Understanding the Reasons Behind Financial Aid Refunds and What They Mean for Students

It’s not uncommon to experience a scenario where money comes back to you after securing monetary support for your education. This situation can leave many wondering about the underlying causes of such occurrences. Various factors contribute to these instances, and grasping them can help clarify your financial journey.

When it comes to educational finances, several elements can lead to surplus funds. These can range from changes in enrollment status to adjustments in tuition fees. Each aspect plays a crucial role in determining the final amount that students may receive, so a closer look at the intricate details can be quite enlightening.

Unraveling the complexities of this process is essential for anyone navigating the world of educational support. By understanding what influences these monetary returns, students can make better-informed decisions regarding their finances and educational investments.

Understanding Financial Assistance Returns

When it comes to educational support, many individuals might find themselves puzzled by the process of receiving excess funds after covering tuition and other essential expenses. It’s like discovering a little extra money in your wallet after a shopping spree. This section aims to unravel the mystery behind those additional funds that sometimes come your way after the school’s financial arrangements have been settled.

This surplus typically occurs when the amount allocated to you exceeds the actual costs incurred for enrollment. The leftover cash can ultimately help cover various other essentials, which can ease the financial burden many students face. So, instead of just being a mystery, these extra funds serve a purpose and can offer relief in other areas of student life.

It’s important to remember that this process isn’t arbitrary. Educational institutions follow specific guidelines and policies when determining the distribution of resources. Understanding your unique situation is crucial, as it can shed light on what to expect and how to best utilize any extra support you may receive.

How Refunds Impact Your Educational Finances

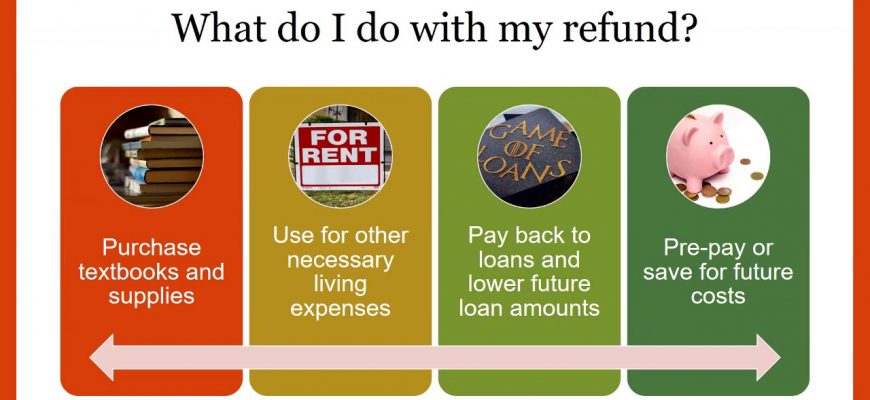

When students receive excess funds after covering tuition and essential expenses, it can significantly influence their budget and overall money management. These allocations often lead to opportunities for investing in additional courses, supplies, or other educational resources. However, understanding the implications of these funds is crucial for making the most of them.

While having extra cash may seem like a windfall, it’s essential to approach it thoughtfully. This financial boost can help cover unexpected costs, but it can also lead to overspending if not managed wisely. To ensure the best use of these resources, students should create a plan outlining their immediate and future educational needs.

Moreover, being aware of potential tax implications is equally important. Depending on how these funds are utilized, they might affect tax obligations in the long run. Students should stay informed about their responsibilities and seek guidance if necessary to navigate these waters successfully.

Ultimately, the impact of these contributions hinges on how they are handled. By budgeting effectively and remaining mindful of their choices, students can leverage these additional funds to enhance their educational journey rather than detract from it.

The Process Behind Receiving Financial Aid Refunds

Understanding the journey that leads to a surplus payment can be quite enlightening. When you enroll in an educational institution, a variety of resources are often set in motion to support your study endeavors. This mechanism not only helps cover tuition but also paves the way for additional expenses like books or living costs.

The initial step typically involves assessing your financial situation and determining eligibility for various programs. After this evaluation, the relevant financial resources are applied to your account. However, it’s not uncommon for the total amount allocated to exceed the cost of tuition and other related expenses.

When this occurs, the remaining balance is processed to be returned to you. This surplus can then be utilized for various educational purposes, beyond just paying for registered courses. Institutions often have specific timelines and procedures to initiate this transaction, so it’s wise to stay informed about the policies in place.

Finally, always keep an open line of communication with the administration. They can offer valuable insights into the stages involved in the process, ensuring you remain updated on when and how to expect your excess resources to arrive. Make the most of these funds to enhance your academic journey!