What Changes Can We Expect in Car Tax Rates by 2025 and How Will They Affect You?

As we look ahead, many individuals find themselves pondering the potential changes to their financial responsibilities related to vehicle ownership. With evolving regulations and economic factors in play, it’s natural to wonder how these elements might influence what we pay for our beloved means of transportation.

Recent discussions in forums and media have raised questions about upcoming adjustments that could impact how much we set aside for these obligations. Being informed about the possible developments can help us better prepare for any shifts that may come our way.

In this exploration, we’ll delve into the various aspects that could lead to alterations in your financial commitments. From government initiatives to environmental considerations, understanding these influences will empower you to make more informed decisions moving forward.

Impacts of New Tax Policies

Changes in fiscal regulations can significantly influence individuals and businesses alike. The introduction of new financial measures often leads to a ripple effect, impacting everything from personal budgets to overall market dynamics. Stakeholders need to be aware of these adjustments and how they may alter their financial landscape.

One of the immediate consequences of updated fiscal frameworks is the potential rise in expenses for many drivers. This can prompt consumers to rethink their spending habits and may even drive a shift toward more economical modes of transport. People could start considering alternative options, such as public transit or carpooling, which can reshape commuting patterns in communities.

Additionally, businesses that specialize in automotive services may experience fluctuations in demand. As the cost of ownership rises, consumers might delay purchases or opt for used vehicles over new ones. This shift could lead to changes in inventory strategies, affecting sales forecasts and profit margins for manufacturers and dealerships.

Moreover, there’s the impact on the environment to consider. Stricter regulations can encourage investment in greener technologies and incentivize the production of electric vehicles. This could lead to a transformation in the automotive industry, fostering innovation and potentially leading to a more sustainable future.

Ultimately, staying informed about these developments is crucial for adapting to the changing landscape. Understanding the broader implications of new fiscal policies allows individuals and businesses to make informed choices, ensuring they are prepared for any shifts in priorities or expenditures.

Understanding Vehicle Duty Calculation Methods

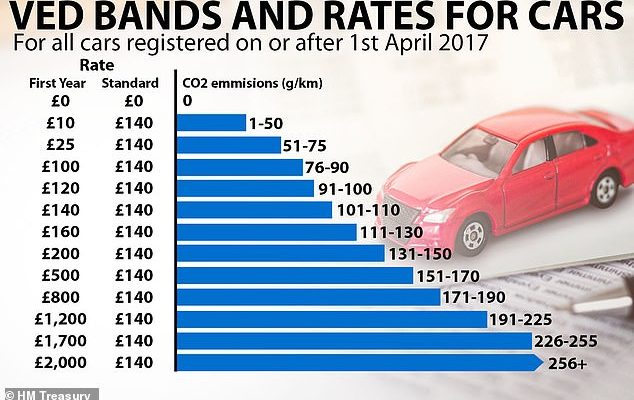

When it comes to assessing how much you might owe for your vehicle, there are various approaches that authorities utilize. By delving into these methodologies, individuals can grasp the underlying principles that drive the figures presented on their annual dues. Factors such as emissions, engine size, and overall performance often play significant roles in determining the amount owed.

One key aspect often considered is the emissions produced by a vehicle. Many regions have adopted a strategy where greener models with lower carbon footprints receive more favorable rates, while those that are less environmentally friendly face steeper fees. This aligns with broader efforts to incentivize eco-friendly practices among drivers.

Another factor influencing your obligations is the size of the engine. Generally, larger engines are associated with higher performance, which can lead to increased financial responsibilities. This approach encourages vehicle owners to think about the environmental impact of their choices while considering economic implications.

Additionally, models can be categorized by age and make, which can also influence the charges. Newer vehicles often boast advanced technologies that adhere to stringent environmental standards, resulting in reduced costs for their owners. Conversely, older models, which may be less efficient, could incur higher obligations due to outdated practices.

Ultimately, understanding these calculation methods helps individuals make informed decisions when purchasing a vehicle or planning for future financial commitments. Keeping abreast of the evolving framework is advantageous for anyone looking to navigate their responsibilities effectively.

Future Projections for Vehicle Tax Rates

As we look ahead, many folks are curious about how changes in regulations and environmental policies might impact expenses related to owning a vehicle. With governments aiming to address sustainability and climate issues, it’s natural to wonder what this could mean for future financial obligations tied to vehicles.

Predicting increases in these charges is not an exact science, as various factors come into play. For instance, the shift towards electric and hybrid vehicles may lead to adjustments in the amount owners contribute based on emissions. Additionally, some regions have been contemplating introducing more personalized fees based on usage patterns, thereby reflecting the actual impact on local infrastructure.

In the coming years, it’s likely that we’ll see a stronger emphasis on encouraging cleaner alternatives, which might alter the fee structures altogether. Future planning relies not only on governmental policies but also on public sentiment about climate initiatives. As discussions evolve, so too will the framework that governs these financial commitments.

What a stunning video! Her elegance and charm shine through in every second. She’s simply amazing.

This is a true work of art! She’s so poised and graceful;and her beauty shines in every frame.