What Are the Predictions for CD Rates in 2025 and Will They Experience an Increase

As we navigate through the financial landscape, many investors find themselves pondering the direction of fixed-income products. The uncertainty surrounding future economic conditions leaves us wondering about potential changes in outcomes that can significantly impact our savings and investment strategies. It’s essential to keep an eye on market indicators, as they often serve as valuable signals for assessing upcoming trends.

In recent years, various factors have influenced how these instruments are performing, including economic growth, inflationary pressures, and shifts in monetary policy. Understanding these elements can provide insight into what might be expected as we look ahead. A well-informed approach can empower investors to adapt their strategies accordingly and make the most of their financial opportunities.

Furthermore, many analysts are diligently analyzing patterns from past developments while also considering current market sentiments. This can help to forecast how fixed-income instruments will evolve. The landscape is constantly changing, and keeping abreast of these shifts can prove to be beneficial in making informed decisions moving forward.

Factors Influencing CD Rate Predictions

When thinking about the future of certificate interest, there are several elements that come into play. Understanding these components can help create a clearer picture of how things may unfold. Various economic indicators, government policies, and market trends all contribute to the fluctuations of returns on these financial products.

One major factor is the overall state of the economy. When the economy thrives, banks tend to offer more competitive returns to attract investors. Conversely, during tough economic times, the increase in demand for safe investments can lead to a different approach. Additionally, central bank decisions on monetary policy can drastically alter expectations, as changes in interest rates signal the direction in which financial institutions may adjust their offerings.

Inflation plays a crucial role too. Should inflation rise, the purchasing power of returns may diminish, potentially pushing banks to enhance the appeal of their offerings. Furthermore, competition among financial institutions can drive changes. As banks vie for customers, they may raise offerings to stand out in a crowded market.

Lastly, consumer behavior cannot be overlooked. Preferences for security and guaranteed returns can shape how banks structure their products. Observing these patterns provides valuable insights into anticipated changes in the landscape of certificates in the coming years.

Market Trends for Savings Investments

As we navigate the evolving landscape of personal finance, it’s essential to keep an eye on how the environment affects our choices in savings vehicles. The dynamics of the economic sphere continually shift, influencing how individuals decide to allocate their hard-earned funds. A keen understanding of these trends can help investors make informed decisions about where to place their assets.

Recent developments suggest a pivot towards more attractive options for those looking to grow their savings. Factors such as inflation levels, central bank policies, and overall economic performance play significant roles in shaping these opportunities. For instance, when inflation is on the rise, many savers might find themselves anxious about the purchasing power of their money, prompting a search for solutions that offer greater security and returns.

Moreover, the rise of digital banking and fintech has introduced new platforms that provide competitive offerings for traditional savings instruments. This shift is encouraging more individuals to explore diverse channels for maximizing their savings. With advanced tools and resources at their fingertips, investors are becoming more discerning, seeking out products that not only safeguard their funds but also enhance their growth potential.

Looking ahead, it’s evident that the landscape for savings options will continue to evolve. By staying informed about current economic indicators and exploring various financial products, individuals can make strategic choices that align with their long-term financial goals. The emphasis should always be on balancing risk with reward, ensuring that every decision contributes to a robust savings strategy.

Impact of Federal Reserve Decisions

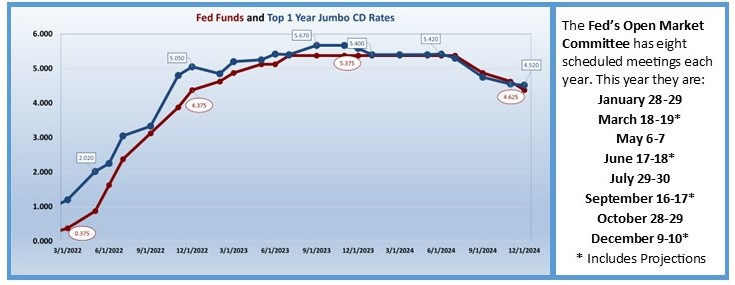

The actions and strategies of the Federal Reserve play a crucial role in shaping the financial landscape. When the central bank makes changes to its policies, it can ripple through various sectors, influencing everything from borrowing costs to investment yields. Understanding these decisions can help individuals anticipate shifts in their financial opportunities.

Monetary policy adjustments are often a response to economic conditions, such as inflation or unemployment levels. These changes can lead to fluctuations in how financial institutions offer various products, including fixed-income options. For savers, particularly those considering low-risk investments, these developments can create either challenges or opportunities.

Moreover, interest fluctuations set by the Federal Reserve influence the overall economic environment. When they opt to tighten or loosen monetary policy, it directly affects the attractiveness of different savings instruments. Future outlooks depend heavily on these strategic moves, which can either enhance or diminish the appeal of particular financial vehicles.

Additionally, investor sentiment is often swayed by the central bank’s interactions with the market. Anticipation of policy shifts can lead to increased volatility, impacting how financial products are perceived. Staying informed about these decisions is essential for anyone looking to navigate the evolving landscape effectively.