Common Reasons for BDO Credit Card Declines and What You Can Do About It

It’s frustrating when a transaction doesn’t go through, especially when you’re eager to make a purchase. This situation can leave you scratching your head, wondering what went wrong. There are various reasons why a payment might not be successful, and they can range from simple technical glitches to more complex issues regarding your account.

In many instances, the failure to complete a transaction may not be under your control, which adds to the confusion. You might have received an unexpected notification, or the checkout process abruptly halted, causing concern. It helps to be informed about common causes, as being knowledgeable can ease your worries and assist in resolving the matter quickly.

From insufficient funds to network errors, there are numerous factors at play. Sometimes, institutions may flag unusual activity to protect your finances, leading to temporary interruptions. In this article, we will dive into the typical scenarios that can hinder your payment attempts and offer guidance on how to navigate these challenges efficiently.

Common Reasons for Payment Rejections

Every individual has experienced that frustrating moment when a purchase is interrupted by an unexpected notification. Understanding the potential triggers behind these interruptions can save you time and hassle. Several factors might be at play, affecting the success of your transaction.

Insufficient Funds is one of the most common issues. If the balance falls short of the purchase amount, the transaction simply won’t go through. It’s essential to keep track of your spending habits and regularly check your balance to avoid this scenario.

Expired Information can also lead to problems. If your payment details aren’t up to date, such as an expired expiration date or an old address, it may prevent the purchase from completing. Always ensure that your information is current to facilitate smooth transactions.

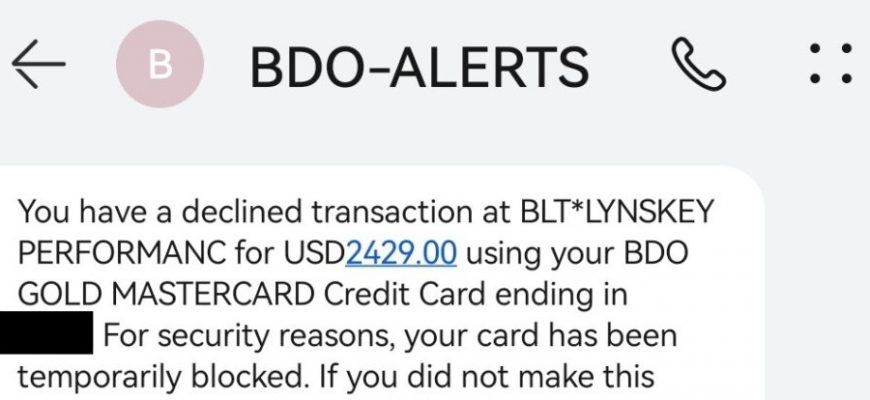

Suspicious Activity often triggers automatic security measures. If you’ve recently made several large purchases or transactions in quick succession, your provider may flag these actions as potentially fraudulent. Always notify your issuer about upcoming big purchases to avoid unwanted interruptions.

Incorrect Data Entry cannot be overlooked either. A simple typo in your details, like a wrong number or name, can lead to complications. It’s a good habit to double-check your entries before finalizing any transaction.

Blocked Transactions may occur too, especially for online purchases. Certain merchants or types of transactions might be restricted by your account settings. Familiarizing yourself with your provider’s policies can help prevent these issues from arising.

By understanding these common triggers, you’ll be better prepared to navigate the payment landscape and ensure a smoother shopping experience.

How to Resolve BDO Card Issues

Encountering a problem with your payment method can be frustrating, but there are steps you can take to get things back on track. It’s essential to understand the common reasons behind these difficulties and how to effectively address them. Here, we’ll explore practical solutions to help you navigate through any inconveniences you might face.

First, check if there are any connectivity issues or technical glitches at the point of sale. Sometimes, a simple restart of the terminal or trying a different machine can make a difference. Additionally, ensure that the status of your account is in good standing and that it hasn’t been suspended or flagged for unusual activity.

Next, it’s wise to verify that your available balance meets the requirements for the transaction. If the purchase amount exceeds your limit, the system may block the attempt. Always keep an eye on your spending and account statements to avoid surprises.

If everything seems in order but issues continue to arise, consider reaching out to customer support. Having your identification and account information ready will make the process smoother. The representatives can provide insights tailored to your situation and guide you through any necessary steps.

In some instances, potential security measures may trigger alerts on your account. If you suspect this is the case, it can be beneficial to review recent transactions to confirm their legitimacy. Additionally, informing the service provider of any travel plans or changes in spending patterns can help prevent unnecessary disruptions.

Finally, keep your contact information updated with your financial institution. This ensures that you receive any important notifications and can act promptly if issues arise. Proactive management of your financial arrangements will go a long way in minimizing unexpected challenges.

Tips for Ensuring Smooth Transactions

Having seamless payment experiences can be crucial in our fast-paced world. Understanding how to navigate potential hiccups can lead to more enjoyable online and in-store purchases. Here are some practical suggestions to help maintain a hassle-free transaction process.

First and foremost, always double-check your account details before making a purchase. Ensure that your information, such as the account number and expiration date, is entered correctly. A small typo can lead to unexpected issues during the checkout process.

Keep an eye on your balance and available funds. It’s easy to lose track of spending, which might result in insufficient resources for a desired transaction. Monitoring your finances regularly can help avoid this scenario and keep things running smoothly.

Another helpful tip is to inform your financial institution of any planned travels or large purchases. Sudden activity in unfamiliar locations can trigger security alerts, causing interruptions in your buying experience. A quick notification can save you from unnecessary complications.

Updating your contact information is also important. In case of any issues, institutions often reach out via phone or email to verify transactions. Being reachable can facilitate prompt resolutions.

Lastly, regularly reviewing your statements can help catch any discrepancies early on. Ensuring everything is accurate not only promotes security but also guarantees that you remain in control of your finances.