Potential Trends in Oil Prices in India and Their Impact on the Economy

As we navigate through the ever-changing landscape of global commerce, the dynamics of energy resources play a crucial role. The fluctuations in the marketplace can significantly impact consumers and industries alike. With recent developments, many are left wondering how the forthcoming shifts will shape the cost of essential fuels, impacting daily life and economic stability.

Emerging factors such as geopolitical conflicts, supply chain disruptions, and evolving environmental policies contribute to this complex scenario. Predictions and analysis from experts can often provide insights, yet they come with inherent uncertainties. The anticipation builds as stakeholders prepare for potential changes that could redefine their financial landscape.

In such a volatile environment, understanding the underlying mechanisms driving these changes becomes imperative. What indicators should we observe? How do global events ripple through local economies? With so many variables at play, it’s an intriguing time to consider what the future may hold for those relying on these vital resources.

Factors Influencing India’s Oil Market

Understanding the dynamics of the energy sector involves a mix of various elements that play crucial roles in shaping the landscape. Numerous forces, both domestic and international, contribute to the fluctuations seen in the market. These influences range from geopolitical events to technological advancements, all intertwining to create a complex web that dictates how energy commodities behave.

Geopolitical Events: Tensions in oil-rich regions can significantly impact supply chains. When conflicts arise or sanctions are imposed, the ripple effects can lead to uncertainty in availability, driving the market in unexpected directions.

Demand Patterns: Consumption habits in different sectors, whether it’s transportation or manufacturing, also play a vital role. Seasonal changes, urbanization, and population growth collectively elevate the appetite for energy, influencing market movements.

Government Policies: Regulations and policies enacted by the authorities can either facilitate or hinder market activities. Taxation, subsidies, and import duties directly affect how resources are allocated and can lead to changes in overall demand.

Technological Innovations: Advancements in extraction and alternative energy sources may shift the balance. Breakthroughs in renewable energy or efficiency improvements can either supplement or substitute traditional energy sources, altering consumption trends.

Global Economic Conditions: The state of the worldwide economy serves as a barometer for energy consumption. Economic growth in major regions can augment demand, while recessions typically lead to a decline, creating a rollercoaster effect on the market.

Examining these factors provides insight into the intricate mechanisms that govern the energy sector. Each element is interconnected, making it essential to understand their roles in navigating potential market changes.

Predictions for Future Energy Cost Trends

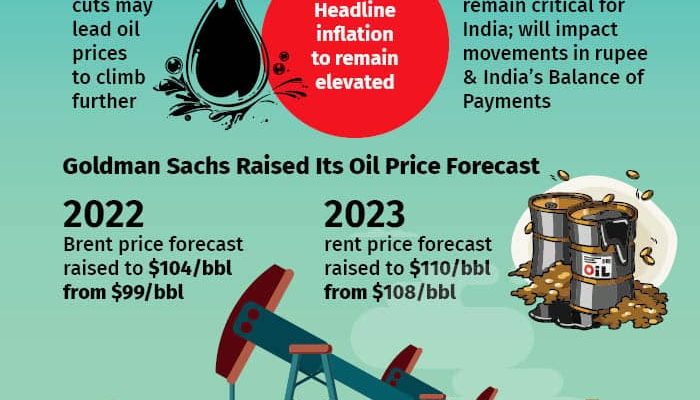

As we look ahead, many are curious about the direction the market will take concerning petrochemical commodities. Analysts and experts are weighing various factors that could shape this evolving landscape. The interplay of global demand, geopolitical tensions, and environmental policies all contribute to the uncertainty of what lies ahead.

Considering the ongoing shifts toward renewable energy and advancements in technology, there’s a possibility that traditional commodities may experience fluctuations. Economic growth in emerging markets is another element that could impact whether we see spikes or declines in energy expenses. Each of these factors invites a hopeful yet cautious outlook.

It’s essential to keep an eye on market indicators and expert forecasts to gauge future movements. As industries adapt to new regulations and consumer preferences, the landscape may transform, making it crucial for stakeholders to stay informed. With such a dynamic environment, anticipating changes can be both exciting and challenging.

Impact of Global Events on Fuel Costs

It’s fascinating how interconnected our world is, especially when it comes to the energy sector. Various global happenings can have a significant effect on the costs associated with fuel, influencing everything from consumer spending to economic stability. These events can range from natural disasters to geopolitical tensions, and they often lead to fluctuations that catch many off guard.

Natural disasters such as hurricanes or earthquakes can disrupt supply chains, affecting the extraction and transportation of energy sources. When these events occur in key regions, we often see an immediate response in the marketplace. For instance, a hurricane hitting a major drilling area can cause a sudden scarcity, leading to an uptick in expenditures.

On the other hand, geopolitical tensions play an equally daunting role. Conflicts or political instability in critical regions can create uncertainty, driving buyers to preemptively stockpile resources. This surge in demand can contribute to a swift increase in costs even when domestic availability remains unchanged.

Trends like technological advancements and shifts towards renewable sources also play a role. As nations invest in alternative energies, the reliance on traditional fuels might shift, leading to a complex landscape where costs can fluctuate significantly based on market perceptions and innovations.

Overall, understanding the interplay of these global events offers valuable insights into why expenditures related to fuel can be unpredictable, reminding us just how delicate the balance of supply and demand truly is.