Understanding the Factors That Lead to a Decrease in Your Credit Score

Maintaining a healthy financial reputation is crucial for navigating the complex world of loans and credit opportunities. Yet, many individuals experience unexpected drops in their ratings, leaving them puzzled about what went wrong. Several factors contribute to these fluctuations, and grasping them is key to regaining control over one’s financial status.

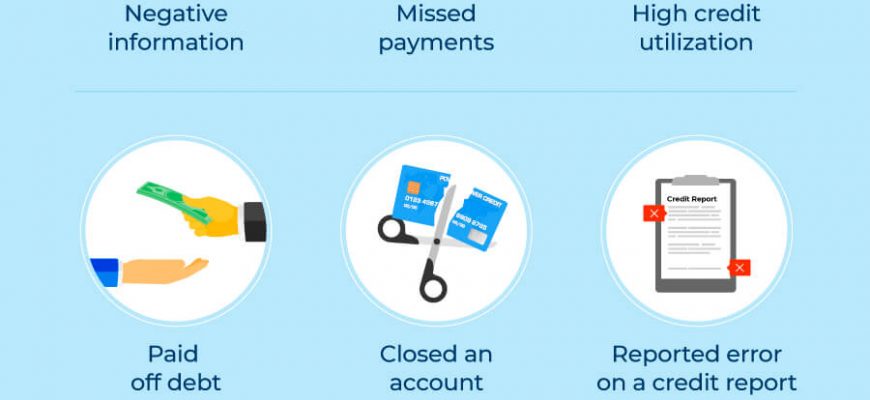

From missed payments to high utilization ratios, numerous elements can significantly affect personal evaluations. It’s important to remain informed and proactive in managing one’s finances. By identifying common pitfalls and understanding the underlying mechanisms, anyone can work towards stabilizing and eventually enhancing their financial standing.

In this discussion, we’ll explore various reasons that impact this essential measure of creditworthiness. By recognizing these influences, individuals can take steps to protect and improve their financial reputation for future endeavors.

Common Factors Affecting Credit Scores

Many elements come into play when evaluating an individual’s financial reliability. Understanding these influences can empower you to make informed decisions and potentially improve your financial standing. It’s essential to recognize that even small changes in behavior can lead to noticeable variations in your overall assessment.

Payment history is often a significant influence. Consistently making payments on time demonstrates responsibility and reliability. On the other hand, late or missed payments can have a detrimental impact that lingers for years.

The amount of debt incurred plays a crucial role too. High levels of borrowing, particularly when close to maximum limits, can raise red flags. Maintaining a balanced utilization ratio is key to showcasing financial discipline.

Length of credit history is another aspect to consider. Established accounts signal experience, while newer accounts may not carry the same weight. A longer history generally provides a more accurate representation of an individual’s financial behavior.

Types of credit used can also influence evaluations. A diverse mix–such as revolving and installment loans–indicates adaptability. Relying on one form, however, can suggest a lack of experience managing various financial products.

Finally, applying for new adds pressure to the perceived risk. Frequent inquiries into your credit availability can signal instability, even if your intentions are sound. Keeping applications to a minimum can help maintain a favorable impression.

Impact of Missed Payments on Ratings

When individuals fail to make timely payments on their financial obligations, it can have a significant influence on their overall assessment by lenders. This impact isn’t just a momentary issue; it can linger for years, affecting future borrowing potential and the associated interest rates.

Timeliness plays a crucial role in maintaining a positive financial reputation. Each missed deadline adds a mark against one’s reliability and portrays a picture of risk to lenders. The longer payments go unpaid, the more detrimental the effects can become. Even a single lapse can provoke heightened scrutiny, leading to harsher terms or outright denial of credit opportunities.

Moreover, consistency is essential. Regular payments reflect diligence, while irregularities suggest instability. For many, understanding this relationship can motivate them to manage finances more prudently, ensuring that every obligation is met promptly and effectively. Recognizing the long-term consequences of these behaviors is vital for anyone looking to safeguard their financial future.

Debt Utilization and Its Consequences

Have you ever thought about how much of your total available credit you’re actually using? It turns out that this value is more important than many people realize. When you rely too heavily on borrowed funds, it can send up red flags to lenders and even affect new opportunities down the line. Understanding the impact of utilizing a significant portion of your credit can open your eyes to better financial practices.

Using a high percentage of your available credit can create a sense of risk in the eyes of financial institutions. They may interpret this as a sign that you’re overextended or struggling, which can lead to reduced chances of receiving favorable loan terms or even obtaining credit when needed. Maintaining a healthy balance is crucial; it’s not just about how much you owe but how it relates to what you have access to.

Keeping your utilization ratio low is not just a good habit for borrowing; it plays a vital role in fostering a robust financial profile. Many experts suggest aiming to use less than 30% of your available limits to stay in the safe zone. This approach not only strengthens your position when seeking additional financing but also contributes to a more positive perception by lenders and creditors alike.

Ultimately, finding the right balance with your debts can make a significant difference in your financial journey. Being mindful of how much credit you utilize can lead to healthier financial choices and a brighter future.