Exploring Online Banking Services Offered by Credit Unions

In today’s fast-paced world, managing your finances has never been easier. The evolution of technology has transformed how we interact with our funds and institutions. Gone are the days of waiting in long lines or juggling with paper statements; now, everything can be handled at your fingertips. It’s all about convenience and accessibility, allowing you to stay in control of your financial well-being from almost anywhere.

Imagine having the power to oversee your accounts, transfer funds, and receive vital updates without needing to step outside your home. This modern approach not only simplifies banking tasks but also ensures that you can keep track of your financial responsibilities efficiently. With various platforms available, navigating through your financial landscape has become an effortless endeavor.

Furthermore, security remains a top priority within these digital realms. Institutions leverage advanced technologies to protect your sensitive information, allowing you to engage in transactions with confidence. Understanding these tools can help you make informed decisions while streamlining your monetary activities.

Join us as we dive deeper into the myriad of services that these virtual platforms offer and discover how they can enhance your financial journey, making it smoother and more rewarding.

Understanding Financial Cooperative Digital Services

When it comes to managing your finances, convenience and accessibility are key. Digital services provided by financial cooperatives make it easier for members to access their accounts and perform transactions from anywhere. These offerings bring a new level of flexibility to how individuals interact with their financial institutions.

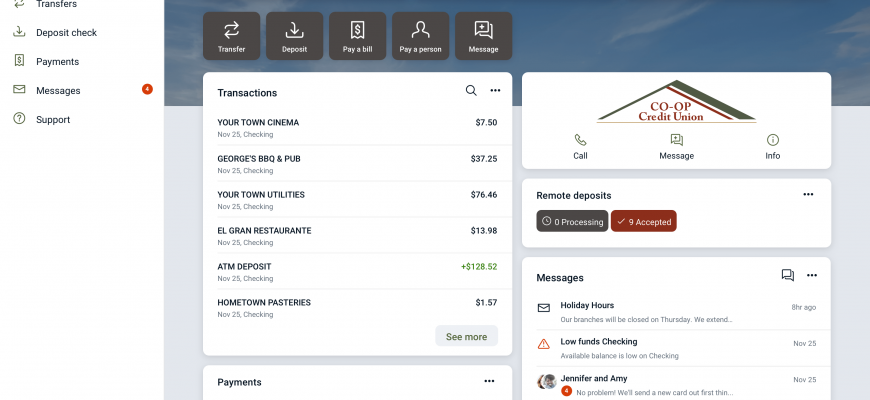

Here are some of the primary features you can expect from these digital platforms:

- Account Management: Check balances, view transaction history, and manage your accounts all in one place.

- Funds Transfers: Easily move money between accounts or send funds to other members with just a few clicks.

- Bill Payments: Set up recurring payments or make one-time payments on your bills without the hassle of writing checks.

- Mobile Access: Use your smartphone or tablet to stay connected to your finances on the go.

- Customer Support: Reach out for assistance via chat, email, or phone, ensuring you get help when you need it.

These digital tools not only enhance convenience but also contribute to overall financial health by allowing users to keep a better eye on their spending and saving habits. Utilizing such features can empower individuals to make informed decisions about their finances. Embracing these resources often leads to a more satisfying and engaging financial experience.

Benefits of Digital Banking Platforms

In today’s fast-paced world, the shift towards virtual financial services presents numerous advantages that simplify our lives. These modern solutions offer an array of features designed to enhance user experience, providing convenience and flexibility that traditional methods often struggle to match.

Accessibility is perhaps one of the most significant perks. Users can manage their finances anytime and anywhere, whether on their daily commute or from the comfort of home. This ease of access empowers individuals to take control of their financial matters without being constrained by typical office hours.

Another advantage lies in efficiency. With just a few clicks, it’s possible to transfer funds, pay bills, or review transactions. This streamlined process eliminates the need for lengthy paperwork and waiting in line, allowing for quick and hassle-free financial management.

Moreover, the emphasis on security cannot be overlooked. Advanced encryption technologies ensure that personal and financial data remains safeguarded from potential threats. Regular updates and security enhancements help maintain peace of mind while using these platforms.

Furthermore, many virtual services provide personalized insights and tools to help users achieve their financial goals. Through budgeting tools and spending analyses, individuals can gain a clearer understanding of their financial health and make informed decisions.

Ultimately, embracing these contemporary solutions can lead to an enriched and more informed financial journey. With a blend of accessibility, efficiency, security, and personalized support, it’s easier than ever to navigate the complex world of personal finance.

Secure Transactions with Financial Cooperatives

When it comes to managing personal finances, ensuring safety during transactions is a top priority for many individuals. Financial cooperatives offer robust measures to safeguard your assets and personal information, giving you peace of mind as you conduct your business.

Encryption technology is a key player in protecting sensitive data throughout the transaction process. This advanced system scrambles your information, making it unreadable to unauthorized parties. As a result, members can confidently perform their financial activities, knowing their details are shielded from prying eyes.

Two-factor authentication also adds an extra layer of security. By requiring users to verify their identity through a secondary method, such as a text message or an authentication app, these organizations make it significantly harder for anyone to gain unauthorized access to accounts. This practice is increasingly becoming a standard to enhance safety.

Another great advantage of working with these institutions is their commitment to monitoring for suspicious activities. Automated systems continuously scan transactions for any irregular patterns, allowing for quick action if something seems amiss. This proactive approach helps to catch potential fraud before it can escalate.

In conclusion, utilizing the offerings of financial cooperatives for your monetary transactions guarantees a secure experience. With their advanced technological measures and vigilant monitoring, members can focus on their finances without the constant worry of security threats.