Reasons Financial Aid Applications May Be Rejected and How to Avoid Common Pitfalls

Navigating the complexities of support programs can sometimes feel overwhelming. Many individuals find themselves in a challenging situation when they apply for resources intended to alleviate their financial burdens, only to encounter unexpected hurdles. It’s essential to grasp the numerous factors that can influence outcomes in these scenarios.

Several elements play a significant role in determining eligibility for support services. While many applicants may assume their circumstances qualify them, various intricacies could lead to a different conclusion. Whether it’s related to documentation, income levels, or specific program criteria, understanding these nuances is crucial for anyone seeking assistance.

Lastly, being well-informed about potential pitfalls can empower individuals to take proactive steps in their applications. Identifying and addressing common missteps not only increases the chances of a favorable outcome but also provides valuable insights for future endeavors. Delving into these common issues can make a significant difference in one’s quest for relief.

Common Reasons for Assistance Denials

Navigating the world of educational support can be tricky, and there are several pitfalls that can lead to a rejection. Understanding these common stumbling blocks can help you prepare and strengthen your application. Let’s dive into some frequent issues that may cause trouble during the review process.

One primary concern often arises from insufficient documentation. Missing key forms or failing to provide necessary details can raise red flags. Accurate and complete information is crucial; any gaps may lead reviewers to question eligibility.

Another factor to consider is income discrepancies. If the declared financial situation doesn’t align with the information from tax documents or other financial records, it can create confusion and result in unfavorable outcomes. Consistency is key here.

Eligibility requirements also play a significant role. Each program has specific criteria, and failing to meet them–whether due to residency status, enrollment levels, or degree programs–can automatically exclude potential candidates from the selection pile.

Lastly, academic performance is a vital piece of the puzzle. Many programs require a minimum GPA or standardized test scores. Falling short in these areas can hinder chances, even if all other components are in order. Staying informed about these requirements helps maintain competitive eligibility.

Impact of Academic Performance on Assistance

Academic achievements play a crucial role in determining eligibility for support programs. When students excel in their studies, they often find themselves in a favorable position regarding the availability of resources. Conversely, those who struggle may face challenges in obtaining necessary backing, as institutions seek to promote a culture of excellence and success.

Maintaining a satisfactory grade point average is often a fundamental requirement for continued support. Schools and organizations aim to invest in individuals who demonstrate commitment and potential. Consequently, consistent performance not only secures aid but may also open doors to additional opportunities, such as scholarships or grants.

An unfortunate decline in academic standing can lead to a reassessment of support eligibility, leaving some students in a precarious position. Institutions expect participants to maintain certain standards to encourage progress and completion of their educational goals. Thus, it’s essential for aspiring scholars to prioritize their studies and seek help if needed, ensuring they remain competitive and qualified for ongoing assistance.

Understanding Financial Eligibility Criteria

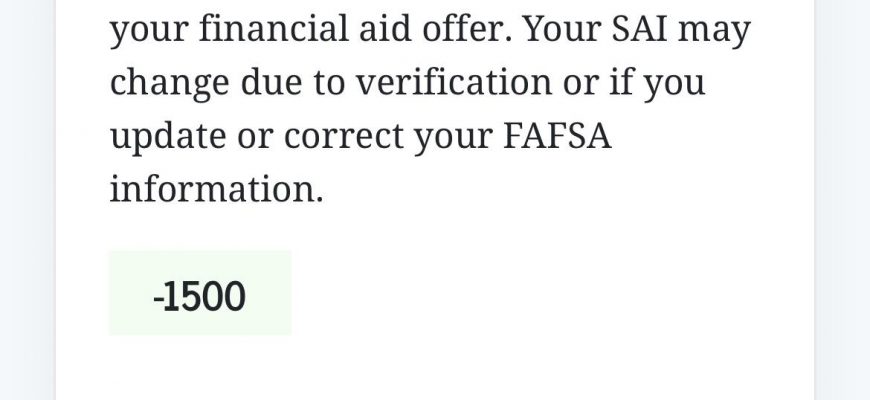

It’s essential to grasp the various standards that determine who qualifies for assistance and who does not. Many factors come into play, and understanding these can make a significant difference in the application process. From income levels to family size, each aspect is carefully considered to assess an applicant’s needs.

One primary element involves income assessment. Typically, there are specific thresholds that need to be met for consideration. If a household’s earnings exceed these limits, applicants might find themselves ineligible for support. Additionally, assets and savings are also evaluated, with certain maximum values in place that can impact decisions.

Another crucial factor is the student’s enrollment status. Full-time students usually have different requirements compared to part-time attendees. Many programs prioritize those who are enrolled full-time, as their need for support might be greater. Academic progress plays a role too; maintaining satisfactory grades is often a condition for continued support.

Lastly, the type of program or institution can influence one’s eligibility. Some financial resources are specifically designated for particular fields of study or types of institutions. It’s always a good idea to research and understand these nuanced criteria before diving into the application process.