Exploring the Possibility of a Decline in Oil Prices

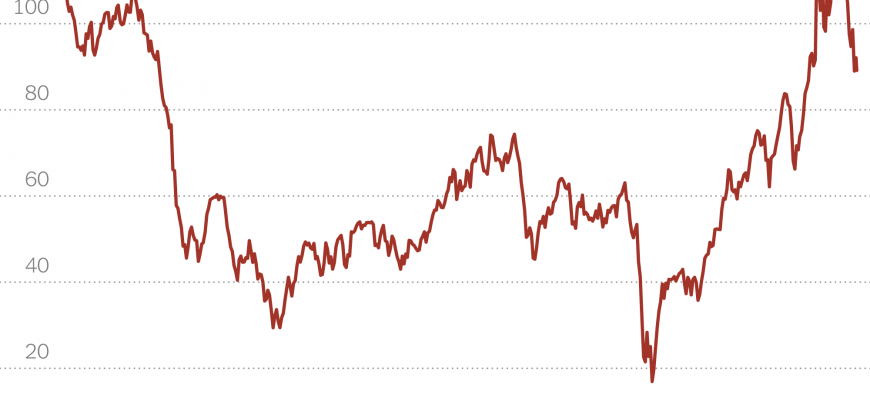

In recent months, fluctuations in energy expenses have caught everyone’s attention. As individuals and businesses alike feel the impact, questions arise about what lies ahead for this vital resource. Are we on the brink of a significant change, or should we brace ourselves for further unsettled conditions?

Many factors influence these shifts, from geopolitical events to seasonal demands. Economists and analysts fervently debate potential outcomes, each presenting their forecasts with varying degrees of optimism and caution. As consumers, we naturally wonder how these conditions will affect our wallets and budgets in the coming months.

Understanding market dynamics can provide insight into whether relief may be on the horizon. As experts analyze trends and patterns, hints emerge that could signal where we’re headed. Join us as we explore potential scenarios and examine what influences these changes in this essential sector.

Factors Influencing Global Oil Prices

Understanding the dynamics of energy markets involves examining various elements that impact costs for crude products globally. These components create a complex web of influence, affecting not only producers and consumers but also economies and geopolitical landscapes.

Supply and demand play a pivotal role in this intricate system. When production levels fluctuate or consumption patterns shift, it can lead to significant adjustments in market valuations. Events like natural disasters or geopolitical conflicts can disrupt supply chains, causing rapid changes in availability and, consequently, in pricing structures.

Market speculation also contributes to variations. Traders’ expectations about future outcomes can lead to rapid increases or decreases in valuations, regardless of fundamental supply and demand trends. Emotional reactions to news, reports, or political developments can drive investment behaviors that impact financial markets significantly.

Moreover, currency fluctuations have a crucial influence. As transactions for these commodities typically occur in certain currencies, changes in the value of these currencies can alter purchasing power significantly. Economic conditions in major importing or exporting nations further complicate matters, as their financial health directly affects trade dynamics.

Regulatory policies are another important factor. Decisions made by major producing countries, like adjustments in production quotas or tax regulations, can lead to immediate repercussions worldwide. Environmental regulations and movements toward renewable sources also play a vital role in shaping the long-term outlook for traditional fossil fuels.

Finally, technological advancements can’t be overlooked. Innovations in extraction methods, refining processes, or alternative energy sources can reshape traditional dynamics, creating both opportunities and challenges for current players in the energy sector.

Future Predictions for Energy Market Trends

As we gaze into the crystal ball of the energy sector, many factors intertwine, shaping its path ahead. Analysts, economists, and industry experts are constantly assessing various elements that influence how costs may shift in the upcoming months and years. From geopolitical events to technological advancements, a multitude of variables serve to paint a complex picture.

Recent developments highlight the increasing importance of renewable resources and their potential to alter traditional markets significantly. With governments worldwide committing to greener initiatives, the demand for classic fossil fuels may gradually decline. This shift could lead to significant fluctuations in market dynamics, depending on how quickly alternatives gain traction.

Moreover, global economic conditions remain a critical piece of this puzzle. Growth in emerging markets can drive consumption upward, impacting recharge values. Similarly, economic slowdowns can have the opposite effect, leading to decreased demands and potential reductions in expenditures associated with fossil energy sources.

Supply chain factors also play a crucial role in forecasting future movements. Maintenance schedules, natural disasters, and even technical difficulties at extraction sites can all cause sudden adjustments, affecting immediate market availability and overall costs. Monitoring these influences keeps experts on their toes as they analyze potential scenarios.

In conclusion, while no one can predict the future with absolute certainty, staying informed about ongoing trends and shifts is crucial for anyone involved in or affected by this dynamic industry. Keeping an eye on both local and global developments will be key to navigating what lies ahead.

Impact of Geopolitical Events on Oil Cost

Geopolitical occurrences can significantly sway fluctuations in energy commodity values. When tensions arise, whether from conflicts, sanctions, or diplomatic shifts, markets react swiftly. This response often leads to uncertainty, driving traders to adjust their strategies, which in turn influences overall costs.

For instance, disruptions in important production regions due to instability can limit supply chains. Producers might struggle to meet demand, resulting in increased valuations. Conversely, positive developments–such as peace treaties or agreements to curb hostilities–can alleviate concerns and lead to decreases in commodity values. Each event creates ripples through the global landscape, showing just how interconnected every aspect of the energy market truly is.

Furthermore, speculation plays a huge role in this dynamic. Traders often predict potential impacts from geopolitical situations, purchasing and selling assets based on anticipated outcomes. This behavior can create volatility that doesn’t always correlate directly with the underlying supply and demand fundamentals. Therefore, understanding these relationships becomes essential for anyone following market trends.

In summary, geopolitical events are like wild cards in the realm of energy markets. They can trigger sudden shifts, turning optimistic forecasts into cautious predictions–or vice versa. Staying informed about global affairs not only broadens perspectives but also aids in anticipating future movements.