Potential Increases in Part B Premiums for 2025

As we look toward the future of healthcare financing, many are left wondering about potential adjustments in the costs associated with specific coverage options. With ongoing discussions about the sustainability of healthcare programs, it’s crucial to stay informed about what might be around the corner. Navigating these changes can be complicated, but understanding the factors at play could make a significant difference for beneficiaries.

Recent trends indicate that adjustments in pricing structures could have a substantial impact on what individuals pay out-of-pocket. Various elements, including economic conditions and legislative decisions, contribute to these fluctuations. As such, many are keen to know how these shifts might affect their financial planning and healthcare access in the coming years.

Staying ahead of potential increases is vital for those relying on this essential support. By keeping an eye on emerging developments and engaging in discussions around policy changes, individuals can better prepare themselves for any upcoming modifications. Awareness is the key to navigating the complexities of healthcare expenses successfully.

Potential Increases in Medicare Part B Costs

When it comes to the topic of senior healthcare expenses, many individuals are curious about the likelihood of a rise in premiums for services that cover essential medical needs. As expenses in the healthcare sector fluctuate, it’s crucial to keep an eye on how these changes might impact personal budgets for those relying on specific government programs.

Factors influencing costs can include a variety of elements such as inflation rates, advancements in medical technology, and shifts in policy decisions. As the economy evolves and healthcare demands adapt, it’s natural to wonder how these variables will shape the out-of-pocket spending required for necessary services.

Budgeting for the future is always a wise move, especially for retirees or those nearing retirement age. Staying informed about potential cost adjustments can empower individuals to better prepare financially and seek preventive measures to mitigate expenses in their healthcare journey.

Ultimately, understanding these dynamics enables beneficiaries to navigate their healthcare choices more effectively while planning for any adjustments that may come their way.

Factors Influencing Premium Changes

Several elements play a crucial role in determining adjustments to healthcare coverage costs. These factors are interconnected and can lead to fluctuations in what beneficiaries are required to pay. Understanding these influences can provide clarity on the overall landscape of medical expenses.

First and foremost, government policies significantly impact premium rates. Legislative changes can either increase or decrease funding for programs, affecting overall cost structures. Additionally, shifts in enrollment numbers influence the financial dynamics of the system. A growing number of participants can spread costs more broadly, potentially stabilizing or lowering individual expenses.

Medical inflation is another critical factor to consider. As healthcare providers raise their rates due to rising operational costs, it naturally leads to higher premiums for those seeking coverage. Furthermore, advancements in medical technology and treatments, while beneficial, can also contribute to increased expenditures, influencing what consumers ultimately pay.

Lastly, actuarial assessments play a vital role in predicting future costs. These evaluations take into account demographic trends, disease prevalence, and usage patterns, helping predict how much funding will be needed to support the system. Consequently, adjustments based on these assessments can significantly affect monthly fees.

Impact of Inflation on Healthcare Expenses

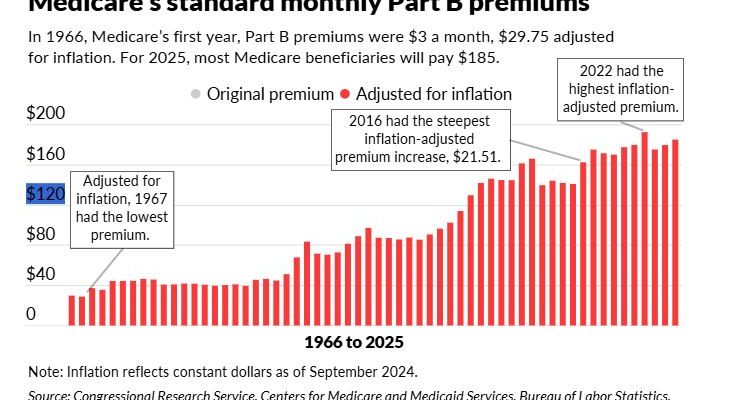

Inflation affects various aspects of life, and healthcare costs are no exception. This economic phenomenon can lead to increased expenses for medical services, making it crucial to understand its implications on personal finances and overall well-being.

Rising prices can create challenges for individuals and families as they navigate their healthcare needs. Here’s a deeper look at how inflation impacts healthcare spending:

- Higher Medical Fees: As the cost of providing medical services rises, patients may find themselves facing steeper bills for doctor visits, treatments, and procedures.

- Increased Insurance Premiums: Healthcare providers often pass on rising costs to insurance companies, which may result in higher premiums for policyholders.

- Prescription Drug Costs: Medications may also see price hikes, potentially making essential drugs less accessible for certain individuals.

To cope with these financial strains, many people might consider various strategies:

- Evaluate insurance plans for comprehensive coverage.

- Maintain a healthy lifestyle to minimize the need for medical interventions.

- Stay informed about available governmental assistance programs.

In conclusion, grasping the effects of inflation on healthcare can empower individuals to make more informed decisions regarding their health and finances. Being proactive and understanding these trends can help mitigate the impact of economic changes on personal and family health expenditures.