Housing Market Predictions for 2025 Are Prices Expected to Rise or Fall

The real estate market is like a living organism, constantly adapting to changes in economy, demand, and societal trends. As we look ahead, many people are wondering about the trajectory of market dynamics and what influences will shape it. While some believe that values will continue to surge, others predict a correction in the prevailing trends. It’s a topic that generates a lot of discussions and opinions, as everyone seems to have a viewpoint on what may lie ahead.

Several factors come into play when considering the direction the market may take, including interest rates, employment levels, and even shifting demographics. Investors, homeowners, and prospective buyers are all eager for insights that could help them make informed choices in the coming years. It’s fascinating to analyze how these components intertwine and the potential implications for individuals looking to navigate the complexities of the property landscape.

In this exploration, we will delve into various elements that contribute to the fluctuations in value and how they might impact the decisions of countless people. Whether you’re contemplating a purchase, sale, or investment, understanding these trends is crucial. Let’s break down the critical factors that could influence real estate fluctuations in the foreseeable future.

Factors Influencing Real Estate Trends

Understanding the dynamics that shape the housing market can be quite enlightening. A variety of elements contribute to whether the cost of properties rises or falls, and these influences often intertwine in complex ways. From economic indicators to social shifts, recognizing these factors is essential for anyone interested in real estate.

Firstly, the state of the economy plays a pivotal role. When employment rates are high and wages are increasing, demand typically surges, leading to an uptick in value. Conversely, economic downturns can cause uncertainty, making potential buyers hesitant. Interest rates are another significant consideration; lower rates can boost purchasing power, while higher rates may dampen enthusiasm for buying.

Demographics also heavily influence market dynamics. As millennials and younger generations enter the market, their preferences and financial capabilities shape demand. Urbanization trends can drive prices up in certain areas, while rural regions may see stagnation or decline. Local policies, including zoning laws and tax regulations, further complicate the landscape, affecting how easily properties can be bought and sold.

Additionally, lifestyle changes and innovations can alter what consumers seek. The rise of remote work has led many to reevaluate their living situations, impacting suburban and urban property values differently. Environmental factors, such as climate change and natural disasters, might also affect desirability in specific locations.

Lastly, global influences should not be overlooked. Economic conditions in other countries, along with geopolitical events, can create ripple effects that influence local markets. All in all, navigating the real estate landscape requires a keen eye on these shifting parameters to anticipate future developments.

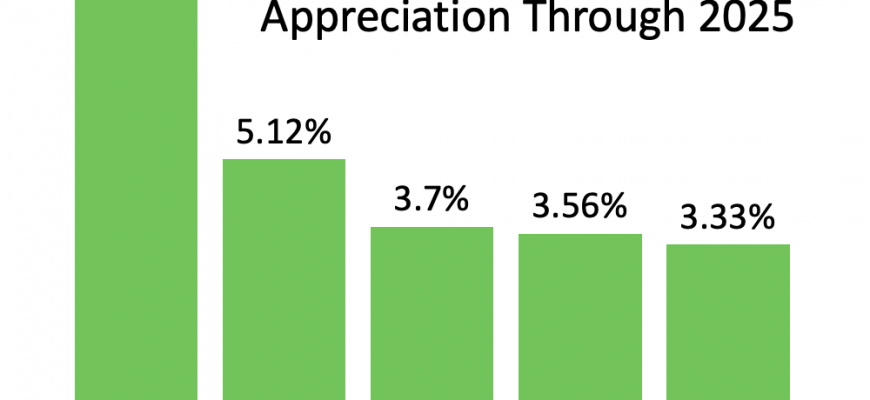

Expert Predictions for 2025 Housing Market

As we look towards the future, there’s a lot of buzz around what the real estate landscape might hold in the coming years. Industry professionals are analyzing trends, economic indicators, and consumer behavior to provide insights into the potential shifts within the market. Given the fluctuations we’ve observed over the past years, many are eager to understand what to expect next.

Market analysts emphasize that various factors will come into play. Interest rates, employment statistics, and demographic shifts will significantly affect demand and supply dynamics. Furthermore, the ongoing evolution of urbanization and remote work trends could reshape buyer preferences, leading to intriguing outcomes in different regions.

Some experts predict a gradual increase in activity as more potential buyers enter the market, motivated by favorable financing options and a desire for home ownership. Meanwhile, others caution against potential downturns driven by economic uncertainties or policy changes. The mixed sentiment creates an interesting environment for investors and home seekers alike.

In summary, while specific predictions vary, the consensus is that adaptability and informed decision-making will be crucial. Understanding the underlying factors influencing the sector will help navigate the landscape as it continues to evolve.

Regional Variations in Property Values

When it comes to the real estate market, one thing is clear: location matters. Different areas can experience significant fluctuations in value due to a myriad of factors, including economic conditions, local amenities, and even demographic trends. Understanding these regional differences can help potential buyers and investors make informed decisions about where to focus their efforts.

For instance, urban centers often showcase a robust appreciation in worth due to high demand for housing and proximity to employment opportunities. Conversely, rural locales may see slower growth, affected by factors such as job availability and local infrastructure development. Climate and environmental concerns can also play a crucial role in influencing desirability, especially in regions prone to natural disasters or adverse conditions.

Moreover, the impact of government policies cannot be overlooked. Incentives for homebuilders or tax breaks for first-time buyers can boost the market in certain states while having little effect elsewhere. Areas experiencing population influxes, driven by job creation or quality of life improvements, typically witness a surge in worth, making them hotspots for potential investment.

In contrast, regions experiencing economic downturns or stagnation often see their values slide, creating opportunities for savvy purchasers to snag properties at lower rates. It’s essential to consider these dynamics when analyzing market conditions, as they can vary widely depending on the unique characteristics of each locality.

Ultimately, staying informed about these geographical differences can provide valuable insights into the future landscape of the property market. Whether one is looking to move or invest, keeping an eye on regional trends will be key to navigating this ever-changing environment.