Will Oil Prices Decrease in the Near Future?

The ongoing fluctuations in the energy market have left many wondering about the potential trajectory of essential resource values. As various factors come into play, from geopolitical events to economic shifts, the question arises: what can we expect moving forward? Observers and analysts are keenly monitoring these developments, trying to piece together the puzzle of future affordability.

Concerns about sustainability, alongside the pace of technological advancements, also influence the conversation. As countries strive for greener alternatives, the dynamics of traditional energy sources continue to evolve. This shifting landscape prompts an evaluation not just of current standings but also of what lies ahead for consumers and industries alike.

In this context, understanding the underlying elements that drive these changes becomes crucial. Economic indicators, supply chain interruptions, and shifts in consumer demand all contribute to the narrative unfolding before us. As stakeholders navigate these waters, the anticipation of what’s next adds an intriguing layer to the discussion.

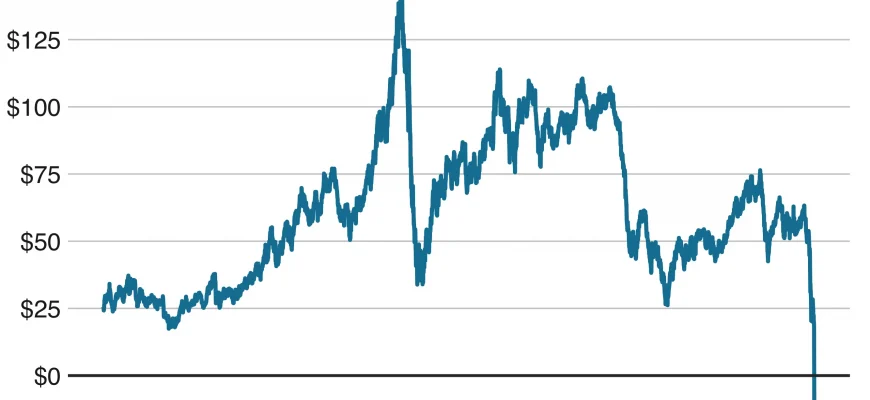

Current Trends in Global Oil Prices

As we navigate through changing times in the energy sector, it’s fascinating to observe the fluctuations and patterns emerging on the global market. Economic developments, geopolitical events, and even seasonal variations all play significant roles in shaping the monetary values associated with petroleum extraction and distribution. The intricate web of supply and demand continues to influence market dynamics in unexpected ways.

One of the key influences on the current financial landscape is the ongoing shift towards renewable resources. Countries across the globe are increasingly investing in alternative energy sources, which has sparked discussions about the future worth of traditional fossil fuels. This shift could very well lead to a re-evaluation of long-standing market trends, prompting both investors and consumers to reconsider their strategies.

Geopolitical factors also cannot be underestimated. Tensions in oil-producing regions often lead to abrupt changes in availability and consequently affect market sentiments. When uncertainty looms, players in the industry may engage in pre-emptive measures, causing immediate surges or drops. This reality highlights the delicate balance that exists within the market and the importance of staying informed.

Another aspect worth noting is the impact of economic indicators, such as inflation rates and economic growth forecasts. When economies show signs of slowing down, the demand for fuel typically wanes, which can lead to a correction in values. Conversely, robust economic activity often drives consumption, leading to potential increases in the financial worth of these resources.

In summary, keeping an eye on current trends in energy commodities is vital. Understanding the multifaceted influences at play provides insights not only into market movements but also into the broader economic context. The future landscape of this sector remains unpredictable, making it all the more exciting for analysts and enthusiasts alike.

Factors Influencing Future Oil Costs

Numerous elements come into play when it comes to the fluctuations of energy commodities. It’s essential to understand the various driving forces that shape the market landscape in order to make educated predictions about upcoming trends. Both global dynamics and localized factors contribute to the overall scenario, influencing the financial frameworks that govern these resources.

Geopolitical tensions often emerge as major players in determining market stability. Conflicts or alliances between nations can lead to supply chain disruptions, causing ripple effects throughout the industry. The more volatile the political climate, the more uncertainty is injected into the market, which can sway investor confidence.

Technological advancements also heavily impact the extraction and processing methods of these resources. With innovations enhancing efficiency and lowering production costs, supply can increase, directly affecting market conditions. Moreover, the rise of alternative energy sources may shift consumer preferences, creating a response in traditional sectors.

Economic growth in various regions can lead to changes in demand. As populations expand and industrial activities ramp up, the need for energy sources will naturally rise. Conversely, during periods of economic downturns, consumption may drop, leading to adjustments in how these commodities are valued.

Environmental policies and regulations are becoming increasingly significant as societies strive for sustainability. Stricter emissions controls and renewable energy initiatives can alter the competitive landscape, driving organizations to innovate and adapt, which also influences market dynamics.

Understanding these contributing factors is crucial for forecasting future trends and assessing how market behavior may evolve over time. Staying informed helps navigate the complex intertwining of global events and local influences, allowing for better strategic decisions.

Impact of Politics on Oil Markets

Political dynamics play a significant role in shaping the landscape of energy complexes worldwide. Decisions made by governments, international relations, and geopolitical tensions can all influence how commodities are traded and valued. The interplay between state policies and market responses often leads to fluctuations that can have broad implications for economies and consumers alike.

For instance, conflicts in key producing regions can disrupt supply chains, leading to spikes in demand and alterations in consumption patterns. Additionally, regulatory measures, such as sanctions or export restrictions, can create uncertainty and alter market behavior. Investors closely monitor these political developments, as they can signal potential shifts in commodity availability and influence market sentiment.

Furthermore, agreements between nations, such as those orchestrated by influential alliances, can stabilize or destabilize the entire sector. The negotiation of production cuts or increases directly impacts the ability of countries to meet their economic objectives, which can ripple through the global market. Observers need to stay attuned to these political movements, as they are often precursors to larger trends that affect everyone from large corporations to everyday consumers.