How the Ongoing Conflict in Israel Could Influence Global Oil Prices

In today’s interconnected world, geopolitical situations can have far-reaching implications that often extend beyond borders. When conflicts arise, one of the critical areas to watch is the energy sector. Fluctuations in global demand and uncertainty can send ripples through various markets, leading to movements that many investors closely monitor.

Understanding the intricacies of how conflict zones influence the flow of resources is essential for anyone interested in the economic landscape. Historical events have shown that disruptions in certain regions can lead to a chain reaction affecting supply chains, investor sentiment, and ultimately, how individuals and businesses engage with energy commodities.

As tensions escalate, analysts and economists often speculate on potential repercussions. This is where the narrative shifts, as stakeholders begin to prepare for possible outcomes. Investors may recalibrate their strategies, while consumers could brace for changes in their energy costs. Keeping an eye on these developments helps to paint a clearer picture of what might lie ahead in the volatile arena of resource management.

The Impact of Conflict on Global Energy Markets

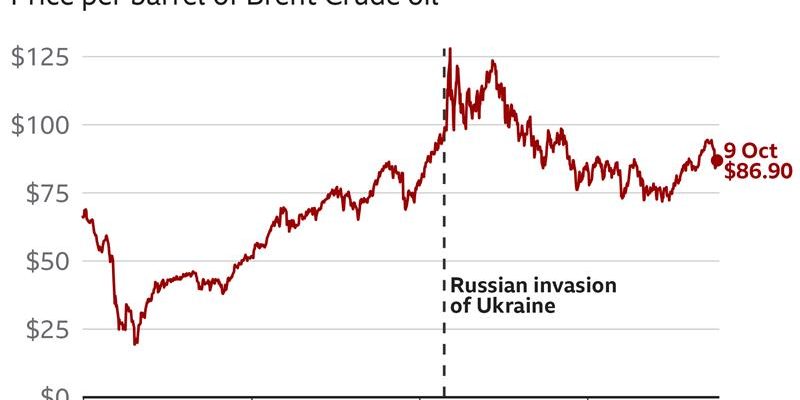

When tensions rise in key regions, the global energy landscape often experiences tremors. These disruptions can lead to fluctuations in the availability and costs of vital resources, profoundly influencing economies worldwide. Historical patterns suggest that geopolitical strife tends to trigger waves of uncertainty, prompting shifts in supply and demand dynamics.

Moreover, the interconnectedness of modern economies means that disturbances in one area can have ripple effects far beyond its borders. As nations respond to crises, whether through sanctions, changes in trade routes, or adjustments in production levels, the entire market can be thrown into disarray. Investors watch closely, reacting swiftly to any sign of instability, which often results in heightened volatility in the energy sector.

Additionally, the perceptions of future conflicts play a crucial role in shaping market behavior. Anticipation of potential disruptions can lead to preemptive actions by both corporations and governments. The need for strategic reserves and alternative sourcing becomes paramount as players in the market brace for potential challenges ahead.

Ultimately, the response to such conflicts isn’t solely about immediate impacts; the long-term ramifications can reshape energy strategies and policies globally. As stakeholders adapt to these evolving circumstances, the foundation of energy security remains a critical concern for nations around the world.

Supply Chain Disruptions and Price Fluctuations

When unforeseen events shake up the global landscape, the ripple effects can be felt far and wide. A disturbance in one area often leads to an unexpected chain reaction, especially in a world that’s tightly interconnected. Disruptions can influence not just the availability of resources, but also the costs associated with them. This relationship is crucial to understand, especially for those keeping an eye on the market.

Issues in logistics and transportation can create shortages that drive demand higher. When products take longer to reach the market, consumers start to panic, leading to skyrocketing costs for everyone. For example, if key routes are compromised, it affects delivery times and increases the expenses related to shipping. This can initiate a spiral effect that impacts various sectors.

Scarcity often leads to a rise in expenses as businesses scramble to secure what little is left. Companies may find themselves in bidding wars, further escalating costs. It’s not just basic commodities; many sectors from manufacturing to retail can feel the pinch when supply chains are disrupted. Planning for such uncertainties becomes essential to mitigate risks.

In addition to immediate impacts, long-term consequences can reshape market dynamics. Companies may diversify their suppliers or adjust their strategies to adapt to the new realities. This adaptive behavior is a natural response, but it can also influence trends for years to come, altering the landscape significantly.

Geopolitical Tensions and Market Reactions

When conflicts arise in key regions, it invariably stirs up a whirlwind of emotions and uncertainty among investors. The interconnected nature of global markets means that any sign of instability can lead to swift reactions from traders and financial institutions alike. People start to question the potential outcomes, weighing risks, and considering how such events might influence various sectors.

Typically, traders closely monitor areas where strife may disrupt supply chains or energy routes. Speculation often runs rampant, with market participants adjusting their strategies to hedge against possible disruptions. This dance between fear and opportunity can create significant volatility, as stakeholders react to breaking news and shifting sentiments.

Furthermore, the ripple effects from geopolitical friction can extend well beyond the immediate region involved. Countries that rely on imported resources may feel the pinch, leading to adjustments in their economic forecasts. This, in turn, influences decisions made by central banks and can alter monetary policies, further amplifying the situation.

Ultimately, as tensions escalate or de-escalate, the markets respond dynamically, navigating through uncertainty while investors seek to capitalize on any fluctuations. It’s a complex interplay of factors that illustrates just how vulnerable global economies are to local disputes, emphasizing the need for vigilance in the face of ever-changing circumstances.