Could We Witness a Decline in Gold Prices in the Near Future?

As enthusiasts and investors closely monitor shifts in the marketplace, speculation around precious metal fluctuations becomes increasingly prevalent. The allure of this shiny commodity has captivated people for centuries, yet its worth can be volatile, responding to various economic factors. With so much uncertainty, many are curious about what lies ahead for this beloved investment.

Recent events have sparked debates among experts about potential movements in this metallic asset. Factors such as inflation, currency strength, and geopolitical tensions all play a significant role in shaping market sentiment. Market watchers eagerly seek insights into how these dynamics could influence value transitions in the near future.

Ultimately, understanding the dynamics at play requires a blend of historical knowledge and awareness of current trends. By examining these components, individuals can better navigate the complex world of wealth preservation and investment opportunities that involve this treasured element.

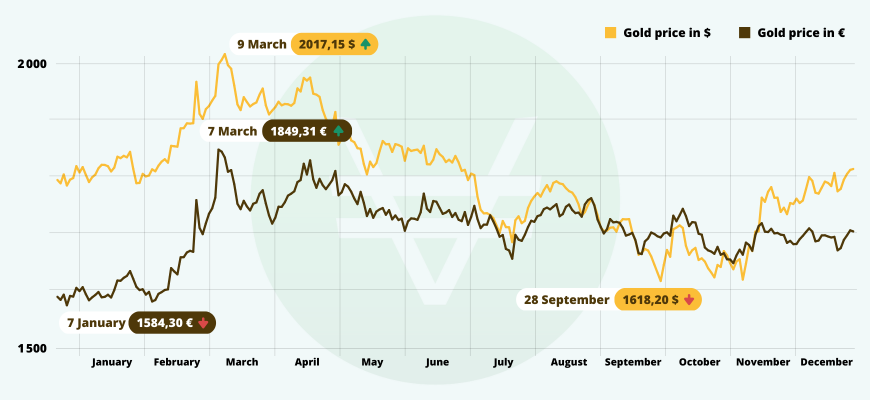

Current Trends in Gold Pricing

It’s fascinating how the value of precious metals shifts over time, influenced by various global factors. Understanding these fluctuations requires a closer look at economic indicators, geopolitical events, and changes in investor sentiment. Each element plays a vital role in shaping how these assets are viewed in terms of worth.

Recently, we’ve witnessed a surge in interest surrounding these commodities, with many turning their attention towards safe-haven investments amid uncertain market conditions. As economies face challenges, individuals often seek security in alternative assets, which can drive demand significantly. This behavior highlights how fear and optimism can swiftly alter perceptions and, consequently, valuations.

Moreover, central bank policies and interest rate adjustments often create ripples within these markets. When rates are low, traditional investments may seem less appealing, prompting shifts toward tangible assets. This shift can lead to increased transactions and, in turn, affect overall worth.

Additionally, external factors like inflation and currency fluctuations can play a significant role in determining the appeal of these materials. As countries grapple with economic shifts, the allure of hard assets often becomes more pronounced, influencing overall market dynamics.

Factors Influencing Market Shifts

When it comes to fluctuations in precious metal investments, a multitude of elements come into play. Understanding these factors can help navigate the complexities of this ever-changing landscape. Various economic indicators, geopolitical tensions, and even cultural trends may have a significant impact on how investors perceive the value of these assets.

Firstly, global economic stability cannot be overlooked. When markets are volatile or uncertainty looms, many flock to safe-haven assets. Conversely, when economies are thriving, risk appetites grow, often leading to decreased interest in traditional hedges.

Interest rates represent another critical factor. Generally, lower rates tend to bolster demand for alternatives, as traditional savings yields pale in comparison. On the other hand, increases in interest rates can make holding these investments less attractive, influencing market behavior.

Geopolitical events also play a vital role. Tensions between nations, wars, and political unrest can drive individuals and institutions to seek refuge in alternative investments, thereby causing sudden surges or drops in demand.

Additionally, currency strength is a noteworthy influencer. A robust currency may lead to diminished interest in alternatives, while a weak dollar often draws attention back towards these resources.

Lastly, technological advancements and changes in consumer preferences shouldn’t be disregarded. Innovative uses in industries such as electronics and healthcare can create new avenues for demand, shifting perceptions and ultimately affecting market dynamics.

Future Predictions for Gold Valuation

Looking ahead, many analysts are considering various indicators that might influence the worth of precious metals. Numerous factors play a role in shaping market outlooks, including economic shifts, geopolitical events, and investor sentiment. As circumstances change, so too do expectations around how these assets will be valued in the coming months or years.

Several experts suggest that fluctuations in interest rates and inflation could significantly impact how traders perceive worth. A growing economy could push demand higher, while economic downturns might lead to a decline in interest among potential buyers. Additionally, global uncertainties often drive individuals toward safe-haven investments, affecting market dynamics in unexpected ways.

Market trends also indicate that technological advancements and alternative investment avenues might alter traditional paradigms. Innovations in finance and changes in consumer behavior can reshape how individuals and institutions perceive value, creating new opportunities or challenges for enduring assets.

Ultimately, while predicting movements can be complex, staying alert to global developments and shifts in investor psychology will provide valuable insights into potential trajectories. Keeping an eye on how external factors influence seasoned markets may yield critical clues for the future.