Understanding the Reasons Behind the Decline of My Credit Score

We often find ourselves puzzled when we notice a decline in our financial reputation. It’s frustrating and concerning, especially when we’re not entirely certain what triggered the shift. Various factors can contribute to this unsettling trend, impacting how lending institutions view us and our overall financial reliability.

Even small changes in our financial behavior can lead to unexpected results. From payment histories to the types of accounts we manage, numerous elements play a role in shaping our financial image. Being aware of these aspects is crucial for anyone looking to maintain a stable and positive standing in the eyes of lenders.

In the following sections, we’ll explore common reasons behind these declines, providing valuable insights to help you regain control and improve your financial status. Understanding the underlying causes empowers you to make informed decisions and take proactive steps towards enhancement.

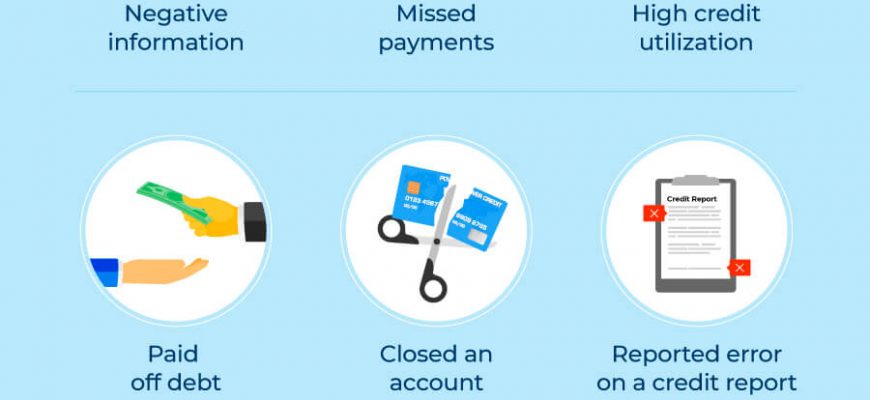

Common Factors Affecting Credit Score

Understanding the elements that influence your financial standing is essential for maintaining good health in your monetary profile. Various behaviors and circumstances can result in fluctuations in your overall score. Let’s dive into some key contributors that might be impacting it.

Firstly, payment history plays a crucial role. Missing payments or settling bills late can leave a negative mark. Even a single late payment can resonate throughout your financial records for an extended period, creating obstacles for future endeavors.

Secondly, the amount of debt you carry heavily weighs on your evaluation. High balances relative to the limits can signal risk, even if you’re making payments on time. Keeping that ratio in check is vital for a favorable assessment.

Another aspect worth mentioning is the length of your credit history. Older accounts generally suggest reliability, while having too many new accounts can raise flags. Lenders often prefer a stable history rather than a string of recent applications.

Also, the variety of credit types you have can influence your rating. A mix of revolving credit, like credit cards, and installment loans, such as mortgages or auto loans, can showcase your ability to manage different financial obligations effectively.

Lastly, hard inquiries can also cause some concern. When you apply for new credit, a lender will typically check your report. Too many inquiries in a short span can suggest financial distress, influencing your overall score negatively.

Impact of Late Payments on Credit

Staying on top of payments can be a challenge for many, but it’s crucial to understand how tardiness can affect your financial standing. Late payments can leave a lasting mark that influences your borrowing potential and overall financial health. The repercussions stretch far beyond just owing a few dollars; they can create complications in various aspects of life.

When payments are missed, it often leads to negative entries on financial reports. This can raise red flags for lenders, causing higher interest rates on future loans or even denials. Over time, the accumulation of these late marks may result in a significant drop in scores that are essential when applying for credit. Being late doesn’t just impact your immediate obligations–it can cause long-term challenges in managing finances.

Furthermore, the effects can linger for years. Each late payment may stay on one’s report for up to seven years, making it imperative to be timely with obligations. Being proactive in managing due dates is vital, and setting reminders or automating payments can help prevent the pitfalls related to delays. Ultimately, it’s all about maintaining responsibility and fostering a more secure financial future.

How Credit Utilization Influences Rate

Understanding how the balance you maintain on your cards in relation to your available limit can significantly impact your financial reputation is essential. This often-overlooked factor plays a crucial role when lenders assess your trustworthiness. Maintaining a smart approach to your expenditure can make a notable difference to the impression you leave on potential creditors.

Your spending habits reflect your ability to manage finances. When you utilize a large portion of your available limits, it raises a red flag. Lenders prefer to see a lower percentage of usage, typically under 30%, as this suggests responsible behavior and reduces perceived risk. If your ratio is high, it could indicate financial strain and unpredictable repayment capacity, ultimately leading to a decline in suitability for advantageous loans.

It’s also worth noting that this ratio isn’t only assessed by lenders when you apply for new credit but is continuously monitored. Regularly checking your usage can help you keep your figures in check and ensure you are on the right side of the financial scale. Striking a balance between utilizing your available resources and maintaining a favorable standing can go a long way in enhancing your overall monetary standing.

In conclusion, being mindful of how much of your credit limits you are using can be a game-changer. By keeping this ratio low, you can paint a positive picture of yourself to financial institutions and pave the way for future opportunities.