Could a Trump Administration Lead to a Decrease in Oil Prices?

As the political environment constantly shifts, many individuals and businesses are left wondering how these changes will impact the marketplace for energy resources. The connection between leadership decisions and market fluctuations cannot be overstated, especially when it comes to vital commodities. Factors like trade policies, geopolitical tensions, and economic strategies play an essential role in determining the trajectory of these important assets.

The dynamics of supply and demand also come into play, influenced by everything from natural disasters to technological innovations. Observers are keen to analyze how recent developments in governance might alter the balance and what that means for consumers and industries reliant on these essential goods. Understanding these nuances is crucial for predicting future trends.

In the midst of such turbulence, conversations swirl about upcoming adjustments and how market participants will react. Many pay close attention to shifts in leadership mentality, looking for clues on whether costs will remain stable or undergo significant transformations. As we delve into this topic, it becomes increasingly clear that the interplay between politics and economic conditions is more intricate than it might initially appear.

Analyzing Trump’s Influence on Oil Markets

The connection between leadership decisions and global commodities is always fascinating. When examining the impact of certain political figures on market dynamics, it’s crucial to consider a range of factors. Actions taken by leaders can shift sentiments, affect regulations, and alter supply-demand equations, ultimately influencing the energy sector in substantial ways.

During his term, various initiatives were introduced that resonated throughout the energy landscape. Revisions in trade policies, alterations to environmental regulations, and a focus on energy independence all played significant roles. These strategies could either stimulate or hinder production levels, which directly correlate with market trajectories.

Furthermore, international relations and foreign policy stances can lead to geopolitical tensions or partnerships that impact global supply chains. Notably, decisions regarding alliances and sanctions have the potential to create ripples that extend far beyond borders, influencing investor confidence and market behavior.

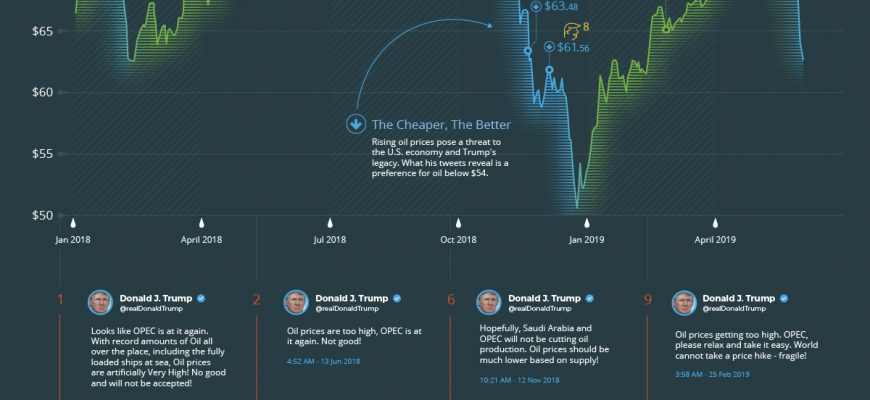

Understanding market psychology is equally essential. The unpredictability of announcements or tweets can sway public sentiment swiftly. Reactions from traders and consumers to such communications can lead to immediate fluctuations in market conditions, showcasing the leader’s capacity to sway perceptions based on rhetoric alone.

In summary, diving into how specific political moves affect the energy market reveals a complex tapestry woven from regulatory shifts, geopolitical considerations, and market sentiment. The interplay of these elements ultimately shapes the dynamics of this essential industry.

Factors Affecting Future Oil Prices

Understanding the elements that influence the market for crude can provide insights into the potential direction it might take. Numerous factors come into play, creating a complex web of interactions that ultimately shape the cost at which this vital resource is traded. From geopolitical tensions to technological advances, each component holds significant weight.

One critical aspect is the balance of supply and demand. When production levels are high, and demand remains stable or decreases, the overall market can shift, leading to lower costs. Conversely, if demand surges unexpectedly, it could result in a substantial increase in values. Similarly, inventory levels play a major role; high stockpiles can suppress the market while dwindling supplies can create upward pressure.

Geopolitical stability is another significant contributor. Conflict in key producing regions can disrupt output, leading to fears of shortages. Such fears often cause a spike in market values, even if actual disruptions are minor. On the other hand, peace agreements and stable political environments tend to calm the market, potentially leading to reduced costs.

Technological advancements in extraction and production methods can also shift the landscape dramatically. Innovations that enable more efficient resource recovery can increase supply, which may lead to a decrease in market values. Additionally, the rise of alternative energy sources has begun to influence the demand side, prompting traditional energy sectors to adapt to changing consumer preferences.

Market sentiment and speculation can heavily impact the cost dynamics as well. Traders’ perceptions of future conditions, influenced by news and analysis, can lead to significant fluctuations that don’t always align with actual supply and demand changes. This speculative element adds another layer of complexity to understanding how the market might behave in the future.

Global Impacts of U.S. Energy Policies

The decisions made in the United States regarding energy can ripple across the globe, influencing economies and environments far beyond its borders. The approach to resource management and production has significant implications for international markets, trade relationships, and even geopolitics. When the U.S. shifts its stance on energy strategies, it creates waves that can affect supply chains, consumption patterns, and overall energy security worldwide.

Changes in domestic energy policy can lead to fluctuations in availability and demand. For instance, if the U.S. opts to increase production of specific natural resources, this could lead to greater availability on the global market, potentially influencing costs in various regions. Conversely, a move toward more stringent regulations might tighten supply, affecting countries that depend heavily on imports from the U.S. Such adjustments often compel nations to reconsider their own energy strategies and seek alternative sources or partners.

Moreover, the environmental impact of energy policies contributes to worldwide discussions around climate change and sustainability. As the U.S. takes steps to either lessen or intensify its carbon footprint, other nations may feel pressured to align their practices accordingly. This interconnectedness has the potential to foster cooperative initiatives or spark tensions between different regions concerning compliance with environmental standards.

In essence, the energy choices made by U.S. policymakers don’t exist in a vacuum; they resonate through global networks, shaping economic landscapes and international relations. Understanding these dynamics is crucial, as shifts in the U.S. energy agenda could alter the paths of many economies around the world.