Understanding the Reasons Behind Credit Card Hacking and Its Growing Threat

In today’s fast-paced world, the ease of electronic transactions has brought about a wave of convenience for millions of users. However, this convenience comes with a flip side. A variety of methods employed by malicious actors put personal financial information at risk, exposing users to potential threats.

Many people find themselves questioning how their sensitive details can be compromised. With the rising reliance on technology, hackers are constantly developing new tactics to exploit weaknesses in security protocols. This unsettling reality raises important concerns about the safety of financial interactions in the digital realm.

Understanding the factors that contribute to these breaches can empower individuals to take proactive measures. With greater awareness and vigilance, it is possible to navigate the intricate landscape of online transactions with more confidence. Staying informed is key to safeguarding personal information against illicit activities.

Common Vulnerabilities in Card Security

In today’s digital landscape, the safety of payment methods is paramount. However, certain weaknesses can leave sensitive financial information exposed. Understanding these flaws helps in taking steps to protect oneself and minimize risks associated with transactions.

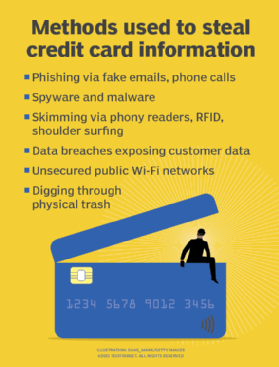

Phishing Attacks: One of the prevalent threats involves deceptive emails or messages that trick individuals into revealing personal information. Cybercriminals often mimic trustworthy sources, making it difficult for users to discern the legitimate from the fraudulent.

Weak Passwords: Utilizing easily guessable passwords remains a significant issue. Many individuals opt for simple combinations or reuse the same credentials across multiple platforms. This habit can turn a seemingly harmless account into a gateway for unauthorized access.

Unsecured Networks: Public Wi-Fi connections can pose a serious risk. When users access sensitive accounts on these open networks, they become vulnerable to interception by hackers lurking undetected, capturing valuable data.

Outdated Software: Neglecting regular updates can leave systems exposed to known vulnerabilities. Security patches often address weaknesses identified by developers, but failing to install these updates allows malicious actors to exploit outdated software.

Malware: Malicious software can infiltrate devices, capturing keystrokes and compromising sensitive information as it gets entered. This type of intrusion often goes unnoticed until the damage has been done.

Awareness of these common vulnerabilities is a crucial step in enhancing protection. By staying informed and taking proactive measures, individuals can better shield their personal information from potential threats.

Impact of Phishing Scams on Users

In today’s digital landscape, the threat of deceitful schemes has become increasingly prevalent, leaving many individuals vulnerable. These tactics not only strive to mislead users but can also lead to significant consequences in their financial and personal lives. Understanding the ramifications of such scams is crucial for navigating the online world securely.

Victims often face immediate financial losses, as unauthorized access to sensitive information can result in emptying bank accounts or incurring unexpected debts. Beyond the monetary aspect, the emotional toll is significant. Individuals may experience anxiety, stress, and a sense of violation, all stemming from the realization that their privacy has been compromised. The aftermath of these incidents can leave lasting scars on one’s trust in online transactions.

Moreover, the effects extend beyond the individual, impacting businesses and institutions as well. When users fall prey to these fraudulent activities, it can tarnish the reputation of companies involved, leading to a decline in consumer confidence. In the long run, organizations may face regulatory scrutiny and are often compelled to invest in more robust security measures to regain their customers’ trust.

Ultimately, awareness and education about these deceptive practices are paramount for everyone who interacts with digital platforms. By recognizing the signs of such scams, users can take proactive steps to safeguard their information and minimize the repercussions of falling victim to these malicious schemes.

How Data Breaches Occur and Affect Consumers

In today’s digital landscape, security incidents are becoming disturbingly common. These breaches often exploit vulnerabilities in systems, leading to unauthorized access to sensitive information. The repercussions can be quite severe for the individuals involved, impacting their finances and personal security.

Attackers typically employ various tactics, such as phishing or malware, to infiltrate databases and extract valuable data. Once they obtain this information, it can be sold on the dark web or used for fraudulent activities. As a result, consumers may find themselves facing unexpected charges, identity theft, or even worse, long-lasting damage to their credit history.

Moreover, the aftereffects of such breaches extend beyond immediate financial loss. Individuals often experience emotional stress and a sense of violation. Tracking down and resolving the aftermath can consume considerable time and energy, leaving victims feeling overwhelmed and vulnerable. It’s crucial for everyone to remain vigilant and take proactive steps to safeguard their private information.