A Comparative Analysis of Z Spread and Credit Spread in Fixed Income Securities

In the world of finance, distinguishing between various measures of risk and return can be quite the challenge. Investors often find themselves navigating a complex landscape, trying to gauge the profitability of different instruments. Two essential tools in this analysis are the concepts that reflect the additional yield an investor might expect over a benchmark rate. While they might seem similar at first glance, the nuances that separate these two metrics can greatly impact investment decisions.

By exploring the differences between these two concepts, investors can enhance their understanding of how different types of securities perform in the market. Each metric offers unique insights into specific financial situations, helping to uncover opportunities and risks that may not be immediately apparent. Grasping these distinctions is crucial for anyone looking to optimize their investment strategy and improve overall portfolio performance.

In this article, we will delve into the characteristics of each approach, examining how they relate to one another and their implications for investors. Whether you’re a seasoned trader or just starting your journey in finance, understanding these tools will equip you with the knowledge needed to make more informed decisions in your investment endeavors.

Z Spread Explained: Key Concepts

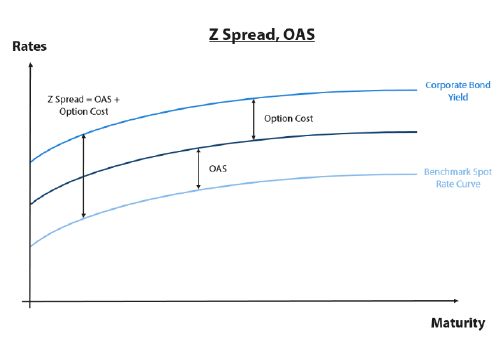

When diving into the world of fixed-income investing, one concept that often comes up is the Z spread. It’s a critical measure that helps investors gauge potential returns while considering the inherent risks associated with different bonds. Essentially, this metric provides insight into how much additional yield can be expected compared to risk-free alternatives, taking into account various cash flows over time.

The Z measure takes into consideration the present value of a bond’s cash flows, which includes both coupon payments and the principal return at maturity. By calculating the difference between the yield of a bond and the benchmark rate, typically the yield curve derived from government securities, investors gain a clearer picture of the additional compensation for bearing credit risks. This becomes particularly useful when examining bonds that may have features such as call or put options, as it reflects adjustments for the timing and probability of these events.

Understanding this metric can enhance investment strategies by allowing for more informed decision-making. Investors can assess whether a specific bond is worth the extra risk or if they should stick with safer options. By analyzing the Z value in conjunction with other financial indicators, one can form a robust perspective on a bond’s potential value within a diversified portfolio.

Understanding Credit Spread Variations

When diving into the world of fixed income securities, it’s crucial to grasp the nuances that differentiate the yield differentials associated with various issuers. These differences can reveal insights about an issuer’s risk and market conditions. It is fascinating how certain elements can influence the perception of risk and thus affect the yields investors expect to receive.

Variations in yield discrepancies often arise from multiple factors such as the issuer’s creditworthiness, market sentiment, and macroeconomic trends. For instance, a healthier economy might tighten yields for safer assets while causing an uptick in returns for riskier offerings. Conversely, in a downward market shift, we typically see these assessments reverse, affecting how attractive certain assets become to investors.

Another aspect to consider is the maturity of the securities. Longer maturities generally expose investors to greater uncertainties, leading to wider yield discrepancies as a form of compensation for the added risk. The nature of the underlying assets also plays a role; for example, differences in collateral quality can substantially influence the return expectations. Understanding these variations can vastly improve one’s investment approach and decision-making.

In summary, getting to grips with the intricacies of yield differentials is essential for anyone engaging with fixed income instruments. Recognizing how various elements interact helps investors navigate risks and opportunities more effectively, ultimately leading to smarter investment choices.

Implications for Bond Investors

Understanding the differences between various types of risk premiums is crucial for bondholders looking to navigate the complex landscape of fixed-income investments. These measures help investors assess potential returns relative to the inherent risks of different securities. By grasping these concepts, one can make more informed decisions, ultimately leading to better portfolio management.

When evaluating investment opportunities, one must consider how these metrics reflect the issuer’s creditworthiness and overall market conditions. A more significant difference may signal heightened risk, prompting investors to reassess their exposure to certain bonds. This can lead to a strategic reevaluation of the bond portfolio to optimize returns while minimizing potential losses.

Moreover, changes in these measures can influence market sentiment and liquidity. Investors should remain vigilant to shifts in these indicators, as they often serve as early warnings for potential market volatility. By keeping a pulse on these developments, one can react more timely to changes in market dynamics.

For those focused on long-term gains, a thorough understanding of these indicators can add depth to investment strategies. By recognizing the nuances of each bond’s characteristics, investors can better align their financial goals with appropriate risk levels. Ultimately, knowledge of these measures fosters a more resilient and adaptive investment approach.