Understanding the Purpose and Benefits of Using Credit Karma for Your Financial Journey

In today’s fast-paced world, keeping track of one’s financial health has never been more crucial. Many individuals seek resources that offer insights into their monetary standing, helping them make informed decisions for a secure future. Having a clear understanding of personal finances empowers people to take charge, ensuring they are prepared for whatever comes their way.

There’s a wealth of information available, but not all of it is reliable or straightforward. This can lead to confusion and missteps when it comes to managing one’s funds. That’s where trusted platforms come into play, aiming to demystify the financial landscape and provide valuable tools and resources to those eager to enhance their understanding.

These platforms often provide significant advantages, from monitoring one’s financial journey to offering personalized guidance. While the financial ecosystem can be overwhelming, leveraging the right resources can make all the difference, enabling individuals to navigate their financial choices with confidence and clarity.

Understanding the Benefits of Credit Karma

If you’re navigating the world of personal finance, you likely want tools that simplify your journey. There’s a platform that offers valuable insights, guiding you through your financial landscape. This digital resource brings clarity, helping you make informed choices without the usual complexities.

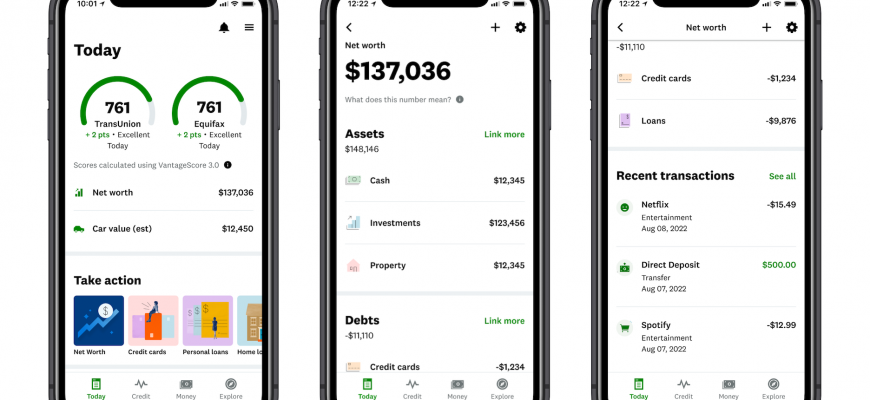

One of the standout advantages of this service is its ability to provide free access to your credit score. Knowing where you stand on the credit spectrum is essential for anyone looking to improve their financial situation. Additionally, the platform offers personalized recommendations tailored to your unique fiscal profile, ensuring you’re always moving in the right direction.

Another noteworthy feature is the educational content available. Articles, tips, and guides abound, making it easier for users to grasp financial concepts that might seem daunting at first. By enhancing your knowledge, you’re better equipped to tackle anything that comes your way, from loans to budgeting strategies.

Furthermore, monitoring changes in your credit status is seamless. You’ll receive alerts if there are fluctuations or potential issues, giving you the opportunity to address matters proactively. This kind of vigilance promotes peace of mind, ensuring that you remain in control of your financial health.

Ultimately, leveraging this service can empower you on your journey toward financial stability. With tools designed to support your needs, you can confidently stride forward, ready to seize opportunities and tackle challenges that lie ahead.

How This Platform Enhances Financial Literacy

Empowering individuals with knowledge about their finances is crucial for making informed decisions. This service offers tools and resources that help users understand various aspects of their economic health. By breaking down complex concepts into easily digestible information, it prepares individuals to navigate their financial journeys confidently.

Users can access a plethora of educational articles, personalized insights, and interactive tools designed to improve money management skills. These resources cover everything from budgeting to understanding credit scores, ensuring that people of all backgrounds can find something beneficial. The goal is to demystify the financial landscape, making it approachable for everyone.

Furthermore, the platform encourages users to stay engaged with their financial progress. By highlighting areas for improvement and providing actionable suggestions, it fosters a proactive approach. This commitment to education not only builds awareness but also empowers individuals to take charge of their financial futures.

Improving Your Score with Credit Monitoring Tools

Enhancing your financial standing can feel overwhelming, but utilizing the right resources can simplify the journey. One such tool provides insights and guidance on managing your financial health more effectively. It offers personalized recommendations and helps you track your progress seamlessly, making it easier to take control of your financial future.

Regular monitoring is key when it comes to boosting your score. By keeping an eye on your credit reports, you can identify areas that need attention. This platform allows you to check for inaccuracies or outdated information that could be dragging your score down. Plus, you can receive alerts about changes in your report, ensuring you’re always informed.

Another significant aspect is understanding the factors that influence your score. With tailored advice, you can learn which behaviors positively or negatively affect your overall rating. Implementing these suggestions could lead to noticeable improvements in your financial profile, potentially opening doors to lower interest rates and better financial products.

Additionally, educational resources highlight common pitfalls and best practices. Armed with this knowledge, you’re better equipped to make sound decisions regarding credit usage and repayment strategies. Over time, small, consistent efforts can lead to substantial growth in your financial reliability.