Understanding the Reasons Behind My Zelle Credit Being Pending

Have you ever found yourself in a situation where a transaction doesn’t show up as expected? It can be frustrating to see that a transfer is taking longer than you anticipated. Many people encounter this issue and often wonder what might be causing the slowdown. There are various factors at play, and it’s essential to grasp the underlying reasons behind such occurrences.

Sometimes, it could be a simple matter of processing times or system updates. Other times, security measures may temporarily hold a transfer for review. Recognizing these potential causes can help ease your mind and provide clarity on the status of your transaction. It’s always good to stay informed about what’s happening behind the scenes.

Whether you’re making a payment, sending funds, or receiving money, understanding the mechanics at work can demystify the entire experience. Let’s dive deeper into what you need to know about these delays and how you can address them effectively to ensure a smooth transaction process.

Common Reasons for Pending Transfers

When you send money, there are times when it doesn’t arrive instantly. This situation can be frustrating, especially if you’re expecting quick transactions. Several factors can contribute to delays, and understanding these can help you navigate the process more smoothly.

One reason for a holdup might be improper account details. If you accidentally enter the wrong information, the transfer won’t go through, leading to a delay. Additionally, if the recipient’s bank experiences issues or is undergoing maintenance, it can slow down the process significantly.

Another common cause is the type of transfer selected. Some services have different processing times based on whether the transaction is going to a new recipient or an established one. Transfers to first-time users may take longer due to additional verification steps.

It’s also essential to consider security checks. Sometimes, if a transaction seems unusual or triggers a flag, extra verification may be needed before it’s completed. This is to protect both senders and recipients from potential fraud.

Lastly, remember that certain banks might have their own policies regarding processing times. Each institution has its own set of rules, so delays might occur based on where the money is coming from or going to. Understanding these nuances can help set your expectations appropriately.

How Bank Policies Affect Transactions

When it comes to transferring funds electronically, various factors can influence the speed and efficiency of your transactions. Each financial institution has its own set of rules and practices, which can lead to variability in how quickly and seamlessly money moves between accounts. Understanding these policies is key to managing your expectations and ensuring smoother transfers.

Processing Times: Different banks have varied timelines for processing payments. Some may clear transfers almost instantly, while others might take longer due to their internal protocols. These differences can significantly impact how fast you see your money available for use.

Limits and Restrictions: Institutions often impose daily or monthly caps on the amount you can send or receive. If your transaction exceeds these limits, it could be flagged for further review, delaying the process. Always check your bank’s guidelines to avoid surprises.

Fraud Prevention Measures: To safeguard your funds, many banks implement robust security measures. While these are crucial for protecting your finances, they can sometimes cause delays if a transaction is flagged for potential fraud. It may require additional verification steps before the payment is finalized.

Customer Verification: Some banks require additional identification processes for new or unusual transactions to ensure the legitimacy of the transfer. This can add an extra layer of security, but it may also lead to waiting periods before the funds are fully accessible.

Recognizing how various banking policies can influence your electronic transfers allows you to navigate the system more effectively, reducing uncertainty and improving your overall experience.

Steps to Resolve Incomplete Transactions

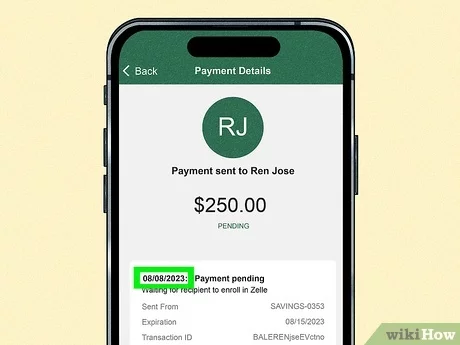

When you find yourself in a situation where a transaction isn’t clearing as expected, it can lead to frustration and uncertainty. Fortunately, there are several straightforward steps you can take to address the issue. Understanding what may have gone wrong and how to fix it can help restore your peace of mind.

Start by reviewing the details of the transaction. Ensure that you have entered all the information correctly, including the recipient’s details and the amount. A small mistake could be the root cause of the delay.

Next, check your financial institution’s policies regarding such transactions. Sometimes, institutions may hold funds for various reasons, including security measures. Familiarizing yourself with their rules can provide insight into what might be happening.

If everything seems in order but the transaction is still stuck, don’t hesitate to reach out to customer support. Representatives can offer assistance and clarify any uncertainties with your transfer.

Another helpful tip is to see if there are any updates or notifications on the platform you’re using. Occasionally, system maintenance or upgrades can interfere with transactions. Keeping an eye on official communications can save you from unnecessary worry.

Finally, consider the time of your action. Certain transactions can take longer based on when they are initiated. If you made the transfer during non-business hours, it may not process until the next working day. Knowing this can help set realistic expectations.