What to Expect for House Prices in 2025 Are We Heading for an Increase

The dynamics of the real estate sector constantly evolve, influenced by various economic factors and consumer behaviors. Enthusiasts and investors alike often find themselves pondering whether the market will experience an uptick in the coming years. With a myriad of predictions floating around, it’s essential to sift through the noise and analyze what might truly lie ahead.

Factors such as interest rates, demographic shifts, and employment trends play a substantial role in shaping the landscape of property values. As we look toward the future, understanding these components can provide valuable insights into potential market shifts. Moreover, the intricate interplay between supply and demand adds another layer of complexity, making the scenario all the more intriguing.

In the quest for knowledge, it becomes crucial to examine both local and global trends. The impact of economic policies and unforeseen events can create ripples that influence everything from property desirability to investment strategies. Ultimately, those curious about what the future holds must equip themselves with information and stay informed about ongoing developments in this ever-changing arena.

Factors Influencing Real Estate Trends

Understanding the dynamics of the property market requires a closer look at various elements that shape its trajectory. Numerous variables come into play, determining how ownership values evolve and shift over time. These aspects can influence buyer behavior, investment decisions, and overall market stability.

Economic Conditions: The state of the economy is a crucial driver. When the economy thrives, individuals tend to have more disposable income, enhancing their ability to invest in properties. Conversely, during downturns, economic hardship often leads to a decline in investment interest.

Interest Rates: The cost of borrowing is another significant factor. When rates decrease, more people are likely to finance their purchases, which can boost demand. On the other hand, higher rates can make mortgages less accessible, potentially cooling off the market.

Demographics: Changes in population dynamics, such as age distribution or migration trends, also affect property demand. Areas attracting younger populations may experience heightened interest, prompting shifts in available properties.

Government Policies: Regulations and incentives from governmental bodies can also play a role. Tax breaks, subsidies, or zoning laws can either stimulate growth or create hurdles for potential buyers and investors.

Technological Advancements: Innovations in technology are reshaping how individuals search for and purchase properties. Online platforms and virtual tours have made it easier for buyers to explore various options, impacting overall market activity.

By analyzing these factors, stakeholders can gain valuable insights into potential future developments within the sector, aiding them in making informed decisions.

Economic Indicators and Housing Market

Understanding the relationship between various economic metrics and the property landscape is crucial for anyone observing potential trends. Different factors like employment rates, inflation, and consumer confidence play significant roles in shaping the dynamics of real estate transactions. These indicators give us insight into market health and can help predict future movements in the sector.

For instance, when job opportunities grow, more individuals are likely to seek residential spaces, driving demand. Conversely, rising costs of living or instability in the job market might deter buyers. Additionally, interest rates have a substantial impact; lower borrowing costs usually encourage more people to enter the market. Thus, tracking these variables can provide valuable understanding of where the sector might head in the forthcoming years.

Moreover, economic growth tends to correlate with increased investment in residential developments. When the overall economy is thriving, people are more willing to make long-term commitments, such as buying properties. On the flip side, economic downturns often lead to lower consumer spending, which can result in stagnation or even declines in the property sector.

Ultimately, a keen eye on these economic indicators offers essential clues about the fluidity of the housing landscape, influencing both buyers’ and sellers’ decisions. Keeping tabs on how these elements interact can serve as a compass in navigating upcoming shifts in the property market.

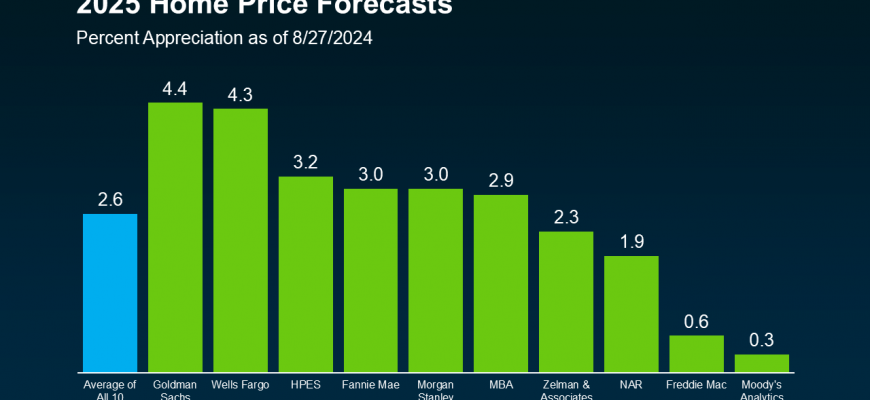

Predictions from Real Estate Experts

When it comes to the future of the market, insights from industry professionals can offer invaluable perspectives. These experts analyze data, trends, and various influencing factors to make informed forecasts about what’s on the horizon.

Many analysts point to a mix of economic indicators and demographic shifts that could shape the landscape. For instance, factors such as interest rates, employment trends, and population growth all play critical roles in determining how the sector will evolve. Some specialists believe that a continuing demand for quality living spaces will lead to upward movement, while others caution about potential fluctuations that could signify a more volatile environment.

Moreover, the growing trend of remote work is influencing where people choose to reside, which could drive demand in previously overlooked areas. As more individuals prioritize lifestyle over proximity to their workplaces, we may see a shift in value allocation across different regions.

Ultimately, while the future remains uncertain, the collective insights of these professionals can help us understand possible scenarios. Keeping an eye on evolving patterns and emerging trends will be essential for anyone wanting to navigate the coming years effectively.