The Impact of the Yom Kippur War on Global Oil Prices and Market Dynamics

Throughout history, significant geopolitical events have produced rippling effects across various sectors, particularly in the realm of energy resources. The intertwining of military actions and the global economy often leads to substantial shifts in commodity markets. This discussion aims to explore how specific historical confrontations have influenced the valuation of energy, further shaping the landscape of international trade and economic stability.

One cannot overlook the role of such events in creating uncertainty among investors and stakeholders. The fluctuation in demand and supply due to regional conflicts often triggers a domino effect, creating a cascade of reactions that alter market dynamics. By examining these instances, we can gain a clearer understanding of how turmoil can reverberate far beyond the immediate combat zones, affecting industries and consumers worldwide.

The relationship between conflict scenarios and energy valuation is complex and multifaceted. It encompasses not only immediate responses from market participants but also long-term ramifications that might persist long after the cessation of hostilities. This exploration invites a closer look at the historical consequences of such events, providing insights into how they have molded economic landscapes and influenced energy consumption trends globally.

The Impact of the Conflict on Energy Markets

During a significant military confrontation in the early 1970s, the energy landscape underwent dramatic shifts. This conflict not only reshaped regional dynamics but also had a profound effect on global energy trade and consumption. The events that unfolded led to a re-evaluation of supply chains and highlighted the vulnerabilities within energy markets.

Here are some key influences on energy markets that emerged from this pivotal moment:

- Supply Disruptions: As tensions escalated, several producing nations leveraged their power, resulting in interruptions to regular supply.

- Market Reactions: Traders and investors reacted swiftly to the unrest, leading to volatility and uncertainty in energy valuations.

- Strategic Reserves: Countries began to reconsider the importance of maintaining strategic reserves to safeguard against potential shortages.

- Dependency Shifts: Nations reevaluated their reliance on certain suppliers, prompting a diversification of energy sources.

- Long-Term Strategies: The conflict spurred governments and corporations to formulate long-term strategies, placing renewed focus on alternative energy solutions.

In essence, the military clash served as a wake-up call for the global community, revealing how interconnected and fragile the energy framework truly is. While the immediate aftermath involved turbulence and adjustment, it ultimately paved the way for essential discussions on energy independence and sustainable practices.

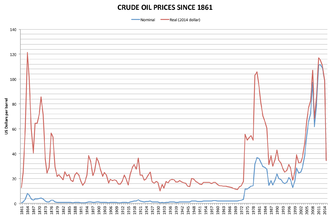

Fluctuations in Petroleum Values During the Conflict

The period of tension saw significant variations in the cost of crude substances vital for energy. As the situation escalated, the global marketplace reacted sharply, with many factors at play, including supply disruptions and geopolitical concerns. These dynamics led to an ever-changing landscape for consumers and industries dependent on these resources.

Initially, as conflict erupted, there was a surge in demand for energy due to fears of shortages. Many countries began to stockpile resources, driving up the rates. This situation was further complicated by retaliatory measures taken by certain nations, including embargoes that restricted exports, causing even more turmoil in the market.

As the situation progressed, the fluctuations in values became more pronounced. Traders reacted to news and developments, leading to rapid increases during moments of heightened tension, followed by sharp declines when temporary resolutions seemed possible. This volatility left many businesses grappling with uncertain budgets, impacting global economies.

Outcomes from this period underscored the interconnectedness of international relations and market stability. A single event could ripple across borders, affecting both suppliers and consumers alike. Understanding these shifts is crucial for comprehending the broader implications of geopolitical strife on essential resources.

Long-term Economic Effects on Crude Supply

The conflict in the Middle East had a profound impact on the global energy landscape, altering the dynamics of availability and distribution of natural resources. As nations grappled with the immediate consequences, they also faced long-standing shifts that reshaped their economies and resource management strategies.

One of the key outcomes was the accelerated exploration of alternative energy sources. Countries heavily reliant on conventional resources recognized the need to diversify their energy portfolios. This led to increased investments in renewable technologies, like solar and wind energy, which, over time, began to reduce dependency on traditional fuels.

Moreover, geopolitical tensions influenced global supply chains. Nations sought to ensure their energy security by establishing strategic reserves. This emphasis on stockpiling not only created a buffer against potential disruptions but also stimulated local economies involved in the production and storage of these resources.

Additionally, fluctuating demand prompted shifts in consumption patterns. As businesses and consumers adjusted to an unpredictable market, innovations in energy efficiency gained traction. This transformation further contributed to reducing overall consumption, impacting long-term projections of resource availability.

In conclusion, the series of events surrounding this historical conflict led to a re-evaluation of energy economies worldwide. Nations continue to adjust their strategies, balancing immediate needs with the prospect of a more sustainable future.