Understanding the Reasons Behind the Low Amount of Your Child Tax Credit

It’s not uncommon for parents to feel a bit puzzled when they review the annual financial assistance they receive. The amount can often seem smaller than expected, leaving many to wonder about the factors contributing to this situation. Navigating through this can be overwhelming, especially when there are numerous elements in play that can influence the overall figures.

Various circumstances in a family’s financial profile can lead to notable distinctions in the assistance amount. From income levels to family size, each factor carries its own weight in determining how much aid one qualifies for. It’s essential to familiarize yourself with the underlying components that govern these evaluations, as this knowledge can help clarify any surprises in the final figures.

Diving deep into your financial situation may uncover reasons and considerations that weren’t initially apparent. Gaining insight into the rules and calculations involved can empower you to make informed choices moving forward. So, let’s unravel the complexities and understand what might be affecting your expected assistance.

Understanding Eligibility for Financial Assistance

It’s essential to grasp the criteria that determine eligibility for various forms of financial support provided to families. There are several factors at play that can influence the amount of assistance you may receive, and knowing these elements can help clarify the situation.

First off, residency status and the age of your offspring play crucial roles. Typically, the program is designed for dependents under a specific age. Additionally, your family’s income impacts the amount received, as the system aims to assist those who are in the greatest need. It’s also worth noting that filing status can influence the overall benefits available, so keeping an eye on that aspect is important, too.

In essence, understanding these components can help families navigate the available options effectively. Each situation is unique, which is why it’s beneficial to evaluate your circumstances thoroughly to identify any potential adjustments or opportunities for increased support.

Factors Affecting Your Credit Amount

When it comes to understanding how financial assistance works, there are several elements that can significantly influence what you might receive. These components can vary widely and often depend on personal circumstances and government regulations. It’s essential to consider these aspects to better comprehend your situation.

One major element is the income level of the household. Generally, if your earnings fall within a certain range, it may impact the financial support you qualify for. Other factors include the number of dependents and their ages, which can also play a crucial role in determining the final amount available to you.

Additionally, existing entitlements or claims you may have can alter what you’re eligible to receive. States may have specific rules or criteria that could further influence the figures involved. Because of this, it’s wise to stay informed and review your personal details regularly to ensure everything aligns accurately with current standards.

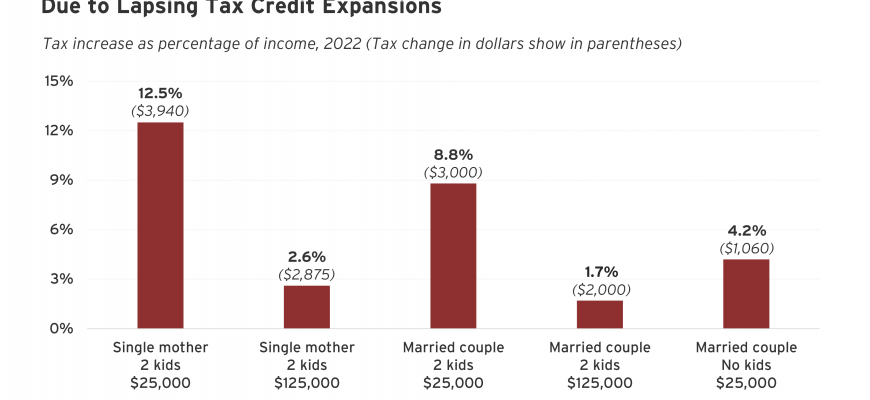

Lastly, changes in legislation or economic conditions might also affect what you can expect. Keeping an eye on any updates or potential shifts in policies can help you understand fluctuations in your assistance. By being aware of these factors, you can better grasp how they come together to shape your financial picture.

Income Limits and Their Impact

Understanding how earnings affect your financial benefits can be quite eye-opening. Many families find themselves puzzled when they discover that their support packages do not match their expectations. This can often be traced back to specific thresholds, which dictate the amount of assistance available based on household income levels.

These thresholds are not arbitrary; they serve to ensure that aid is directed towards those who truly need it. As incomes rise, the amount of relief typically decreases. This system is designed to allocate resources more effectively, but it can leave some feeling shortchanged, especially if they have come to rely on these funds for family expenses.

Furthermore, the way these limits are structured means that even a slight increase in earnings might lead to a significant drop in assistance. It can feel discouraging when hard work results in less financial help, but the aim is to promote self-sufficiency and reduce dependency on governmental support.

It’s vital for families to be informed about these financial thresholds and how they can influence available assistance. Knowing this information empowers families to make better decisions about their finances and future planning.