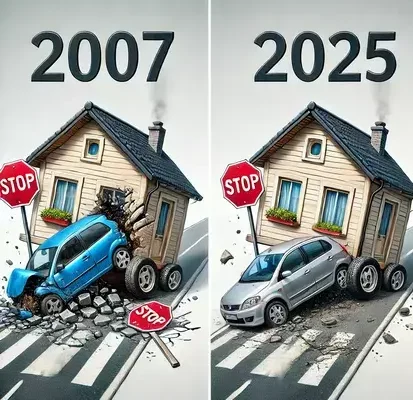

Is a Significant Decline in the Housing Market Likely to Occur in 2025?

As we glance toward future trends in real estate, many are speculating about the potential shifts in value that could shake up the industry. Economic indicators, buyer behavior, and various external factors create a landscape full of uncertainties. Understanding these elements is crucial for anyone looking to navigate this possibly turbulent terrain.

Investors, homeowners, and industry experts alike are pondering whether current conditions will lead to significant changes. With a mix of optimism and concern in the air, conversations are buzzing about whether prices will stabilize, decline, or continue on an upward trajectory. It’s an intriguing time for those following the cycles of this ever-evolving sector.

In this discussion, we’ll delve into expert insights, historical trends, and a myriad of influencing aspects that could shape the future. By unraveling these complexities, we can gain a clearer picture of what lies ahead for property values and how various stakeholders can prepare for potential outcomes.

Forecasting Real Estate Trends for 2025

As we look ahead, it’s fascinating to explore potential shifts in property dynamics and what they might mean for future buyers and sellers. Speculating on upcoming patterns is not just about guessing; it’s about understanding economic indicators, consumer behavior, and regional developments that can shape an environment in the coming years.

Industry analysts are already hinting at various factors that could steer changes, including interest rates, employment rates, and even shifts in demographics. For instance, as remote work continues to gain traction, different areas might see increased demand based on lifestyle preferences rather than traditional factors.

Moreover, supply chain disruptions could still play a role, influencing construction timelines and availability of new homes. Watching these elements will be crucial to anticipating how desirability in certain locations is affected. Overall, staying informed and adaptable will be paramount for anyone involved in buying or selling properties as we navigate through the next few years.

Signs of a Potential Market Decline

As we look ahead, there are various indicators that might suggest a downturn in property values. Recognizing these signs early can be crucial for both buyers and sellers in navigating future developments in real estate. Here are some trends that could signal trouble on the horizon.

Increased Interest Rates: When borrowing costs rise, potential buyers often hesitate. Higher interest rates can lead to decreased affordability, pushing some individuals out of the buying process altogether. This reduction in demand could set the stage for a price drop.

Stagnating Sales: A slowdown in transactions can indicate that properties aren’t moving as quickly as they once were. If listings start to accumulate and days on the market lengthen, it might reflect changing buyer sentiment or external economic pressures.

Rising Inventory: An increase in available homes can suggest that supply is exceeding demand. If sellers outnumber buyers, it could lead to downward pressure on prices as competition among sellers intensifies.

Economic Indicators: Keep an eye on broader economic metrics, such as unemployment rates and inflation. A struggling economy often translates to uncertainty in property investments, which could further impact buyer confidence.

Shift in Buyer Demographics: A change in the profiles of prospective owners, such as a younger population with different priorities, can alter the dynamics of property preferences. If trends veer towards renting rather than owning, it could reshape long-term projections.

Understanding these potential warning signs is essential for anyone involved in real estate. Staying informed and responsive can help mitigate risks during uncertain times.

Expert Opinions on Future Real Estate Value

As we navigate through evolving trends in property appreciation, insights from industry professionals become crucial. Their perspectives help anticipate potential fluctuations and understand factors impacting residential valuations. Analysts, economists, and real estate agents bring valuable expertise to the table, shedding light on what lies ahead.

Market analysts emphasize the importance of demographic shifts and economic indicators. They believe that factors such as job growth and migration patterns play a pivotal role in determining asset prices. A shift in population dynamics can either bolster demand or lead to excess supply, sparking a change in trends.

Meanwhile, financial experts highlight interest rates as a significant influence. With borrowing costs shifting frequently, they stress how affordability affects buyer behavior. Changes in lending conditions can create ripples throughout the industry, altering investment strategies and consumer confidence.

On the ground, real estate agents provide anecdotal evidence from local neighborhoods. They often observe variations tied to community developments, amenities, and local policies. Their insights reveal how closely intertwined community aspects and property values are, suggesting that even small changes can have considerable effects.

Overall, expert opinions offer a mosaic of predictions, reflecting a range of factors that interact within this complex system. Staying informed through these viewpoints can empower prospective buyers and investors as they make decisions in an ever-changing landscape.