is safeguarded, allowing for worry-free shopping experiences. Overall, embracing this modern financial tool can lead to a more rewarding and enjoyable way to manage your finances.

Step-by-Step Application Process Online

Navigating the process of securing a financial tool through the internet can seem daunting at first. However, once you break it down into manageable steps, it becomes a straightforward experience. Here’s how you can smoothly move from start to finish in obtaining this financial option.

- Research Your Options:

Before diving in, it’s wise to explore the different alternatives available to you. This helps you choose the one that best fits your financial lifestyle.

- Gather Required Information:

Having your personal details handy is crucial. Prepare the following:

- Name and address

- Date of birth

- Social security number

- Income details

- Employment information

- Visit the Website:

Head over to the provider’s official site where you’ll find a dedicated section for registration. Make sure you’re on the right site to ensure security.

- Fill Out the Form:

Once you’re on the appropriate page, you’ll find a form. Carefully provide the information requested. Take your time to avoid any errors.

- Review Your Submission:

Before hitting that submit button, double-check all the details. Accurate information increases your chances of a successful outcome.

- Await Confirmation:

After submitting, patience is key. You’ll receive a confirmation email or notification shortly. If selected, further instructions will follow.

- Follow Up:

If you haven’t heard back within the specified time, don’t hesitate to reach out to customer service for an update on your status.

Following these steps will ensure a smooth journey towards obtaining your desired financial service, making it easier for you to manage your finances effectively.

Understanding the Benefits of the Zilch Payment Solution

In today’s fast-paced world, having a convenient method to manage your transactions is vital. This offering brings a fresh approach to handling purchases, making it easier for users to enjoy a range of features designed to enhance their financial experience. Let’s dive into what makes this option unique and how it can simplify your spending habits.

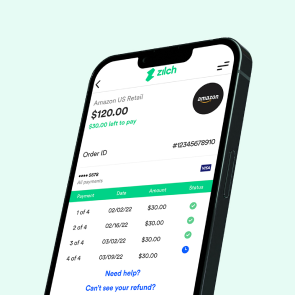

One of the standout aspects is the flexibility it provides. Users are given the freedom to split their payments, allowing them to manage their finances without overwhelming themselves. This feature makes it more manageable to afford larger expenses by breaking them down into smaller, manageable installments.

Moreover, this solution often includes a rewards program, which adds value to every transaction. Users can earn points or cashback on their purchases, turning everyday spending into a rewarding experience. It’s a great way to get something back for what you normally buy.

Security is another crucial benefit. With advanced encryption and fraud protection measures, users can shop with confidence, knowing their financial information is safeguarded. This peace of mind is essential for anyone making transactions in an increasingly digital landscape.

Lastly, the user-friendly application process means getting started is straightforward. With just a few clicks, individuals can set themselves up for a hassle-free way to spend and manage their finances, making it a desirable option in the modern marketplace.