Exploring the Trends and Fluctuations in WTI Crude Oil Prices

The world of energy commodities is an ever-evolving landscape, shaped by a multitude of factors ranging from geopolitical shifts to market demand. Understanding the fluctuations within this sphere is crucial for anyone looking to grasp the broader economic implications. As the driving force behind numerous industries, these natural resources play an essential role in our daily lives, influencing everything from fuel for our vehicles to the costs of goods and services.

When examining the value of these natural resources, one cannot overlook the impact of external variables such as political instability, technological advancements, and environmental considerations. Each of these elements can cause significant ripples that influence how markets respond and evolve over time. This exploration provides insights into not only the numbers themselves but also the stories and events that lie beneath the surface.

In this discussion, we’ll delve deeper into the patterns and shifts observed in the valuations of these critical resources. By taking a closer look at historical data and recent developments, we can better understand where these figures might be headed and what that means for consumers, investors, and policymakers alike. So, let’s unravel the complexities and gain a clearer perspective on this captivating subject.

Factors Influencing WTI Oil Prices

When we talk about the dynamic world of energy markets, numerous elements come into play that impact the fluctuations we observe. Understanding what drives these shifts can be key for investors and consumers alike. Various contributors–including geopolitical events, economic indicators, and environmental policies–shape the landscape and determine how the market reacts at any given moment.

Geopolitical Factors: Political stability in resource-rich regions is crucial. Events like conflicts, sanctions, or diplomatic negotiations can lead to apprehension among traders. For example, tensions in the Middle East have historically caused spikes in values due to fears of supply disruptions.

Economic Indicators: Economic performance across the globe plays a significant role. Growth rates, employment figures, and retail sales can signal increased demand for energy. A booming economy often leads to higher consumption, which in turn elevates market values.

Supply and Demand Dynamics: The balance of production and consumption heavily influences market assessments. If production levels rise due to technological advancements or new discoveries, it can lead to a surplus, causing a downturn. Alternatively, natural disasters or maintenance problems can hinder supply, triggering an upward swing.

Market Speculation: Traders’ perceptions and market sentiments can also significantly sway values. Speculators often react to news, forecasts, and trends, leading to price movements based on anticipated changes rather than actual supply or demand dynamics.

Environmental Regulations: Increasingly stringent environmental policies are also making their mark. Regulations that limit extraction or carbon emissions can constrain supply and raise costs, thereby influencing market behavior. Additionally, investments in renewable energy sources are shifting the landscape, potentially impacting fossil fuel markets in the long run.

In summary, numerous variables determine the course of energy market valuations. By keeping an eye on these influences, stakeholders can better navigate the often turbulent waters of this vital sector.

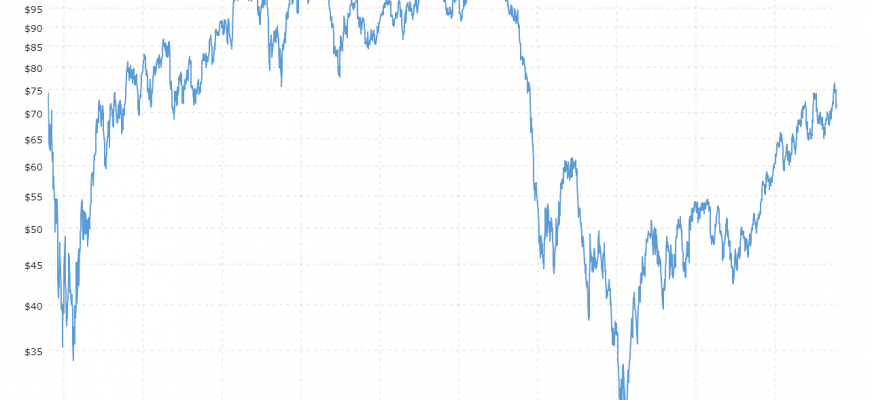

Historical Trends in Crude Oil Valuation

Examining the past movements of energy resource assessments reveals a compelling narrative shaped by various global events and market dynamics. The valuation of these vital commodities has always been influenced by a mix of geopolitical factors, economic shifts, and technological advancements. Understanding this historical context helps unravel the complexities of present-day market behavior.

Throughout the decades, fluctuations in these resource evaluations have been marked by significant milestones. For instance, the oil embargoes of the 1970s brought sharp increases in costs, fundamentally altering consumption patterns and energy policies worldwide. Similarly, the financial crises and subsequent recoveries have played pivotal roles in setting the stage for pricing and demand-related changes.

Moreover, advancements in extraction techniques, such as hydraulic fracturing, have led to substantial shifts in supply dynamics, contributing to notable drops in assessments during certain periods. The interplay of supply and demand, combined with the ever-evolving regulatory landscapes, continuously shapes the valuation of these essential products.

By analyzing past data and events, one can glean valuable insights that inform future expectations. Understanding historical valuation patterns not only aids investors in making educated decisions but also highlights the need for adaptability in an increasingly volatile market.

Future Predictions for WTI Prices

In the ever-changing world of energy commodities, forecasts play a crucial role in helping investors and analysts navigate potential shifts. It’s essential to consider various factors that influence the future of this vital resource. By examining market dynamics, we can gain insights into what might come next.

Several key elements are shaping expectations:

- Global Demand: The recovery of economies post-pandemic is expected to drive consumption. Monitoring how nations bounce back will be vital.

- Geopolitical Factors: Tensions in oil-producing regions can cause fluctuations. Keeping an eye on geopolitical developments is necessary for a clearer forecast.

- Technological Advancements: Innovations in extraction methods and renewable energy sources could alter traditional markets significantly.

- Regulatory Changes: New environmental regulations might impact production rates and influence future movement.

- Market Sentiment: Traders and investors’ perceptions often lead to speculative movements that can sway values unexpectedly.

Experts suggest a mixed outlook. Some foresee stabilization around current levels, while others predict potential surges or downturns based on emerging trends. Keeping a finger on the pulse of these factors will be essential for anyone looking to understand the trajectory of this industry.

Ultimately, while forecasts provide guidance, the unpredictability of the market demands that stakeholders remain agile and informed. Continuous monitoring and adapting strategies based on new information will be key to navigating the future landscape.