Understanding the Reasons Behind Your Frozen Credit Status

Have you ever wondered why your financial profile seems to be locked up? Sometimes, individuals find themselves facing unexpected restrictions that can leave them puzzled and frustrated. This section aims to shed light on those situations when accessing your financial services becomes a challenge.

Life can bring surprising turns, and it’s not uncommon for people to encounter limitations that hinder their ability to borrow or make transactions. Whether it’s an unforeseen turn of events or protective measures activated for security reasons, understanding the underlying causes can help demystify the situation.

In this discussion, we’ll explore the various elements that might contribute to such circumstances. From potential risks to precautions taken by financial institutions, gaining insights into these factors can empower you and guide you through the complexities of managing your finances.

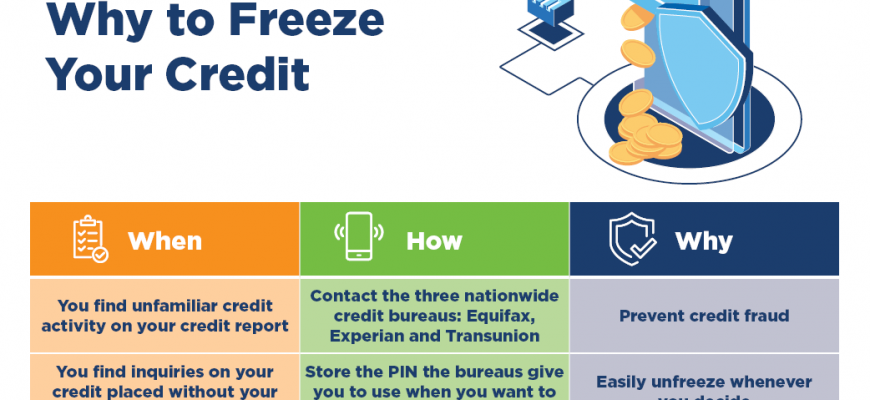

Understanding the Credit Freeze Process

Let’s delve into a fundamental process that empowers individuals to protect their financial information. This approach is not just about securing personal data; it’s a shield against potential threats, ensuring peace of mind in an increasingly digital world.

When you initiate this protective measure, it essentially restricts access to your financial history. Here’s how it typically unfolds:

- Initiation: The procedure begins with notifying major reporting agencies that you wish to restrict access to your records.

- Verification: You’ll need to provide some personal details to confirm your identity. This step is crucial for your safety.

- Confirmation: Once verified, you receive a unique PIN or password that will be essential for unfreezing your records in the future.

It’s important to note that this action does not eliminate your financial history; it merely curtails unauthorized inquiries.

Here are some reasons why individuals choose to take this step:

- Protection against identity theft.

- Regaining control over who can access your sensitive information.

- Staying ahead of potential fraud attempts.

Each time you decide to lift restrictions, you’ll need to use that special PIN. This ensures that only you have the authority to grant access when necessary.

In summary, understanding this process is key to safeguarding your financial well-being in a modern and fast-changing environment.

Reasons to Consider Freezing Your Credit

There are times when individuals seek to take extra precautions to safeguard their financial well-being. Implementing a restriction on access to your financial information can be a smart move, especially in a world where identity theft and fraud are increasingly common. By temporarily halting external access, you take a proactive step towards securing your personal details.

One significant factor that can lead to this decision is the rising incidents of data breaches. When companies experience hacks, sensitive data can fall into the wrong hands, making individuals vulnerable. Limiting access to your information reduces the chances of someone using that data to open new accounts in your name.

Moreover, if you’ve experienced suspicious activities or received alerts regarding unauthorized transactions, it’s a clear signal that additional measures are necessary. Taking control in such situations not only provides peace of mind but also helps in mitigating potential losses.

Another important consideration is planning for significant life changes, such as purchasing a home or relocating. By ensuring that only you can authorize access to your information, you can focus on your goals without the stress of unwanted surprises hindering your progress.

Finally, if you’ve recently experienced a change in your financial situation or are concerned about identity theft, this precaution can act as an added layer of protection. It allows you to monitor your accounts closely and react swiftly if any issues arise, ensuring that your financial landscape remains intact.

How a Hold on Your Financial Profile Affects Your Finances

When you choose to restrict access to your financial history, it can have a notable impact on your overall monetary situation. This action is primarily a defensive measure meant to safeguard against unauthorized borrowing under your name. However, it also brings about certain changes in how you manage your finances.

First and foremost, while this strategy provides a layer of protection, it can hinder your ability to obtain loans or open new accounts swiftly. Lenders typically require access to your financial details to evaluate your trustworthiness, and a restriction means they’ll have to wait for you to lift that safeguard. This can delay important purchases, such as a home or a vehicle, when you may be eager to take action.

On the other hand, having such a measure in place might encourage more responsible financial habits. With limited access to your profile, you may become more mindful of your spending and saving, fostering a sense of diligence in managing your money. This period could serve as a valuable opportunity to reassess your financial strategies and chart a course toward more secure practices.

In summary, while placing a hold on your financial records can pose challenges, it can also lead to a more disciplined approach to your finances. Balancing the benefits of protection against the potential obstacles will help you navigate this situation effectively.