Understanding the Factors That Contribute to Increases in Credit Scores

There’s a fascinating world behind those elusive numbers that often dictate our financial opportunities. Many of us have pondered what exactly contributes to the increase in these metrics over time. It’s not just a random phenomenon; a variety of factors play a key role in how these figures evolve, impacting everything from loan approvals to interest rates.

As we dive deeper into this topic, we’ll uncover the subtle yet powerful changes that can lead to a boost in these figures. From timely repayments to prudent management of available resources, each action can have a significant ripple effect. Understanding this can empower you to make informed decisions that positively influence your financial standing.

Join us as we explore the various components and strategies that can help elevate your ratings, paving the way for greater financial freedom and opportunities. With the right knowledge in hand, you can turn what seems like mere numbers into a tool for unlocking your financial potential.

Understanding the Factors Behind Credit Score Increase

Improving your financial standing involves recognizing the elements that contribute to a positive change in your numerical representation of trustworthiness. Several factors play a crucial role in this process, and grasping them can empower you to make informed decisions about your financial journey.

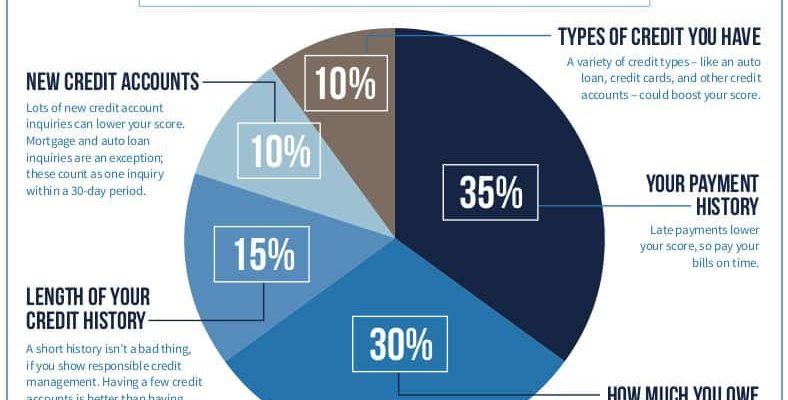

One of the primary components is payment history. Consistently meeting your obligations on time demonstrates reliability to lenders and can significantly benefit your overall ranking. Another vital aspect is the utilization ratio; keeping balances low relative to your available limits signals responsible credit management.

Additionally, the length of your financial history matters. A longer track record, showcasing stability, often results in a favorable assessment. It’s also important to diversify your types of borrowing. A mix of revolving credit and installment loans can enhance the overall picture of your financial behavior.

Lastly, new inquiries into your borrowing habits can have both positive and negative effects. While seeking new options may reflect proactive behavior, multiple requests in a short period might raise concerns. Balancing these factors can lead to a remarkable upgrade in how lenders perceive you.

Key Strategies to Boost Your Credit Rating

Improving your financial reputation may seem daunting, but there are effective ways to enhance your standing in the eyes of lenders. A few thoughtful actions can make a significant difference over time. Let’s explore several practical approaches that can help elevate your standing.

First off, always pay your bills on time. This habit demonstrates reliability to those assessing your financial behavior. Even one late payment can have a ripple effect, so set reminders or automate payments to keep everything on track.

Next, consider reducing your debt load. High balances compared to your available limits can negatively impact how lenders view you. Strive to pay down outstanding balances and aim to keep credit utilization below 30% for a stronger profile.

Additionally, diversifying your financial accounts can enhance your situation. Having a mix of installment loans and revolving credit can show that you can manage different types of obligations effectively, which can be appealing to potential creditors.

Moreover, regularly check your reports for errors. Mistakes happen, and a simple error can lower your standing. By keeping an eye on your records, you can address inaccuracies that might be harming your image.

Finally, refrain from opening too many new accounts at once. While having access to more options might be tempting, numerous inquiries in a short time can signal risk to lenders. Instead, be strategic and deliberate about any new accounts you pursue.

By following these steps, you can steadily build a healthier financial profile and demonstrate your readiness for responsible borrowing. Remember, it takes time, but the effort is well worth it for a brighter financial future.

The Role of Payment History in Improvement

A strong track record of timely payments plays a crucial part in boosting one’s financial profile. It’s all about demonstrating reliability and commitment. When you consistently meet your obligations, it signals to lenders that you are a trustworthy individual, capable of managing your responsibilities effectively.

Making payments on time is often regarded as one of the most significant factors influencing financial assessments. Every time you settle a bill or installment promptly, it adds to a foundation of trustworthiness. Conversely, late payments can hold you back, casting a shadow over your overall standing and making it challenging to gain favorable terms in the future.

Moreover, the length of this positive history also matters. The longer you maintain a clean slate, the more it reflects your reliability. Consistency over time not only enhances your standing but also increases confidence among potential lenders. Thus, developing a robust payment routine can significantly contribute to your financial journey.

In essence, nurturing a positive payment pattern becomes a vital strategy in elevating your standing. Practicing diligence and making timely settlements can lead to a brighter financial future, making it easier to secure favorable arrangements when needed.