The Potential Collapse of Oil Prices and Its Implications for the Global Economy

Have you ever wondered about the ever-changing landscape of the energy market? It’s a topic that evokes a lot of discussions and predictions. Many factors play into the fluctuation of energy values, and every industry player is keenly watching the trends to gauge future directions. Economists and analysts are often at the forefront, trying to decipher patterns and make sense of the complexities involved.

As we dive deeper into the conversation, questions about the sustainability of certain energy resources come to the forefront. Factors like geopolitical tensions, demand fluctuations, and technological advancements are always in play. There’s an undeniable interconnectedness in this realm that keeps everyone on their toes and sparks debate on what’s next for this vital sector.

Join us as we explore what the potential shifts could mean for consumers, markets, and the global landscape. It’s a ride filled with speculation, insights, and projections, and it’s only just beginning!

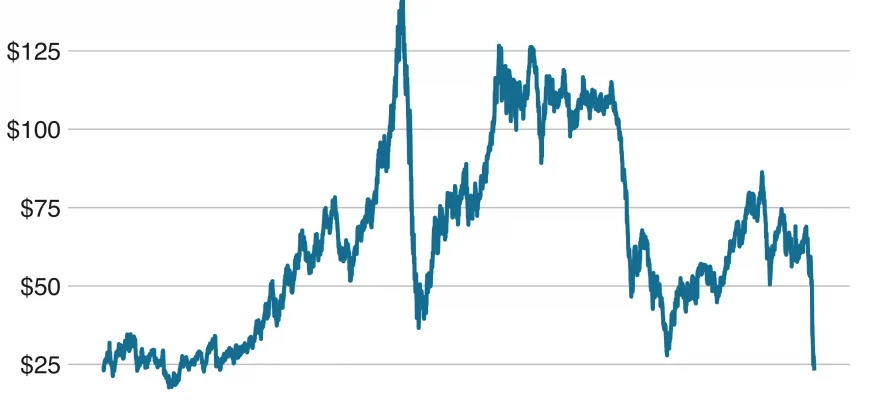

Current Trends in Oil Pricing

Right now, we’re seeing some fascinating shifts in the energy market that are capturing a lot of attention. The dynamics surrounding the costs associated with fossil fuels are influenced by a myriad of factors, ranging from geopolitical tensions to advancements in renewable technologies.

Supply and Demand Fluctuations: One major element driving these costs is the balance between supply and demand. When production ramps up or adjustments are made to extraction levels, it can lead to notable variations in the marketplace. Conversely, increasing consumption in emerging economies can place significant pressure on available resources.

Speculative Activity: Traders and investors also play a vital role in impacting market conditions. Speculative trading can create volatility, as expectations about future trends can shift within a matter of days, altering the sentiment around these commodities dramatically.

Geopolitical Factors: Additionally, political situations in key producing regions contribute to uncertainty. Events such as conflicts or sanctions can disrupt availability, causing costs to swing unexpectedly. This creates an environment where players must stay alert and adaptable to changing circumstances.

Technological Advances: On another front, the rise of green energy initiatives is reshaping perspectives on traditional fuels. Innovations in extraction techniques and a growing focus on sustainability are encouraging diversification, which could impact long-term strategies and forecast models.

As we navigate these intriguing trends, it’s clear that the landscape is anything but static. Stakeholders from various sectors will need to monitor these developments closely to make informed decisions about their futures.

Factors Influencing Market Volatility

Understanding the fluctuations in the energy sector requires a closer look at various elements that can sway the market dramatically. Numerous aspects contribute to the unpredictability of this landscape, making it essential for investors and analysts to stay informed and adaptable.

Geopolitical Tensions play a crucial role in influencing the stability of the market. Conflicts or unrest in key production regions can create uncertainty, leading to rapid swings in values. Additionally, decisions made by governmental bodies or organizations can further impact sentiment and trading behavior.

Supply and Demand Dynamics are fundamental factors that shape market behavior. Disruptions in production, whether due to natural disasters or technical issues, can lead to shortages that drive up demand. Conversely, advances in alternative energy sources can result in shifts in consumer preferences, causing values to drop.

Economic Indicators also have a significant impact. Reports on employment rates, manufacturing output, and consumer spending can signal potential growth or contraction in the economy, affecting how traders respond to the sector’s performance. Strong economic data often leads to optimism, while poor statistics can trigger sell-offs.

The role of investor sentiment cannot be underestimated. Emotions and market psychology often lead to erratic behavior, with traders reacting to news or trends that may not have a direct relationship with underlying fundamentals. This can exacerbate volatility and create further unpredictability in the market.

Lastly, the influence of technological advancements and innovations in energy extraction and production can reshape the landscape entirely. As new methods emerge, they can either stabilize the market or introduce new risks, depending on how they are adopted by industry players.

Future Predictions for Global Crude Demand

Looking ahead, the landscape of global energy consumption is poised for significant changes. Analysts are closely monitoring various factors that could influence the appetite for fossil fuels. With technological advancements, shifts in consumer preferences, and evolving policies, the interplay between supply and demand will certainly reshape the market dynamics.

As nations strive for sustainability, alternative energy sources are gaining traction. This could spark a gradual transition away from traditional fuels, impacting overall consumption rates. However, the pace at which this shift occurs remains uncertain, as industrialism and transportation sectors still heavily rely on these resources.

In emerging economies, rapid industrial growth may counterbalance the push for greener alternatives. Increased urbanization and the demand for energy-intensive infrastructure could keep consumption levels robust, even as developed nations move towards renewable sources.

Additionally, geopolitical tensions and OPEC+ strategies will play pivotal roles in shaping the future. Decisions made by major producers can lead to fluctuations in extraction strategies which, in turn, may significantly impact global consumption patterns.

Investors and stakeholders should remain vigilant, as indicators in technology, policy, and market trends will guide the future trajectory of energy demand. The journey ahead is sure to be complex, with a myriad of influencing factors at play.