Understanding the Factors That Cause Your Credit Score to Decrease

It’s frustrating when you notice a sudden dip in the numbers that reflect your financial trustworthiness. Many people find themselves puzzled over the reasons behind these variations, especially when they’ve been diligent in managing their finances. The landscape of personal finances is complicated, and even a small change can lead to unexpected results.

Numerous factors can contribute to this issue, often leaving individuals scratching their heads. From varying payment practices to new financial engagements, it’s essential to grasp what influences these changes. Understanding the elements that affect your standing is a crucial step toward improving your overall financial picture and regaining that sense of stability.

In this discussion, we’ll explore common pitfalls and situations that may lead to unwanted shifts. By identifying these triggers, you’ll be better equipped to navigate your financial journey and make informed decisions that could enhance your long-term economic well-being.

Understanding Key Factors Affecting Credit Scores

Grasping the elements that influence your financial reputation is essential for maintaining a healthy standing. Many individuals overlook how various activities and decisions can impact their financial profile. By becoming familiar with these factors, you can make informed choices that help preserve or improve your situation.

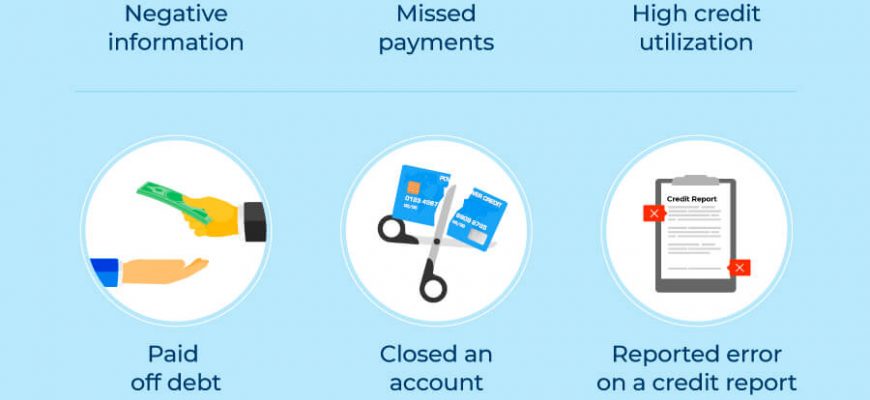

Payment History: One of the most significant contributors to your financial image is how reliably you meet your obligations. Late payments or defaults can leave a lasting mark, so timely payments are crucial for showcasing dependability.

Utilization Rate: This refers to the balance you carry relative to your available credit limits. Keeping your usage below a certain threshold is generally advisable, as high utilization can signal to lenders that you may be overextended.

Length of Credit History: The duration over which you’ve managed financial accounts also plays a role. A longer history can reflect stability, while a short timeframe may raise concerns about your experience with handling financial responsibilities.

Types of Credit Accounts: Having a mix of various account types–such as revolving credit and installment loans–can be beneficial. A diverse portfolio demonstrates your ability to manage different financial products effectively.

New Accounts and Inquiries: Opening multiple new accounts in a short period can raise red flags. Additionally, each time a lender assesses your application, it may slightly impact your standing. Thus, being strategic about how often you apply for new credit is wise.

By understanding these crucial factors, you can take proactive steps toward ensuring that your financial profile remains strong and favorable. It’s all about making smart decisions and developing good habits over time.

Impact of Late Payments on Financial History

Timely payments play a crucial role in how financial institutions assess an individual’s reliability. When someone misses a deadline, it sends a signal that can lead to unfavorable consequences. These late contributions can leave a mark, affecting how lenders view future potential borrowers.

Each instance of delayed payment is recorded, leading to an altered perception of one’s financial habits. Neglecting deadlines can create a ripple effect, not just in immediate financial interactions but over time, influencing opportunities for favorable loan terms and interest rates. It’s essential to recognize how such behaviors can linger in records, potentially shading one’s financial reputation.

Those who find themselves in this situation often wonder about the long-term repercussions. Recovery from these lapses may take time, thus emphasizing the importance of maintaining a consistent payment schedule. Establishing responsible practices can mitigate the impact of unforeseen circumstances, fostering a healthier financial narrative in the long run.

How Credit Utilization Ratios Influence Scores

Understanding the balance between available funds and what you owe is crucial for maintaining healthy financial standing. This relationship plays a vital role in shaping perceptions of your borrowing behavior. Essentially, lenders look for indicators of responsible usage, and one key aspect they focus on is the ratio of debt to available credit.

When you keep your usage low, it signals to potential lenders that you manage your finances wisely. On the other hand, a high utilization ratio may raise red flags, suggesting that you are overly reliant on borrowed funds. This can lead to negative impressions and may hinder your ability to secure new loans or favorable interest rates.

It’s generally recommended to aim for a utilization rate below 30%. By doing so, you showcase your capability to handle credit responsibly. Monitoring this ratio regularly can also help you stay on track and make informed decisions about your spending habits and future borrowing needs.