Understanding the Factors That Contribute to an Increase in Your Credit Score

Many individuals often wonder about the factors that can lead to an improvement in their financial reputation. It’s a topic that stirs curiosity, especially when one is striving for greater financial stability. In essence, a positive change in this metric can open doors to better opportunities, such as favorable loan conditions and lower interest rates.

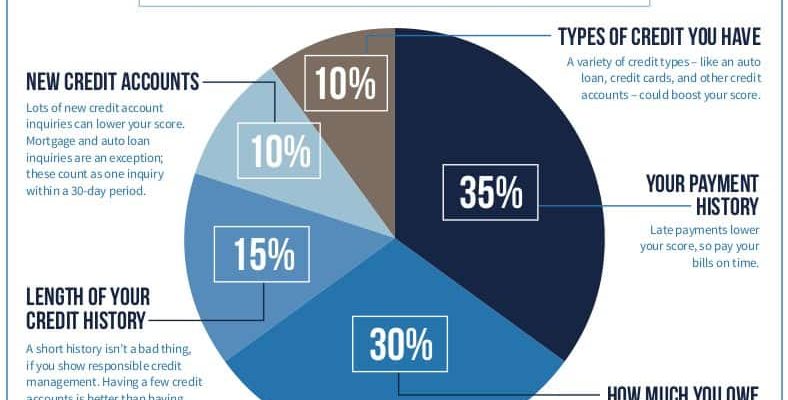

There are several key elements that contribute to this upward movement. Regular payment of obligations plays a significant role in shaping how financial institutions perceive individuals. Maintaining a disciplined approach to managing debt and making payments on time can bolster a person’s standing in the eyes of lenders.

Furthermore, the overall management of available resources and disciplined spending habits can have a profound impact. Making intentional choices, such as reducing outstanding balances and avoiding excessive borrowing, can lead to tangible improvements. Embracing these practices not only enhances one’s financial reputation but also fosters a more secure future.

Understanding Improvement Factors

It’s fascinating to explore the elements that contribute to enhancing one’s financial profile. People often wonder what actions can lead to a more favorable evaluation of their borrowing habits. Sometimes, it’s the little changes that make a big difference over time.

First off, maintaining timely payments plays a crucial role. Regularly settling debts and obligations on time demonstrates reliability to lenders. Each on-time payment sends a positive message about your commitment to managing financial responsibilities.

Another important aspect is keeping usage levels of available credit low. When individuals are mindful about how much of their limits they utilize, it signals prudent management. This is often referred to as keeping a low ratio, which is a key indicator of financial health.

Building a long-standing history with various types of financial instruments can also enhance one’s profile. Establishing a diverse portfolio of agreements reflects the ability to manage different forms of credit effectively. This varied experience can bolster overall trustworthiness in the eyes of financial institutions.

Add to that the importance of regular monitoring and dispute resolution. By staying proactive and addressing any inaccuracies, individuals can ensure that their financial representation remains accurate. This vigilance can lead to a significant uptick in their overall assessment strength.

Lastly, seeking professional guidance or educational resources can lead to better decision-making. Understanding how different factors interact helps one navigate the complex landscape of borrowing and repayment. With knowledge comes power, and making informed choices ultimately paves the way for improvement.

Effective Strategies to Boost Your Score

Improving your financial standing can feel like a daunting task, but with the right approach, it becomes entirely manageable. There are several simple yet impactful steps you can take to enhance your standing, paving the way for better opportunities and financial health. Let’s explore some of these strategies together.

One of the most effective tactics is to ensure timely payments. Habitually paying bills on time–be it loans or utility bills–can significantly elevate your profile. Setting up reminders or automatic payments can help in maintaining this discipline.

Additionally, keeping your utilization ratio low is crucial. This means not overwhelming your available funds. A good rule of thumb is to keep your usage below 30%. If possible, aim even lower for optimal results.

Moreover, regularly reviewing your financial history holds immense value. By checking for errors or outdated information, you can rectify issues that might be dragging you down. If you spot inaccuracies, promptly disputing them can lead to a quick boost.

Lastly, maintaining a diverse mix of accounts can also play a role. A healthy mix of revolving credit and installment loans demonstrates responsible management and enhances appeal. However, avoid opening too many new accounts at once, as it may signal riskiness.

With these straightforward strategies in hand, you’ll be well on your way to elevating your financial profile and enjoying the benefits that come with it.

The Role of Payment History in Ratings

When it comes to assessing financial trustworthiness, one element stands out as crucial. It reflects how consistently individuals manage their monetary obligations over time. This aspect serves as a major indicator of reliability, influencing overall evaluations immensely.

Each time payments are made on time or are missed, it leaves an imprint. Positive experiences, such as meeting deadlines, contribute significantly to a favorable impression. Conversely, late or missed payments can tarnish one’s reputation, often leading to negative consequences in evaluations. The more responsible behavior you exhibit, the clearer the message you send about your fiscal responsibility.

Moreover, this history takes into account various types of financial commitments, including loans, credit lines, and bills. A solid pattern of on-time payments showcases a dependable character. In contrast, frequent delays can result in setbacks that linger for years.

Ultimately, maintaining a strong track record is paramount. Investing time and effort into ensuring timely payments can yield remarkable benefits in enhancing one’s standing in the financial world. This small yet powerful habit could be the key to unlocking better opportunities and favorable conditions for future dealings.