Potential Decline in Euro Value on the Horizon

In the ever-evolving landscape of finance, the uncertainty surrounding specific monetary units often captures the attention of investors and analysts alike. As global economies fluctuate and geopolitical events unfold, questions arise about the future trajectory of various currencies. The interplay of market forces, economic indicators, and international relations can create a whirlwind of speculation about what lies ahead for these currencies.

Traders and enthusiasts delve into debates, examining economic policies, inflation rates, and trade balances to gauge potential shifts in purchasing power. With a keen interest in understanding the implications of these changes, many are left pondering: what does the future hold for a particular currency?

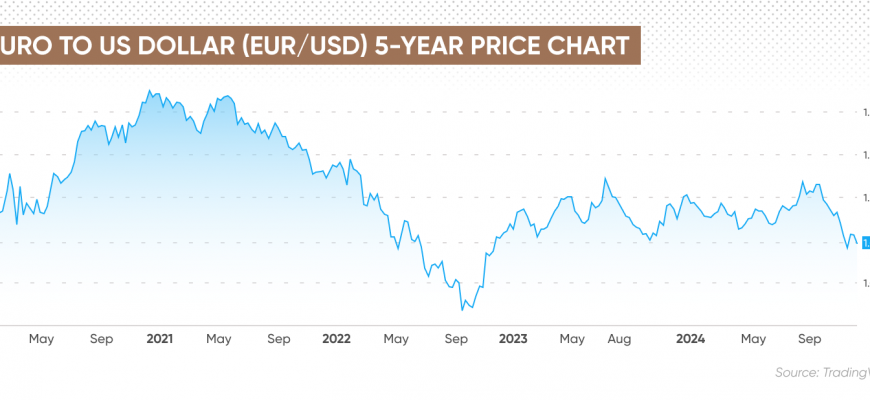

Recent trends and historical data provide valuable insights into these matters, yet uncertainty remains a constant companion. Analysts meticulously track movements and trends in the market, attempting to predict how various factors might influence consumer confidence and economic stability. As discussions continue, it is essential to keep an eye on the signs that might indicate a turning point.

Factors Influencing Currency Exchange Rates

When it comes to understanding how currencies fluctuate against one another, there are several key elements at play. These factors can vary widely and influence the buying and selling power of various currencies in the global market. Grasping these components helps make sense of the changing landscape of financial transactions between countries.

One major influence is the economic health of a region. Indicators such as GDP growth, employment rates, and inflation can significantly sway investor confidence. A strong economy often leads to a stronger currency, as it attracts investments and enhances global trade opportunities.

Another essential aspect is the monetary policy implemented by central banks. Interest rates and other financial policies can either encourage or discourage investment, impacting currency demand. When rates rise, it often leads to an influx of foreign capital, whereas lower rates might deter investors.

Geopolitical events also play a critical role. Political stability, trade agreements, and even conflicts can create uncertainty in the markets. Investors typically seek safety in stable currencies during turbulent times, affecting exchange rates as a result.

Lastly, market sentiment should not be overlooked. Traders’ perceptions and economic forecasts can lead to temporary fluctuations driven by news reports, analyst predictions, or changes in investor mood. This emotional aspect of trading highlights how psychology intertwines with fundamental economic factors.

Current Economic Trends in Europe

The landscape of European economies is undergoing significant transformations, impacting not only local markets but also the global financial scene. As countries face varying challenges and opportunities, it becomes crucial to analyze the intricate factors driving these economic shifts.

One notable aspect is the rising inflation rates observed across many nations, which influence purchasing power and overall consumer behavior. This scenario prompts authorities to adopt different monetary policies, affecting interest rates and investment climates. Moreover, supply chain disruptions, exacerbated by global events, continue to challenge businesses, forcing them to rethink strategies and adapt to new realities.

On the other hand, there is a growing emphasis on sustainability and green energy initiatives. Countries are increasingly prioritizing environmentally friendly projects to stimulate growth while addressing climate change concerns. This transition not only paves the way for innovative technologies but also encourages investment in renewable resources.

In summary, the current trends within European markets illustrate a complex interplay of various elements that shape economic prospects. Stakeholders must closely monitor these developments to navigate the evolving terrain effectively.

Impact of Global Events on Currency Strength

In today’s interconnected world, the performance of a particular currency can be significantly influenced by various international happenings. Whether it’s political unrest, economic downturns, or natural disasters, these factors can trigger shifts in perceptions and confidence among investors and traders. Understanding how these global events interact with a specific monetary unit is crucial for anyone interested in the financial markets.

Political stability plays a key role in determining how strong a currency stands against others. For instance, elections, governmental policies, or geopolitical tensions can create an air of uncertainty. When chaos reigns, people often seek refuge in more stable currencies, leading to potential declines in the affected currency’s standing in the market.

Economic indicators, like GDP growth and unemployment rates, are also pivotal. If a nation reports strong economic performance while others are lagging, it typically draws investment and strengthens the local currency. Conversely, signs of economic struggle in a particular region might lead to individuals looking elsewhere, thus affecting the relative strength negatively.

Additionally, global crises such as pandemics or severe economic recessions can reshape the landscape. These events can lead to swift changes in trading patterns and investor sentiment, making it imperative to stay informed about ongoing global conditions. Market reactions can be unpredictable, yet understanding these dynamics can help forecast potential shifts in currency performance.