Understanding the Reasons Behind the Decline of Your Credit Score

Managing personal finances can sometimes feel like navigating a maze. One of the critical components in this journey is a numerical representation that influences many aspects of financial life. Many people are often surprised to find that this figure can fluctuate, sparking a flurry of questions and concerns.

When that important number takes a dip, it can lead to uncertainty and anxiety. Various factors can contribute to this drop, and understanding them is essential for anyone looking to maintain a healthy financial profile. Recognizing the underlying reasons helps in making informed decisions that can positively impact financial wellbeing.

As we delve into the intricacies of what may cause a decrease in this vital indicator of financial reliability, it’s crucial to approach the topic with a clear mind. By highlighting potential pitfalls and misconceptions, you can better equip yourself to manage your fiscal responsibilities, ensuring a more stable future.

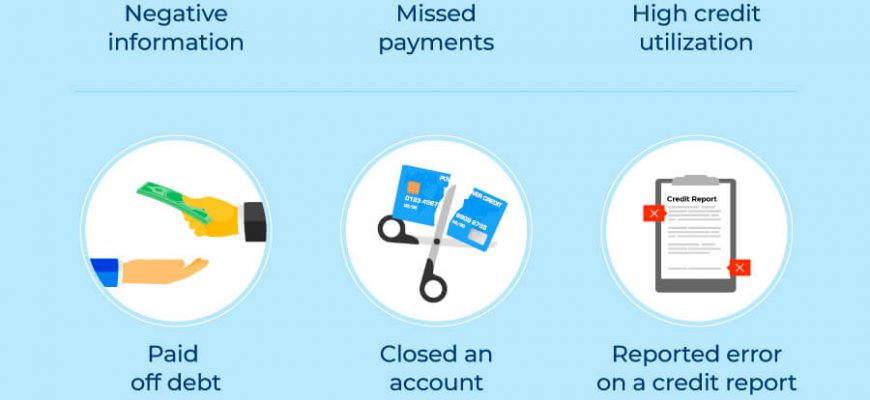

Factors That Lower Your Credit Score

Maintaining a healthy financial profile is essential for accessing favorable lending options and managing your expenses. However, certain behaviors and circumstances can negatively impact your financial reputation, making it harder to secure loans or obtain favorable interest rates. Understanding what influences this aspect of your finances can help you make better decisions and improve your standing over time.

One significant contributor to a diminished financial rating is late or missed payments. When bills are not settled on time, it signals to financial institutions that you may struggle with money management. High balances on revolving accounts can also be detrimental. Utilizing a large portion of your credit limits not only increases the risk of default but can also suggest to lenders that you are over-relying on borrowed funds.

Hard inquiries made when applying for new credit can further affect your status. Each application sends a signal to creditors that you are seeking additional financing, which can be interpreted as a sign of financial strain if done excessively within a short period. Additionally, the length of your credit history plays a crucial role; a brief or inconsistent record can create uncertainty for lenders about your reliability.

Lastly, managing different types of credit accounts is vital. A lack of diversity in your credit profile might raise concerns about your experience with different types of financial products. All these factors combined can lead to a less favorable evaluation, highlighting the importance of mindful financial habits and proactive management of your borrowing behavior.

Impact of Late Payments on Credit

When individuals fail to meet their financial obligations on time, it can significantly affect their overall financial health. Late payments can create ripples that reach far beyond just the immediate consequences, influencing various aspects of one’s financial standing.

One of the most noticeable effects is the potential decrease in the trustworthiness perceived by lenders. When payments are delayed, it signals a lack of reliability, which might result in higher interest rates on future loans or even denial of credit altogether. Lenders often view such behavior as a risk factor, prompting them to take precautionary measures.

Timeliness in payment plays a crucial role in maintaining a favorable financial image. Even a single lapse can linger on reports for a considerable duration, causing an unfortunate chain reaction. Over time, this can accumulate and lead to an unfavorable situation where accessing funds becomes an uphill battle.

Furthermore, late fees often accompany delayed payments, creating an additional financial burden. These fees not only add to the existing financial obligations but can also contribute to a cycle of difficulties that makes it harder to meet future commitments.

Ultimately, staying on top of payments isn’t merely about avoiding penalties–it’s about fostering a solid foundation for future financial endeavors. By prioritizing timely contributions, individuals pave their paths toward better opportunities and enhanced financial security.

How Credit Utilization Affects Ratings

When it comes to managing personal finances, one important factor can significantly influence how lenders view you. The way you handle your available borrowing limit plays a crucial role in shaping your financial reputation. Striking the right balance is essential for ensuring that your image remains strong in the eyes of institutions.

Understanding this balance is key. Utilization reflects the amount of borrowed funds relative to your total limits. Keep this ratio low, and you send a positive signal about your financial habits. However, if you find yourself using a large portion of your available credit, it can raise red flags. Lenders may interpret this as a sign of financial strain or over-reliance on borrowed funds.

Maintaining a healthy ratio is often recommended to remain in good standing. Aim for a figure around 30% or lower to showcase responsible usage. Additionally, paying off balances consistently not only helps maintain this ideal but also demonstrates reliability. Understanding these nuances can empower you to take control of your financial narrative.