Exploring the Reasons Behind Interest Charges on Credit Cards

When it comes to borrowing funds, there are often additional costs involved that borrowers need to understand. It’s not just about the amount borrowed; the terms associated with it can significantly impact one’s financial journey. Grasping these nuances is vital for anyone looking to manage their finances efficiently.

One common aspect of these financial transactions is the added expense incurred when repayment is delayed. This mechanism ensures that lenders can maintain their business while providing users with the flexibility to access funds when necessary. However, the way this extra cost is calculated and presented can sometimes be confusing.

The relationship between borrowed sums and the extra fees tied to them can feel like a tangled web. As we delve deeper into the world of borrowing, it becomes clear that understanding the rationale behind these expenses can empower individuals to make informed decisions and avoid potential pitfalls in their financial dealings. Let’s uncover the reasons behind these costs and explore how they affect the borrowing experience.

Understanding Credit Card Interest Rates

When it comes to borrowing money through plastic payment methods, many folks find themselves wondering about the extra fees that come into play. These costs can add up quickly, and it’s essential to grasp the underlying factors at work. This section dives into what influences the rates applied and how they affect the total amount one ends up paying over time.

Firstly, the rate attached to your borrowing isn’t just a random figure; it reflects a mix of market dynamics and individual financial profiles. Lenders assess various elements, including your credit behavior, to determine how much of a risk they’re taking on by allowing you to borrow. A higher risk might result in steeper fees, while those with a solid repayment history may enjoy more favorable terms.

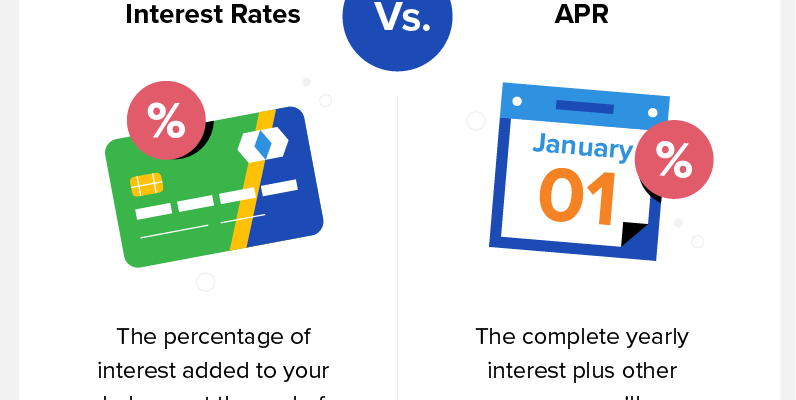

Another significant point is the type of calculation used to determine these expenses. Most establishments apply a method known as the annual percentage rate, which outlines the yearly cost of borrowing expressed as a percentage. Understanding this helps consumers make informed choices when deciding which options align best with their financial situations.

Ultimately, awareness of these rates and how they operate can lead to wiser spending habits. By paying attention to the terms and comparing various options available, individuals can make smarter financial decisions that align with their long-term goals.

Factors Influencing Credit Card Costs

When it comes to using plastic for purchases, several elements play a role in determining the overall expenses involved. Understanding these influential factors can help individuals make informed decisions and manage their financial commitments more effectively.

One significant aspect is the individual’s creditworthiness. Lenders evaluate payment history, outstanding debts, and overall financial behavior to set the terms of the agreement. A solid track record often results in more favorable conditions.

Another crucial component is the specific agreement between the lender and the user. Different financial institutions offer varying terms, including fees, annual contributions, and repayment options. Comparing these details can lead to smarter choices.

The type of transactions or activities also affects costs. Some expenditures may incur additional fees, while others may have promotional periods with reduced rates. Being aware of these variations can save money in the long run.

Lastly, economic factors, such as inflation rates and central bank policies, can indirectly impact how much users ultimately pay. Staying informed about broader financial trends helps users anticipate shifts in their expenses over time.

Impact of Interest on Debt Management

When individuals take on borrowing, the extra cost associated with it can significantly influence their financial decisions. This added expense not only affects how much money one needs to repay but also has ripple effects on budgeting and spending patterns. Understanding this concept is essential for anyone looking to maintain a healthy financial status.

One of the most critical aspects to consider is how the additional fees can accumulate over time. As repayments stretch out, the total amount owed can escalate, which can lead to a cycle of borrowing more to manage existing obligations. This often results in a precarious situation where individuals find themselves trapped in a loop, struggling to keep up with their payments.

Moreover, having a clear grasp of these costs can guide people in making informed decisions about their finances. Being aware of how these fees can alter the overall picture may encourage individuals to either pay off balances quickly or avoid taking on excessive amounts of debt altogether. Adopting strategies to manage or minimize these expenses can lead to improved financial outcomes and peace of mind.