The Future of Oil Prices and Their Potential Decline

As we navigate through complex landscapes of global economies and markets, a pressing question frequently arises among consumers and investors alike: what direction will we see regarding energy costs? Various factors are at play, influencing shifts and fluctuations in this vital sector. Understanding these dynamics can help us predict how things might unfold in the near future.

Economic indicators, geopolitical developments, and changing consumption patterns all contribute to shaping expectations. For instance, how do shifts in supply chains or alterations in demand affect what we pay at the pump? Engaging with these themes allows us to grasp not only immediate impacts but also longer-term implications for households and industries.

In this discourse, we will unpack contributing elements and assess possibilities. Let’s delve into what influences fluctuations and what potential outcomes may arise in this fast-evolving realm.

Current Trends in Oil Pricing

In recent times, the landscape of energy valuation has shown significant fluctuations, influenced by various global dynamics. Understanding what drives these changes is essential for both consumers and investors alike. The realm of crude commodities is intricate, with numerous factors at play that make it a fascinating area to explore.

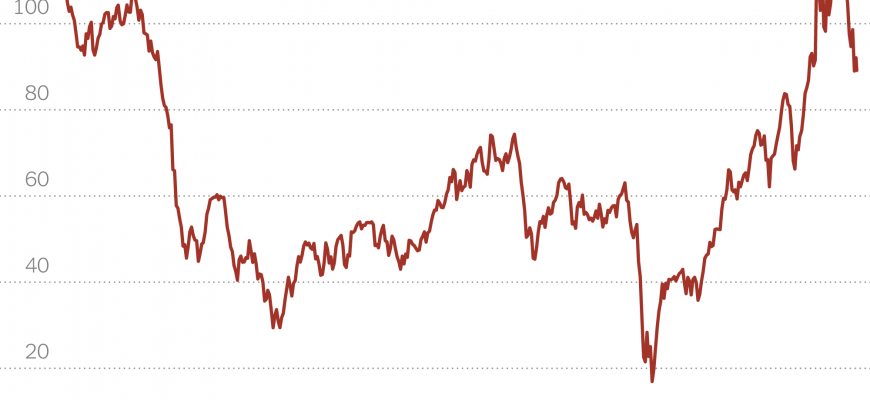

Market fluctuations have become increasingly volatile, driven by geopolitical tensions, supply disruptions, and shifting consumer demand. Recent events in key producing regions have caused ripples throughout the marketplace, leading to unexpected alterations in valuation. Additionally, economic indicators and changes in energy policies across nations contribute to this ever-evolving environment.

Another noteworthy element is the growing significance of renewable alternatives. As countries strive to transition towards greener energy solutions, traditional fossil fuels face new challenges. This rise in sustainable energy technologies may reshape long-term consumption patterns and alter perceptions about value stability.

Consequently, stakeholders from various sectors are keenly watching these developments. Analysts are keen to gauge how emerging trends will affect future energy strategies. As data continue to unfold, keeping a close eye on the evolution of this sector will be crucial.

Factors Influencing Future Oil Costs

Understanding shifts in energy costs is crucial for many stakeholders. Various elements play a role in determining how rates evolve over time. From geopolitics to technological advancements, multiple forces work together to shape the landscape of the market.

Geopolitical tensions are significant players in this arena. Conflicts or changes in leadership within producing nations can lead to disruptions in supply, causing fluctuations in market value. Additionally, trade agreements and sanctions often influence availability and demand on a global scale.

Another key factor is technological innovation. Advances in extraction processes, like fracking or renewable alternatives, can either boost supply efficiency or reduce dependency on fossil fuels. As new methods emerge, they can significantly alter how energy is sourced and priced.

Economic trends also cannot be overlooked. A robust global economy typically drives higher demand for energy, pushing costs up. Conversely, recessions or downturns can lead to decreased consumption, resulting in lower market values.

Lastly, environmental regulations and climate policies come into play. Stricter rules can restrict production or influence investments in greener technologies, affecting supply dynamics and ultimately altering market behavior. All these factors intertwine, making the outlook for energy costs an intriguing and complex subject.

Impacts of Global Events on Oil Prices

When it comes to fluctuations in the energy market, various international occurrences play a significant role. Understanding these dynamics can help us grasp the forces at play behind shifts in costs associated with fuel. Let’s delve into some key factors that can influence these changes.

- Geopolitical Tensions: Conflicts or political unrest in major producing regions often lead to uncertainty. This can cause a spike in costs as supply is threatened.

- Natural Disasters: Hurricanes or earthquakes affecting refineries and drilling locations can disrupt production and transportation, leading to increased costs.

- Economic Policies: Changes in regulations or trade agreements between countries can impact how resources are traded, affecting overall market conditions.

- Technological Advancements: Innovations in extraction and production techniques can create efficiencies, potentially lowering costs over time.

- Global Demand Shifts: Economic growth in emerging markets typically increases consumption, which can push costs higher in the short term.

These factors illustrate why keeping an eye on global developments is crucial for understanding how costs can change in the energy sector. They remind us that economic environments are interconnected, and what happens in one part of the world can significantly impact others. By staying informed, consumers and businesses alike can navigate the complexities of the market more effectively.