Understanding the Reasons Behind Your Credit Report Being Frozen

It can be concerning to discover that access to your financial information has been restricted. This situation often arises when there’s a need for greater security regarding personal details. You might feel puzzled or anxious about what it means for your situation and why you might find yourself in this position. This article aims to shed light on those feelings and clarify what could lead to such a scenario.

Many individuals find themselves facing limitations on their financial background due to various factors. Sometimes, this is a protective measure aimed at safeguarding against potential identity theft or unauthorized access. It’s important to recognize that these steps, although they might seem inconvenient, are often put in place for your benefit. Understanding the reasons behind this circumstance can empower you to navigate the process more effectively.

In the following sections, we’ll explore common triggers that lead to these restrictions and the steps you can take to manage your personal information responsibly. You’ll learn about the importance of being proactive and aware of your financial footprint in today’s digital age. Let’s dive into the reasons that may have brought you here and what actions you can take moving forward.

Understanding Credit Report Freezes

When you feel the need to protect your financial identity, taking certain precautions is essential. One effective method allows individuals to restrict access to sensitive information, making it harder for potential fraudsters to misuse their details. This action offers peace of mind, especially if you’ve faced security threats in the past.

This protective measure essentially acts as a barrier, safeguarding your personal data from unintended prying eyes. While it may sound complex, the process is straightforward and can be done through various services that keep your information under wraps. It’s a proactive approach, ensuring that only you have the power to grant access when necessary.

Understanding the implications of this choice is crucial. While it’s an excellent defensive strategy, it does come with responsibilities. You might encounter some limitations on obtaining new financial products or services during the restriction period. However, it’s a small trade-off for enhanced security, helping you stay one step ahead in a world where identity theft can happen to anyone.

Reasons to Freeze Your Credit Report

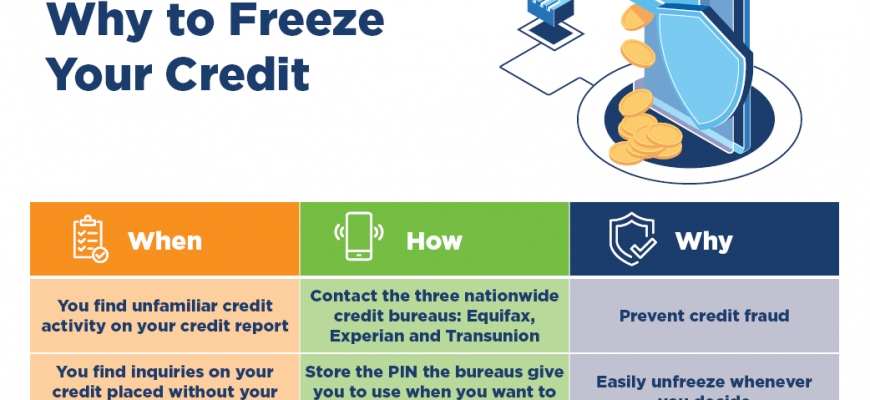

When it comes to protecting your financial identity, taking proactive steps can make a world of difference. Locking down access to your financial information is a powerful tool for safeguarding against unauthorized use. Here are a few motivations behind choosing this protective measure.

First and foremost, if you suspect that your personal information has been compromised, it’s wise to act swiftly. Preventing potential fraudsters from opening accounts in your name can save you from a lot of hassle down the road. It’s all about staying one step ahead of any threats that may arise.

Another reason is the peace of mind that comes with knowing your sensitive details are under wraps. Life can be unpredictable, and having the ability to restrict access offers a sense of security during uncertain times. This is particularly true if you’re in the process of a big life change or if you’ve been targeted by scams in the past.

Additionally, this course of action can be especially relevant if you are planning to apply for new lines of credit. Making your information inaccessible temporarily allows you to control who can view it, enabling you to manage your applications more effectively.

Lastly, it’s a strategic move for anyone wanting to minimize the chances of identity theft. By restricting access, you create barriers that can deter potential thieves from misusing your personal data. It’s a simple yet effective way to add an extra layer of defense to your financial well-being.

Effects of a Frozen Credit Report

When your financial profile is locked down, it influences various aspects of your life in unexpected ways. Many people may not realize the broader implications of such a precaution, beyond the obvious security benefits. Understanding these effects can help you navigate your financial activities more effectively.

Firstly, you might encounter obstacles when trying to apply for new financial opportunities. Whether it’s a loan for a home, financing a new car, or opening a new line of credit, lenders typically need access to your financial history. With restrictions in place, they won’t be able to evaluate your eligibility, causing delays or even disapproval of your applications.

Additionally, unexpected situations like job offers or rental agreements may require a background check that involves your financial records. If you’ve placed limitations on access, you could miss out on a great opportunity simply because your details are off-limits.

Moreover, the process of lifting these restrictions can take time. It often involves contacting the relevant organizations and verifying your identity, which might add to your stress during critical moments. Planning ahead is essential to avoid any last-minute complications.

Lastly, while it provides peace of mind against identity theft, consistently monitoring your accounts and being proactive about your finances remains crucial. Even when measures are in place, staying vigilant can safeguard you against emerging threats.

Steps to Unfreeze Your Financial Records

Releasing the hold on your financial history can seem daunting, but it’s a straightforward process. Follow these simple guidelines to regain access to your personal information and ensure your financial activities can proceed smoothly.

- Gather Your Information:

Start by collecting important details. You’ll need personal identifiers such as your Social Security number, date of birth, and address. Having this ready will make things easier.

- Contact the Agencies:

Reach out to the organizations that maintain your records. There are three major ones, and you’ll need to contact each of them directly.

- Choose an Unfreeze Method:

You can often choose between a temporary or permanent removal. If you’re expecting to apply for a loan soon, a temporary option might work best.

- Provide Necessary Verification:

Be prepared to confirm your identity. This may involve answering security questions or providing additional documentation.

- Confirm the Release:

Once you’ve submitted your request, double-check that the hold has been lifted. Most agencies will send you a confirmation notification.

Taking these steps will help you quickly navigate the process, ensuring that you can move forward with your financial plans without unnecessary delays.