Prospects for Euro Appreciation Against Indian Rupee in the Coming Months

When delving into the complexities of global finance, one cannot help but notice the constant fluctuations in currency values. The relationship between different monetary systems plays a crucial role in international trade, investment decisions, and even travel plans. As markets evolve, many are left pondering how certain currencies will perform in comparison to others, especially in the backdrop of changing economic conditions.

Analysts and enthusiasts alike often speculate on potential shifts in value, driven by various factors such as economic indicators, political climates, and market sentiment. With every passing day, the dynamics of currency pairs adapt, leading to both opportunities and risks for investors and businesses. Therefore, understanding these movements becomes essential for making informed choices.

In this discussion, we will navigate the intricacies of the monetary landscape, taking a closer look at anticipated trends and providing insights that may help you gauge potential developments. As we embark on this journey, we aim to shed light on what might lie ahead in the world of currency trading.

Factors Influencing Euro to INR Trend

Understanding the dynamics of currency pairs is crucial for anyone interested in the foreign exchange market. Several elements can sway the value of one currency relative to another, and the relationship between these two currencies is no exception. Market participants should be aware of various influences that shape this trend.

Firstly, economic indicators play a significant role. Data such as GDP growth rates, employment figures, and inflation levels provide insights into the economic health of countries involved. Strong economic performance typically correlates with a rise in currency value, while poor economic indicators can have the opposite effect.

Political stability is another vital consideration. Countries with stable governance tend to attract more investment, boosting their currency. Conversely, uncertainty or political turmoil can lead to diminished confidence among investors, often resulting in a decline in currency value.

Interest rates set by central banks can also impact exchange rates. Higher interest rates generally offer better returns on investments denominated in that currency, making it more attractive to foreign investors. This increased demand can elevate the currency’s value, while lower interest rates might have the reverse effect.

Finally, global market sentiment and external factors like geopolitical events or changes in trade policies can create fluctuations in currency values. Investors often react to these events, leading to short-term volatility in exchange rates.

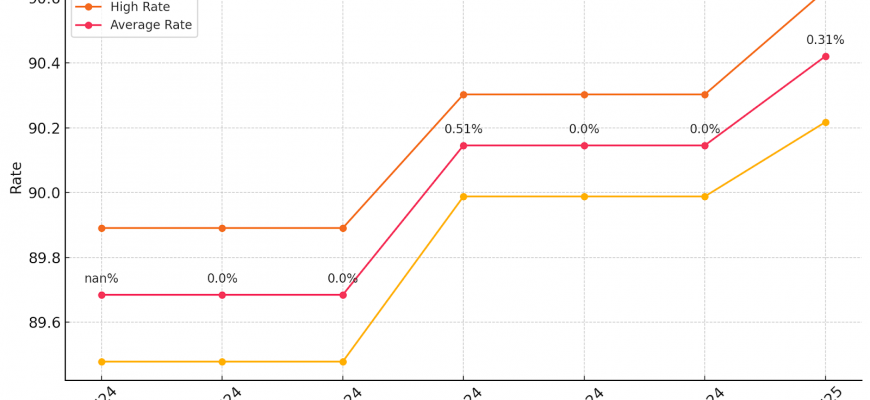

Future Predictions for Euro and INR

When considering the dynamics of currency exchange, many enthusiasts often ponder where the rates will head in the coming months and years. This discussion is not just about numbers; it encompasses economic indicators, geopolitical events, and even market psychology. Understanding these factors can help in making informed predictions about future movements in these financial assets.

Looking ahead, analysts are closely monitoring global economic trends, inflation rates, and interest policies that could impact exchange rates. As economies rebound from past challenges, shifts in demand and supply chains are also pivotal. Factors like trade balances and foreign investments will play a vital role in shaping the strength of currencies, reflecting their relative value on the international stage.

Moreover, it’s important to keep an eye on central bank policies and international relations. Changes in regulatory approaches, fiscal measures, and other macroeconomic policies can significantly influence investor sentiment, which ultimately drives currency valuation. Observing these elements provides insight into potential future scenarios.

Overall, while pinpointing exact fluctuations can be challenging, being aware of the factors at play can certainly aid in navigating the financial landscape. As conditions evolve, staying informed is key to understanding how these two currencies may interact in the future.

Impact of Economic Policies on Currency

Economic strategies adopted by governments can significantly sway the value of a nation’s financial unit. When policymakers decide on measures to stimulate growth, control inflation, or manage employment rates, these decisions directly influence how currencies behave in the international arena. Investors and traders closely watch these moves, as they can create ripples that affect exchange rates across the globe.

For instance, when a central bank opts to lower interest rates, it often makes borrowing cheaper, encouraging spending and investment. This, in turn, may lead to a depreciation of the local currency, as the influx of money into the economy might exceed what foreign investors are willing to commit. Conversely, tightening monetary policies usually boost the currency’s strength, as higher interest rates attract investment from overseas, leading to increased demand.

Moreover, fiscal policies such as government spending and taxation play a crucial role in shaping a currency’s trajectory. A well-implemented fiscal agenda can enhance economic stability and investor confidence, leading to an appreciation of the currency. On the flip side, excessive public debt or irresponsible spending can trigger concerns, causing the currency to lose value as investors seek safer assets.

In summary, the interplay between various economic policies and currency valuation is intricate and multifaceted. Understanding these dynamics can provide valuable insights into predicting fluctuations in currency markets, ultimately guiding investment decisions and financial planning.