Is the Price of Gold Set to Rise in the Near Future?

Investors often find themselves pondering future dynamics of valuable resources, particularly in times of economic uncertainty. Many factors can influence demand for these assets, from global events to shifts in market sentiment. Understanding these elements can provide valuable insights for those interested in wealth preservation and investment strategies.

As individuals analyze historical patterns and recent developments, questions arise about potential shifts in worth. It’s essential to consider not only traditional market forces but also geopolitical changes and financial policies that can reshape perceptions. Staying informed on these trends could be key for navigating investing waters.

Moreover, the appeal of safe-haven assets tends to grow when volatility increases. This shift can lead to heightened interest among different investor groups seeking stability. Evaluating expert analyses and market forecasts can help paint a clearer picture of upcoming tendencies, empowering stakeholders to make informed choices.

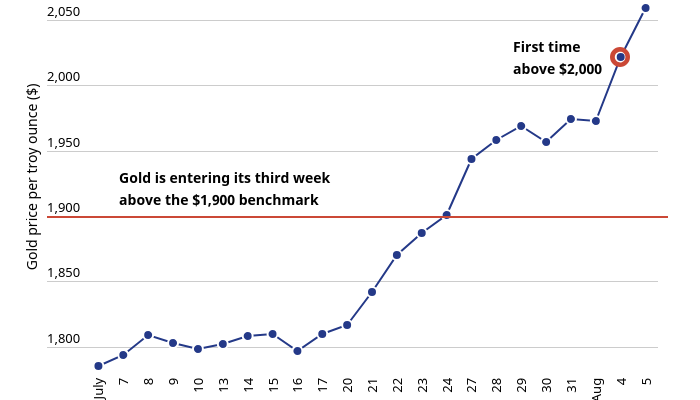

Current Trends in Gold Pricing

Recently, there has been quite a buzz surrounding the precious metal market. Many enthusiasts and investors are closely observing shifts in value and various factors influencing these movements. It’s essential to dive into the dynamics that shape this fascinating trade.

- Global Economic Conditions: Economic stability plays a crucial role. When uncertainties arise, many turn to metals as a safe haven.

- Currency Fluctuations: Changes in major currencies, especially the US Dollar, can significantly impact how metals are valued globally.

- Inflation Rates: High inflation often drives interest in tangible assets, as individuals seek to preserve wealth.

- Interest Rates: Lower interest rates typically encourage investment in non-yielding assets like bullion.

Investors often analyze these elements to navigate potential opportunities. Understanding these trends can be key to making informed decisions.

- Market Sentiment: The overall mood among traders and investors can create dramatic swings.

- Supply and Demand: Production levels and consumer interest consistently influence market values.

- Geopolitical Events: Political instability often triggers reactions in the market, prompting protective measures.

Keeping an eye on these variables can provide insights into where this market might head next. Engaging discussions among experts and enthusiasts alike make this topic ever more intriguing.

Factors Influencing Market Dynamics

Understanding fluctuations within precious metal markets requires a closer look at various elements that drive changes. Several key aspects play pivotal roles in shaping how these commodities interact with economic conditions, investor sentiment, and geopolitical events.

Economic indicators such as inflation rates, interest trends, and currency strength significantly impact demand for these shiny assets. When inflation rises, many investors turn to metals as a safe haven, believing their value will stand firm against dollar depreciation. Similarly, low interest rates can push individuals to seek alternative investments as traditional savings yield minimal returns.

Geopolitical tension also adds an interesting layer to market behavior. Political uncertainty or conflicts often lead to increased interest in precious metals, as individuals look for safer options amid chaos. Furthermore, changes in government policies and trade agreements can sway interest and alter demand on a global scale.

Finally, supply issues and mining activities affect availability, influencing market dynamics. Natural disasters, mining regulations, and other disruptions can create fluctuations, making it vital for investors to stay informed about production levels and industry trends.

Analysts’ Predictions for Future Prices

Insights from experts offer intriguing perspectives regarding future shifts in valuable assets. Many analysts weigh various economic indicators, market sentiment, and geopolitical factors to provide forecasts. Their assessments often reveal a mixture of optimism and caution, making the landscape for investment decisions quite dynamic.

One common theme among analysts centers on global economic conditions. As nations grapple with inflationary pressures and fluctuating currencies, some see opportunity for substantial appreciation in precious resources. Historically, economic uncertainty tends to drive individuals towards alternative investments.

Additionally, the impact of interest rates and monetary policy plays a pivotal role. When central banks adjust rates, it influences market behavior and investors’ appetites. Consequently, some analysts predict an uptick in demand for these assets as traditional investment vehicles become less attractive.

In summary, while predictions can vary significantly based on individual viewpoints and methodologies, observers agree that multiple factors will shape future trends. Keeping an eye on these evolving dynamics will be crucial for those looking to navigate the ever-changing investment landscape.