Understanding the Reasons Behind Credit Karma’s Failure to Update Information

Keeping track of one’s financial standing has become increasingly important in our fast-paced world. With various tools available to consumers, ensuring that the information provided is timely and accurate can sometimes be a challenge. Users often find themselves puzzled when they notice that their financial reports aren’t reflecting the most current data. This lack of synchronization raises questions about the underlying systems and processes involved.

Many individuals rely on these platforms to gain insights and make informed decisions regarding their financial health. When the information provided appears stagnant, it can lead to confusion and frustration. Understanding the reasons behind these discrepancies can empower users to navigate their financial journeys more effectively.

It’s essential to explore the technical aspects and possible limitations of these services. Various elements can play a role in the refresh rates and accuracy of information received. By delving deeper, we can uncover potential reasons and solutions to enhance the user experience and ensure that financial management remains straightforward.

Common Reasons for Credit Karma Delay

There are several factors that can lead to a lag in the information you see on your financial monitoring service. Users often encounter situations where changes in their ratings or account details are not reflected as quickly as they might expect. Understanding these common issues can help clarify why your financial situation may appear stagnant.

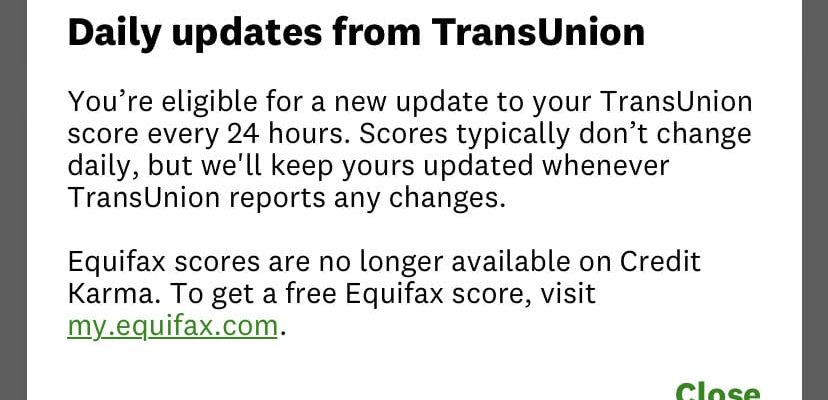

One frequent cause is the timing of updates from reporting agencies. These organizations may operate on a set schedule, which might not align perfectly with your own financial activities. Therefore, any recent alterations in your accounts, payments, or inquiries could take a bit of time before being captured in the system.

Another consideration is the platform’s periodic maintenance. Just like any other online service, technical overhauls or software updates can momentarily disrupt data visibility. During such times, accessing fresh information might be delayed as the system synchronizes or enhances its capabilities.

Additionally, if you’ve recently opened new accounts, there may be a delay in integrating this data. It can take some time for your new financial activities to be fully registered and processed across the network.

Moreover, occasional discrepancies in consumer data can lead to unforeseen delays. If there are inconsistencies in what the agencies report and what your service provider receives, it might take additional time for corrections to be made, impacting what you see.

Recognizing these scenarios can help manage expectations regarding the freshness of the information presented. Staying proactive and monitoring your accounts regularly ensures you’re always in the loop about your financial standing.

Understanding Your Score Updates

Keeping tabs on your numerical representation of financial health is essential. Many individuals find themselves puzzled when they notice inconsistencies or periods of inactivity in the information shared. It’s crucial to grasp how various elements contribute to the fluctuations in this crucial figure.

Several factors influence the regularity of updates:

- Timing of reporting from your lenders.

- A frequency of credit inquiries.

- The way in which accounts are managed over time.

- External influences like economic shifts.

Generally, financial institutions report to major organizations on a schedule, usually monthly. If your lender hasn’t reported recently, you might see a static number until they do.

Furthermore, if you’ve made recent requests for new lines of credit, those hard inquiries will impact your overall standings, potentially delaying further revisions. Staying aware of your financial activities can provide insight into why things seem stagnant.

Lastly, remember that shifts in the economy can have ripple effects. Changes in regulations or market conditions could mean your information takes longer to reflect on your profile. Stay proactive, check regularly, and make informed financial choices to maintain healthy visibility into your standing.

How to Troubleshoot Credit Karma Issues

Experiencing problems with your financial monitoring service can be frustrating. It’s important to pinpoint the root of the situation to ensure you’re getting the most accurate and up-to-date information. Luckily, there are several steps you can take to resolve any hiccups you might encounter.

First off, check your internet connection. A weak or unstable connection can lead to incomplete data loads. If you’re having issues, try switching to a different network or resetting your router. Sometimes, the simplest solutions are the most effective.

Next, consider the application or website itself. If you’re using an app, make sure it’s the latest version. Updates often contain fixes for various bugs that might be causing problems. For browser users, clearing the cache can also help resolve loading issues. Navigate to your browser settings and delete temporary files, then try accessing the service again.

Another point to investigate is linked accounts. If financial institutions linked to your profile are undergoing maintenance or have technical issues, it could affect the information displayed. Give it a little time and check back later to see if the situation has improved.

Lastly, don’t hesitate to reach out for help. Customer support can provide valuable insights or assist with specific errors you may be encountering. They’re equipped to help troubleshoot and can guide you through resolving your issues swiftly.

By following these steps, you can typically identify and fix the problem. Maintaining a healthy connection to your financial data is crucial, and addressing any issues promptly will ensure that you stay informed about your financial standing.