Is Singapore Facing a Potential Recession in 2025 and What Factors Could Influence Its Economic Future?

The ever-shifting landscape of global finance raises intriguing questions about potential future scenarios for many nations. As we delve into the evolving trends, it becomes essential to assess various economic indicators that could influence prosperity or obstacles ahead. Understanding the interplay of these factors can provide valuable insights into what lies ahead.

The economic forecast often resembles a complex puzzle, where numerous pieces contribute to the broader picture. Analysts and policymakers alike scrutinize shifts in consumer behavior, international trade dynamics, and fiscal measures to gauge the overall health of the economy. The uncertainty surrounding these variables can either instill confidence or spark concern among businesses and citizens.

As 2025 approaches, discussions about upcoming economic dynamics are gaining momentum. Speculation grows about the potential impact of global events and local policies. Engaging in this dialogue can help stakeholders prepare for possible outcomes, ensuring that strategies are in place to navigate any turbulence that may arise.

Factors Influencing Economic Outlook

Understanding the dynamics that shape a nation’s financial future is crucial for grasping its potential trajectories. Several elements interplay to create the economic landscape, each contributing to either stability or volatility. These factors encompass domestic policies, global market trends, and socio-political influences that collectively shape the overall economic health.

Firstly, governmental strategies play a vital role. Policy decisions regarding trade agreements, taxation, and investment incentives can stimulate growth or hinder progress. There’s also the impact of infrastructure development and innovation initiatives that can propel sectors forward, creating jobs and enhancing productivity.

Secondly, external conditions significantly affect local economies. The performance of major global economies, fluctuations in commodity prices, and international trade relationships all ripple through the market. In this interconnected world, challenges like supply chain disruptions can have immediate repercussions on local businesses.

Moreover, consumer sentiment cannot be overlooked. Public confidence influences spending habits, driving demand for goods and services. Changes in employment rates, wage growth, and overall financial security directly affect how communities respond to economic shifts.

Lastly, technological advancements are reshaping industries at an unprecedented pace. Embracing innovation can result in increased efficiency and competitive advantage, while resistance to change may leave sectors lagging behind. The adaptability of businesses and workforce plays a critical role in navigating future prospects.

Potential Global Risks and Their Impact

As we navigate through a complex economic landscape, various uncertainties loom on the horizon, potentially influencing financial stability across regions. Factors such as geopolitical tensions, fluctuating commodity prices, and the unpredictability of global supply chains can create ripples that affect growth and development. Understanding these vulnerabilities is crucial for anticipating future scenarios.

The interconnectedness of today’s economies means that a disturbance in one area can set off a chain reaction elsewhere. For instance, trade disputes or environmental crises can disrupt production lines or consumer confidence, leading to broader economic challenges. It’s essential to analyze how these risks intertwine and what measures can be implemented to mitigate their effects.

Moreover, shifts in monetary policy among major economies play a significant role in shaping market dynamics. Changes in interest rates or inflation targets influence investment flows and can either bolster or hinder growth trajectories in different regions. Keeping a pulse on these financial indicators can provide insight into emerging challenges worldwide.

In addition, technological advancements, while often viewed as a boon, also present risks, particularly regarding cybersecurity threats and the rapid pace of change that can outstrip regulatory frameworks. It’s vital for industries to not only embrace innovation but also prepare for potential disruptions that accompany such progress. This balancing act will be key in cushioning economies against uncertain futures.

Indicators of Local Economic Performance

Understanding how a region is faring economically can often be a complex task. Numerous factors come into play, from consumer spending habits to industrial outputs. By examining various indicators, one can gain insights into the overall health of the marketplace and make more informed forecasts about future developments.

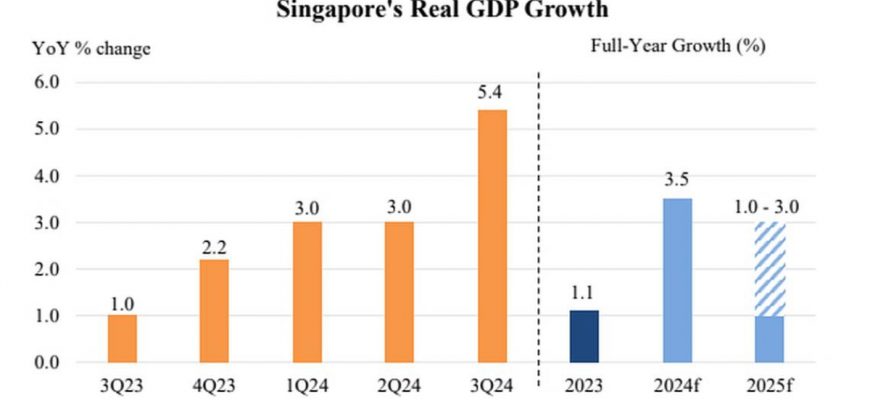

One crucial sign of economic vitality is the Gross Domestic Product (GDP) growth rate. A rise usually signifies that businesses are thriving, while a decline may indicate potential challenges ahead. Similarly, fluctuations in employment rates provide valuable information. Strong job growth often correlates with increased consumer confidence and spending, which are vital for sustaining economic momentum.

Another aspect to consider is the performance of the manufacturing sector. Manufacturing output can serve as a bellwether for overall economic conditions. When factories are busy, it typically means demand is robust, which bodes well for broader economic activity. Additionally, consumer price indexes (CPI) are essential for assessing inflationary pressures. Moderate inflation can signal a growing economy, but excessive inflation could raise red flags.

Lastly, trade balance figures can illustrate a region’s competitiveness on the global stage. A healthy trade surplus indicates strong export activity, while a deficit might highlight reliance on imported goods. Collectively, these indicators help paint a clearer picture of local economic performance, allowing both businesses and policymakers to strategize accordingly.