Understanding the Reasons Behind the Decline in Your Credit Score

Navigating the complexities of personal finance can often feel like walking through a maze without a map. Many find themselves puzzled when they notice fluctuations in their financial standing. It’s a common concern that can arise from various influences, leaving individuals scratching their heads in confusion. Gaining clarity on this matter is crucial for anyone wishing to maintain a stable economic position.

There are numerous factors that can impact your financial score, some of which may be unexpected. Understanding the elements that contribute to shifts is essential for managing your overall financial wellbeing. From spending habits to account management, each decision can play a role in how you’re perceived in the financial landscape.

In this discussion, we’ll unravel the mystery behind those changes, empowering you to make informed choices moving forward. By examining the key elements that affect your standing, you can better position yourself for a brighter financial future.

Factors Affecting Your Credit Score

Understanding the elements that play a role in determining your financial standing can be quite enlightening. Each component of your financial behavior can either uplift or diminish your standing in the eyes of lending institutions. It’s crucial to recognize how these factors interact to paint a clearer picture of your overall financial health.

Payment History: Timely payments are one of the most significant components. When you stay on top of your bills, it indicates reliability to lenders, while missed or late payments can create a negative impression.

Debt Utilization Ratio: This refers to the amount of credit you are using compared to your total available credit. Keeping this ratio low signals that you manage your resources wisely. High utilization, however, can raise red flags.

Length of Credit History: The duration for which you’ve been borrowing also matters. A longer history, especially with positive patterns, builds trust with lenders, whereas a short or new record can indicate less experience.

Types of Credit: A diverse array of borrowed resources, such as loans, credit cards, or mortgages, can positively influence your standing. It shows that you are capable of managing different kinds of debt effectively.

Recent Inquiries: Every time you apply for additional lines of credit, a check is performed on your financial profile. Too many inquiries in a short span can suggest financial distress and may lead to a decrease in your overall score.

By keeping an eye on these elements, you can better navigate your financial future and work towards improving your standing over time. Being proactive and informed is key in this journey.

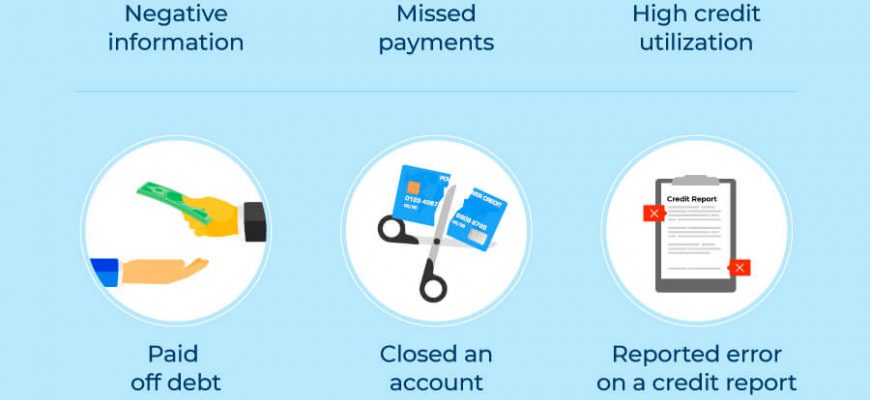

Common Mistakes That Lower Credit

We all make errors sometimes, and some of these blunders can have unexpected effects on our financial reputation. Recognizing and avoiding these pitfalls is crucial for maintaining a healthy standing. Let’s explore some frequent missteps that can negatively impact your financial image.

One of the biggest issues many encounter is missing payments. Life gets busy, and it’s easy to overlook due dates. Unfortunately, even one late payment can create a ripple effect and draw attention away from your otherwise positive habits.

Another common error involves using too much available balance. If you’re consistently nearing or maxing out your limits, lenders may see you as a higher risk, leading to potential consequences. Keeping your utilization ratio in check is a smart move.

People often forget the importance of regularly reviewing their financial reports. Mistakes or inaccuracies can slip through the cracks, and addressing them promptly can prevent unnecessary harm to your standing. Always stay proactive about checking your information.

Closing old accounts might seem like a wise choice to simplify things, but it can backfire. Older accounts contribute to your history length, which plays a role in your overall assessment. Keeping them open and active can actually work in your favor.

By steering clear of these missteps, you can help safeguard your financial reputation and create a more stable future. Awareness is the key here; the more informed you are, the better decisions you can make.

Understanding Report Components

When it comes to evaluating your financial trustworthiness, there are several key elements that come into play. Each component tells a part of your financial story, and together they create a complete picture of your borrowing habits and reliability. Grasping these components can help you figure out what influences your standing and how to improve it if needed.

The first major piece of this puzzle is your payment history. This reflects whether you’ve been punctual with your obligations. Late payments, defaults, or collections in this section can significantly sway your overall assessment. Next, you’ll find the amounts owed, which reveals your current debt levels. High balances relative to your limits can signal risk to potential lenders.

Length of credit history is also essential. A longer track record often suggests stability and responsible usage. However, if you’re new to borrowing, this can work against you. Then there’s the type of credit used, showcasing the different kinds of accounts you have, such as revolving credit or installment loans. A diverse portfolio can favorably impact your evaluation.

Lastly, there’s the inquiry section. Each time you request new financing, it can lead to a hard inquiry, which may slightly decrease your standing. Understanding how these factors interact allows you to navigate the financial landscape with greater confidence and make informed decisions for your future.