Prospects for the Japanese Yen to Appreciate Against the US Dollar

When it comes to currency trading, the dynamics between various economies create a fascinating landscape for investors and enthusiasts alike. Market fluctuations, economic indicators, and geopolitical events all play roles in shaping the value of one currency relative to another. As traders keep a close watch on these trends, many begin to speculate about the potential movements of specific currencies.

In this discussion, we’ll explore the intriguing interaction between the Japanese currency and its American counterpart. The strength of these two currencies can have significant implications for global trade, investments, and even everyday transactions. Understanding the factors that contribute to changes in currency values can provide valuable insights for individuals looking to navigate this complex field.

As we delve into the analysis, we’ll highlight key elements to consider, from economic data releases to shifts in monetary policy. By examining these aspects, we can gain a clearer picture of the potential future trajectory of one of the world’s most significant currency pairs. So, let’s get started and discover what lies ahead in this ever-evolving financial landscape.

Factors Influencing Currency Rates

When it comes to understanding the fluctuations in currency values, several key elements come into play. The dynamics between two currencies are often shaped by economic indicators, geopolitical events, and market sentiment. These factors can create a complex environment that affects how one currency measures against another.

Economic Performance plays a significant role. Indicators like GDP growth, unemployment rates, and inflation statistics can sway perceptions about a country’s financial health. For instance, a robust economy typically attracts foreign investment, boosting its currency’s strength. Conversely, economic downturns or instability can lead to depreciation.

The monetary policy set by central banks is another critical aspect. Changes in interest rates can draw investors seeking higher returns. If one nation’s central bank tightens its monetary policy while another remains loose, it could lead to an increased demand for the stronger currency.

Geopolitical tensions also impact markets significantly. Uncertainties stemming from political stability, trade wars, or global conflicts can lead to capital moving toward perceived safer assets. This often benefits traditionally strong currencies during turbulent times.

Finally, market psychology plays a vital role. Traders’ perceptions, driven by news and sentiment analysis, can lead to rapid shifts in currency demand. A surge in confidence or fear about future developments can prompt swift movements in exchange rates.

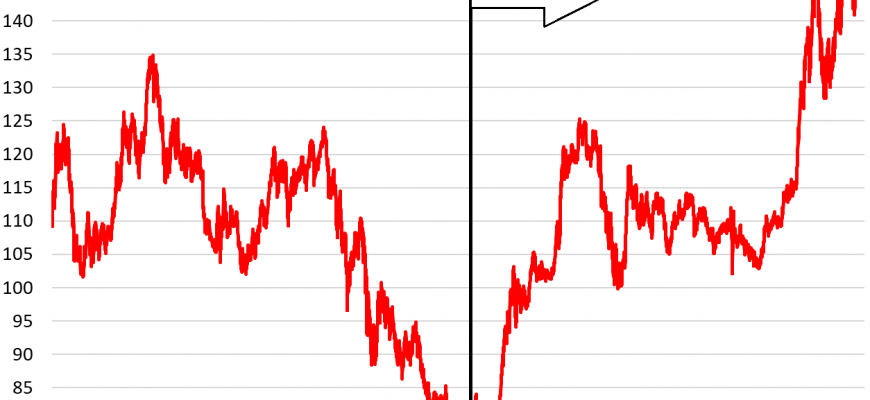

Technical Analysis of Currency Trends

When diving into the world of foreign exchange, understanding patterns and movements is essential. By examining historical data and chart formations, analysts can identify potential future behaviors of different currencies. This approach not only helps in making informed decisions but also sheds light on underlying market psychology.

One of the primary tools utilized in this type of analysis is moving averages. These indicators smooth out price fluctuations to reveal the overall direction of currency pairs. Traders often observe crossovers between short-term and long-term averages, which can signal shifts in momentum. Additionally, support and resistance levels offer insights into potential price barriers, guiding when to enter or exit positions.

Another key aspect involves trendlines, which act as visual representations of price trends over time. By drawing trendlines, one can easily identify whether a currency is in an upward, downward, or sideways movement. Coupled with oscillators and volume analysis, traders gain a more comprehensive view of current market conditions.

Ultimately, technical analysis serves as a valuable framework for understanding the interplay of currencies. By relying on historical indicators, market participants can better navigate the complexities of foreign exchange and capitalize on opportunities as they arise.

Impact of Economic Policies on Exchange Rates

Economic strategies set by governments and central banks are crucial factors that significantly influence currency values. These policies can create fluctuations in the financial markets, leading to changes in how one currency measures up against another. Understanding this relationship helps investors and analysts gauge potential market moves.

Monetary policies, particularly interest rates, play a vital role in shaping currency strength. For instance, when a central bank increases interest rates, it often attracts foreign capital, pushing the currency’s value higher. Conversely, lower rates may deter investment, resulting in a depreciation of the currency. This dynamic showcases the direct connection between policy decisions and market reactions.

Fiscal policies, such as government spending and taxation, also affect currency performance. When a government invests in infrastructure or social programs, it can stimulate economic growth, boosting confidence among investors. However, excessive debt levels can create uncertainty, leading to a decline in currency appeal. Therefore, prudent fiscal management is essential for maintaining currency value.

Additionally, geopolitical events and trade agreements can further complicate this scenario. Decisions made in international relations can either strengthen or weaken existing economic policies, impacting overall currency stability. Keeping tab on these developments can provide valuable insights for anyone engaged in currency trading or economic forecasting.