Finding Your Credit Score on Equifax – A Step-by-Step Guide to Accessing Your Financial Information

Understanding your financial standing is essential in today’s world. It impacts your ability to make significant purchases, secure loans, or even rent an apartment. While many are aware of this importance, navigating through the maze of service providers to check this information can be a bit daunting.

For those looking to get a precise assessment of their financial health, knowing where to look and how to access such information is crucial. It’s not just about numbers but also about what those numbers represent in your financial journey.

If you’ve been wondering how to access this vital data directly from a specific agency, you’re not alone. Fortunately, a few steps can guide you on this path, ensuring you’re equipped with the knowledge you need to take charge of your financial future.

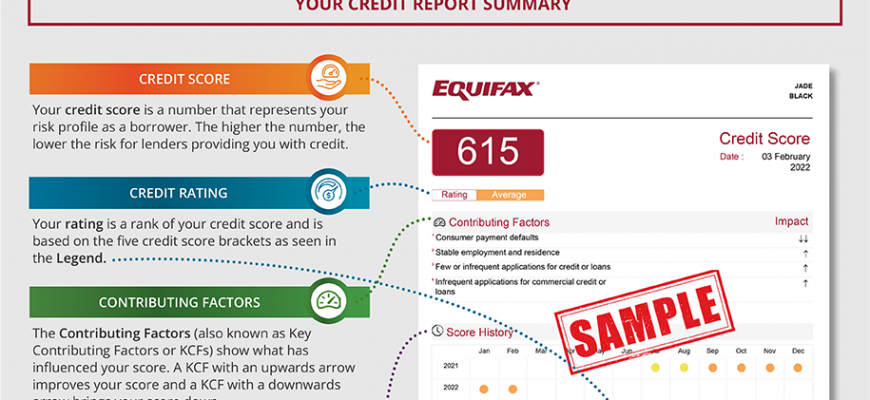

Understanding Your Equifax Credit Score

Grasping the ins and outs of your financial standing is essential to ensuring a healthy fiscal future. Many factors come into play when evaluating your financial reputation, and it’s crucial to be aware of these elements. This segment will walk you through the essential aspects that influence your rating, allowing you to take control of your financial journey.

Your financial history acts as a roadmap for lenders, providing insight into how you’ve managed your obligations over time. This history can include various elements such as your payment habits, the length of your credit relationships, and even the types of accounts you’ve opened. Understanding these components can empower you to make informed decisions regarding your future finances.

Another key aspect is the importance of regular monitoring. Keeping track of your financial standing can alert you to any discrepancies or potential issues before they escalate. Establishing healthy habits, like reviewing your information regularly, will contribute to your overall financial well-being. It’s all about staying proactive.

Finally, don’t forget that making positive strides can dramatically enhance your standing. Simple actions like paying bills on time, reducing outstanding balances, and avoiding unnecessary inquiries can make a notable difference. Embrace these practices as part of your financial routine, and you’ll likely see favorable outcomes in your ratings.

Accessing Your Financial Report Online

Monitoring your financial profile has never been easier, thanks to the digital tools available today. With just a few clicks, you can reveal essential information about your financial standing, empowering you to make informed decisions. Understanding this data is crucial for maintaining a healthy financial life.

Step 1: Begin by visiting the official website designated for accessing your personal information. Ensure that the site is secure and legitimate to protect your details.

Step 2: You’ll need to create an account or log in if you already have one. This usually involves providing your name, address, and social security number for verification purposes.

Step 3: Once logged in, navigate to the section where you can view your financial report. Here, you’ll find a wealth of information about your payment history, loans, and overall financial activity.

Step 4: Take the time to review your data carefully. Look for any discrepancies or unfamiliar entries. If anything seems off, you have the right to dispute inaccuracies.

Utilizing online resources not only simplifies the process but also keeps you informed about your financial journey. Regular checks can help you stay on track and open doors to better opportunities in the future.

Improving Your Rating Effectively

Boosting your financial standing may seem daunting, but with the right strategies, it can be a manageable task. Understanding the various elements that contribute to this can set you on a path toward a healthier financial profile. Here’s how you can enhance your situation step by step.

- Monitor Your Reports: Regularly check your financial records for inaccuracies. Mistakes can drag you down without your knowledge.

- Pay Bills on Time: Consistently meeting payment deadlines is crucial. Set reminders or automate payments to avoid missing due dates.

- Reduce Outstanding Balances: Focus on paying down debts. Aim to keep your utilization low by not maxing out available credit.

- Limit New Applications: Try to minimize the number of new accounts you open. Each application can temporarily ding your standing.

- Maintain Older Accounts: Having a longer history can positively impact your profile. Keep older accounts active, even if you rarely use them.

By implementing these strategies, you’ll create a solid foundation for growth. Stay patient and consistent in your efforts, and over time, you’ll likely see a positive shift in your financial standing.