Exploring the Potential Impact of the Port Strike on Oil Prices and Global Markets

In recent times, discussions about maritime operations have taken center stage. When large-scale disruptions occur in these crucial logistical hubs, many wonder how it will ripple through various sectors. It’s not just a matter of ships being unable to dock or unload; it’s about the broader implications that follow.

Take, for instance, the potential consequences for essential goods, including energy resources. As transportation routes are compromised, supply chains can experience significant stresses, leading to fundamental shifts in availability and market dynamics. This creates a space for speculation and concern among those who keep a close watch on market fluctuations.

As the narrative unfolds, many industry experts and analysts aim to decode what a disruption means for consumers and producers alike. Understanding these intricate connections helps to paint a clearer picture, allowing stakeholders to navigate the uncertain landscape better. So, what should one expect moving forward in this ever-evolving scenario? Let’s dive deeper into this conversation.

Impact of Port Disruptions on Global Trade

When key maritime hubs encounter interruptions, the ripple effects can be felt around the world. Such events lead to delays, increased costs, and uncertainty in supply chains, striking at the heart of international commerce. Businesses, consumers, and economies alike can experience significant challenges as goods and commodities struggle to reach their destinations.

Numerous factors highlight how disturbances in nautical operations can reshape trade dynamics:

- Shipping Delays: Essential goods are held up, disrupting schedules and creating bottlenecks in delivery.

- Increased Costs: Organizations may face higher transportation fees as they seek alternative routes or expedited services to overcome delays.

- Supply Chain Disruptions: Components critical to manufacturing processes may arrive late, impacting production timelines and operational efficiency.

- Market Uncertainty: Businesses may hesitate to commit to long-term contracts due to unpredictability in logistics, influencing market stability.

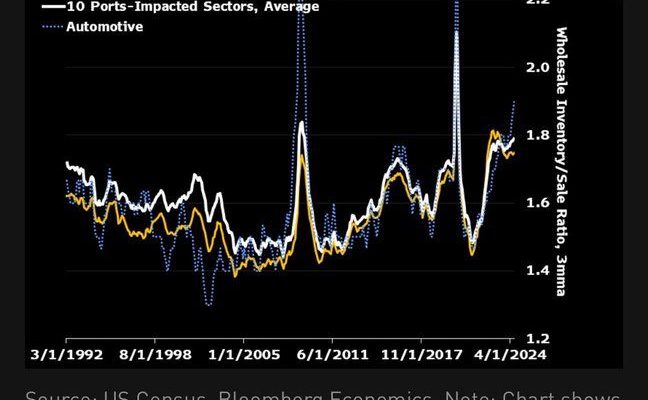

As supply levels fluctuate, consumers may notice variations in availability and costs, altering purchasing behaviors. Ultimately, the interconnected nature of global trade means that challenges in one area can have widespread implications, influencing everything from local prices to international agreements.

Supply Chains and Disruptions

When we talk about energy resources, there’s a web of connections that plays a crucial role in how everything flows together. From extraction to refinement and distribution, each link in this chain is essential. Any hiccup can ripple through the entire system, leading to outcomes that affect multiple sectors globally.

Infrastructure is key in ensuring that these resources move smoothly from one point to another. If facilities, terminals, or transportation routes experience interruptions, it can lead to significant delays. Market dynamics then shift, reflecting the challenges in delivery timelines and availability, which in turn influences consumption habits and corporate strategies.

Additionally, stakeholders have to keep a close eye on geopolitical situations, labor relations, and unexpected events, all of which can shake up this delicate balance. A minor disruption might trigger a re-evaluation of contracts and lead to strategic adjustments aimed at minimizing risks. This proactive approach becomes increasingly vital to maintain stability in the market.

Overall, the interconnected nature of resource distribution means that any variation, no matter how small, holds the potential for broader repercussions. As a result, understanding these dynamics is essential for anyone engaged in or affected by this industry.

Market Reactions to Shipping Challenges

Disruptions in logistics can lead to notable fluctuations in various sectors. When issues arise in transportation networks, businesses often scramble to adjust their strategies. This, in turn, influences investor sentiment and overall market dynamics. Understanding these reactions is crucial for anyone looking to navigate the complexities of modern commerce.

When shipping hurdles occur, companies may face increased operational costs. For instance, alternative transport methods might be more expensive or take longer. As a result, manufacturers and retailers need to reassess their pricing strategies. This creates a ripple effect where consumers may also feel the pinch as prices adjust on shelves.

Traders in commodity markets tend to closely monitor these disruptions. An unexpected challenge in transportation can signal to them that supply may dwindle in the near future. Consequently, they might start buying up stocks in anticipation of future hardships. This behavior can rapidly drive up costs across multiple goods, reflecting the interconnectedness of global trade.

In summary, unexpected logistics issues can initiate a chain reaction within markets. By keeping an eye on how companies respond to these scenarios, investors can better position themselves in an ever-changing economic landscape.

I’m blown away by the beauty in this video. It’s truly remarkable.