Understanding the Factors That Lead to an Increase in Your Credit Score

Ever wondered what factors lead to an improvement in those all-important financial evaluations? It’s a topic that many find perplexing, yet it’s essential for anyone looking to secure loans, mortgages, or favorable interest rates. A deeper knowledge of how these measurements fluctuate can empower individuals to take actionable steps toward enhancing their financial standing.

There are various elements that contribute to the elevation of these numerical representations of one’s financial health. Some might be related to habits and practices, while others could be linked to broader economic trends. Recognizing these catalysts can provide valuable insight for making informed decisions that ultimately benefit financial aspirations.

Ultimately, understanding these influences can pave the way for a more stable financial future. Every small effort counts, and with the right strategies, anyone can experience a positive shift in their financial profile. Embracing knowledge is the first step toward unlocking better opportunities and achieving financial goals.

Factors That Improve Credit Scores

Building a solid financial reputation can enhance opportunities for better loans and interest rates. Numerous elements play a role in elevating these ratings, and understanding them is crucial for anyone looking to improve their standing in the lending world.

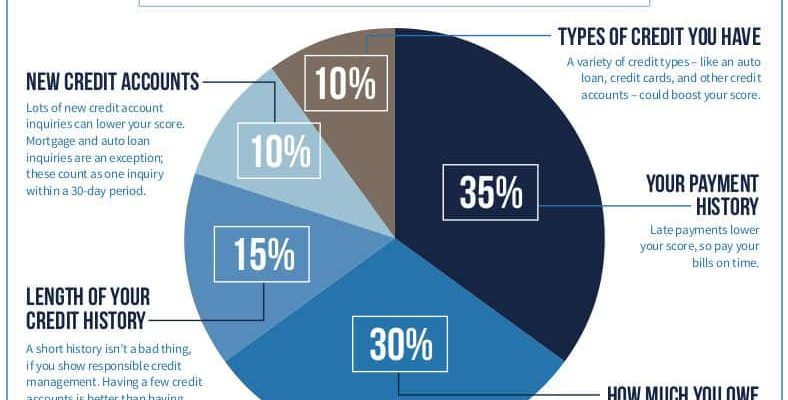

Timely payments on outstanding debts are among the most significant contributors. Consistency in meeting deadlines showcases reliability and commitment, which lenders greatly value. Moreover, reducing outstanding balances can also have a positive impact; keeping usage low relative to available limits signals responsible financial behavior.

The length of one’s financial history is another critical aspect. A longer track record with various types of credit demonstrates stability and management skills. Additionally, diversifying credit types, such as incorporating installment loans and revolving credit lines, allows for a more comprehensive evaluation by lenders.

Lastly, checking for and correcting errors on financial reports is essential. Disputing inaccuracies can protect and potentially raise a rating. By being proactive and informed, anyone can take actionable steps toward a healthier financial profile.

The Role of Payment History

Understanding how timely payments influence financial evaluations is crucial. This element plays a significant part in shaping perceptions of an individual’s reliability. When commitments are met on time, it’s like sending a positive signal to lenders about one’s trustworthiness.

Regular and prompt settlements build a solid foundation. Each on-time payment serves as a stepping stone, enhancing overall assessments. On the flip side, late or missed payments can tarnish this image, making it essential to remain disciplined. Lenders often view a well-maintained payment track as a sign of future responsibility.

In essence, maintaining a consistent record of timely payments not only fosters trust but also opens doors for better financial opportunities. A little effort in managing obligations can lead to substantial benefits down the line.

Impact of Credit Utilization Ratio

The way individuals manage their available credit can significantly influence their financial standing. It’s all about how much of that credit is being used compared to what’s available. This relationship plays a crucial role in shaping perceptions about one’s financial responsibility, often leading to noticeable changes in evaluations made by lenders.

Credit utilization ratio refers to the percentage of available credit being utilized at any given time. When this ratio remains low, it generally reflects a level of discipline and financial prudence. As a result, those who maintain a balanced approach often witness improvements in their financial profiles, making them more appealing to potential lenders.

On the flip side, high usage of available credit can raise flags for lending institutions. It may suggest potential risk or difficulty in managing finances. Therefore, keeping this ratio in check is essential. Regular monitoring and responsible usage, such as paying off balances promptly, contribute to a healthier financial reputation.

In summary, understanding the dynamics of credit utilization can empower individuals to take charge of their financial health. By being mindful of how much credit is actively being used, one can enhance their standing in the eyes of creditors and ultimately pave the way for better financial opportunities.