Understanding the Reasons Behind a Higher Credit Karma Score

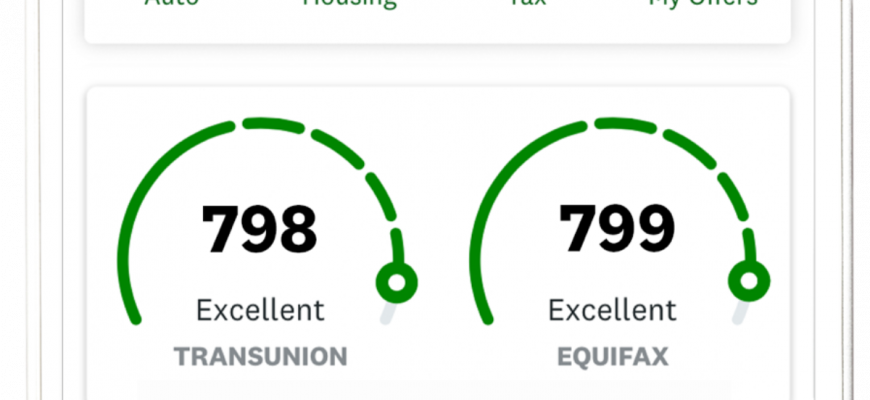

Have you ever noticed discrepancies in the numbers reflecting your financial health? It can be puzzling to see a figure that seems more favorable than what you anticipated. Many individuals find themselves asking this very question, wondering about the factors that contribute to this seemingly optimistic evaluation.

It’s important to recognize that not all metrics are created equal. Various platforms employ different methodologies to calculate and present these figures, which can lead to variations that might catch you off guard. Understanding the nuances of these assessments can provide clarity and help you navigate your financial landscape more effectively.

As we delve deeper into this topic, we’ll explore the elements that may lead to a more positive representation of your financial standing. By unpacking the layers behind these evaluations, you can gain valuable insights into your economic habits and decision-making processes.

Understanding Calculation Methods

Ever wondered how different systems evaluate your financial reliability? It’s fascinating to delve into the various approaches employed to assess one’s monetary trustworthiness. Each method has its unique way of interpreting data, reflecting diverse aspects of financial behavior.

The Influence of Data

Various factors come into play when these systems gauge your financial standing. Elements such as payment history, amounts owed, length of credit history, new accounts, and types of credit all contribute to the overall assessment. Depending on the method utilized, some of these factors may weigh heavily while others may be less significant.

Methodologies at Play

Two main methodologies dominate the scene: the FICO model and the VantageScore model. While both aim to provide a snapshot of your financial credibility, their mechanisms and the importance they place on each criterion can differ significantly. This divergence may lead to varying evaluations, even when the underlying data remains unchanged.

Factors that Influence Variations

What’s intriguing is how these disparities can stem from simple nuances. For instance, one model might prioritize timely payments more than another, while the latter may focus on credit utilization. Understanding these intricacies can shed light on why you might see different readings across platforms.

Ultimately, the more you know about how these systems function, the better equipped you’ll be to manage your financial reputation effectively. Embracing this knowledge empowers you to make informed decisions that positively impact how others perceive your monetary dealings.

Factors That Influence Your Credit Score

Understanding what elements affect your financial rating can be essential in navigating your monetary journey. Different aspects contribute to how lenders perceive your reliability and overall capability to manage borrowed funds. By recognizing these components, individuals can take charge of their financial health.

Payment History plays a pivotal role in shaping your financial reputation. Consistently making on-time payments indicates responsibility and reliability, while missed or late payments can significantly lower your assessment.

Credit Utilization is another critical factor. This reflects the amount of available funds you’re currently using compared to what’s accessible. Maintaining a lower balance relative to your limit can enhance how lenders view you.

Length of Credit History also matters. A longer history can signify stability, suggesting that you’ve effectively managed financial obligations. However, newer accounts might not showcase this reliability yet.

Types of Accounts you hold can influence your rating as well. A mix of different accounts, such as revolving credit and installment loans, demonstrates your ability to handle various financial products responsibly.

Finally, New Inquiries can impact your standing. When you apply for additional credit, lenders perform a hard inquiry, which could slightly reduce your evaluation. Being selective about applications can help maintain a strong reputation.

By being mindful of these aspects, individuals can work towards improving their financial standing and making informed decisions when it comes to managing their obligations.

How to Improve Accuracy of Financial Ratings

Ensuring that your financial evaluations reflect your true situation can be quite a journey. It’s essential to take proactive measures to enhance the precision of these assessments. By focusing on certain strategies, you can pave the way for more reliable representations of your financial health.

First, regularly check your reports for any discrepancies. Mistakes can creep in, and finding them early is crucial. Monitor for inaccuracies related to payments or accounts. Addressing these errors promptly can lead to significant changes in how you are perceived.

Next, keep your payment habits on track. Timely bill payments hold considerable weight in the overall evaluation. Setting up reminders or automating payments can ensure you’re never late, contributing positively to your financial profile.

Maintaining low borrowing levels is another effective tactic. Utilizing only a small percentage of available credit demonstrates responsible usage. Aim for a balance that reflects a lower ratio of borrowed amount to total credit available.

Lastly, consider limiting new inquiries. Each time you apply for new financing, a check occurs, which can momentarily impact your evaluations. Space out your applications and only seek new credit when necessary, protecting your overall standing.