Exploring the Path of Your Financial Aid Dollars and Understanding Their Impact

Have you ever paused to wonder what happens to the support you receive for your education? It’s an important question and one that many students ponder. When those resources land in your account, it sets off a chain of events that can be both exciting and a bit confusing.

From tuition fees to essential supplies, your support funds are allocated in various ways. Each dollar plays a pivotal role in shaping your learning experience. It’s more than just a sum; it represents opportunities, experiences, and sometimes sacrifices made along the way.

Let’s dive into how these resources are distributed and what that means for your academic journey. Understanding the path of your support can empower you to make informed decisions and get the most out of your investment in education.

Understanding Financial Aid Distribution

When you receive assistance for your educational pursuits, it can be a bit of a puzzle to figure out how those resources are allocated. The process encompasses several factors that determine how much you get and where it goes. It’s essential to grasp the underlying mechanics to appreciate its impact on your learning experience.

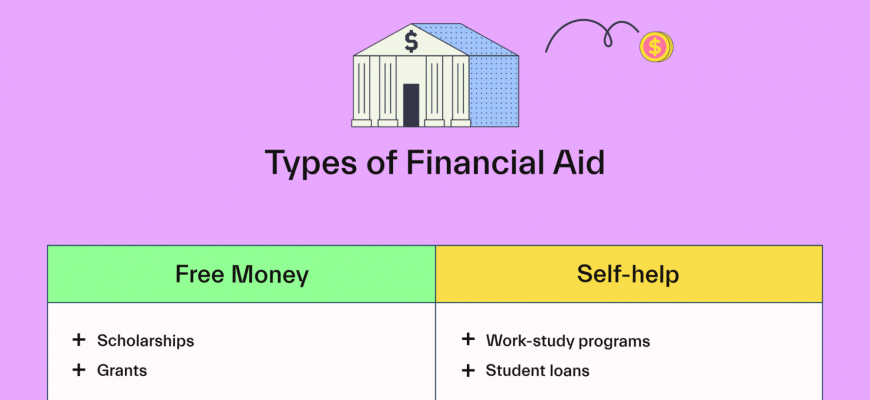

Initially, these resources are often divided into various categories, each serving specific purposes. For instance, a portion might be allocated for tuition costs, while another part could cover essential expenses like books and supplies. The overall goal is to support students in navigating their academic journey without an overwhelming financial burden.

Keep in mind, not everyone receives the same distribution. Individual circumstances play a significant role in determining the amount awarded. Factors such as financial health, enrollment status, and program choice can all influence how resources are shared. Understanding these criteria is vital to ensure you maximize any assistance offered.

Additionally, knowing the timeline of disbursement is crucial. Assistance typically comes in staggered payments throughout the semester or academic year. This approach helps students manage their expenses more effectively rather than overwhelming them with a lump sum. Being aware of when to expect each disbursement can help you plan accordingly.

In summary, comprehending how support is distributed can empower you to make informed decisions about your education. The clearer you are on expectations, allocations, and timelines, the better equipped you’ll be to navigate your academic journey with confidence.

How Grants and Scholarships Function

Understanding how certain types of funding operate can be quite enlightening. These resources play essential roles in supporting individuals on their educational journeys, making learning accessible to many who might otherwise struggle. Instead of relying on loans, students can explore these opportunities, which often come with specific advantages.

Grants are typically awarded based on various criteria, often focused on need or specific circumstances. They come from a range of sources, including government programs and private organizations. The good news is, unlike loans, they don’t require repayment, which makes them a desirable option for many. As long as recipients meet the required obligations, such as maintaining their enrollment status or meeting academic standards, they can benefit greatly from this support.

Scholarships, on the other hand, are often granted based on merit, talent, or particular characteristics, like academic performance or involvement in extracurricular activities. Many organizations, schools, and businesses create these opportunities to encourage excellence and diversity in education. Just like grants, scholarships generally don’t require repayment, allowing recipients to focus more on their studies rather than financial burdens.

Understanding repayment obligations and interest charges is crucial for anyone navigating the world of borrowing. When you take out loans, the journey doesn’t end with approval; there are important aspects to keep in mind about how it all unfolds over time.

Managing repayment means being aware of how your choices can affect your future. Here are some key points to consider:

- Interest Rates: These figures dictate how much extra you will pay over the life of the loan. Fixed rates remain steady, while variable rates may fluctuate.

- Loan Terms: The duration of your loan impacts monthly payments and total interest paid. Shorter terms typically mean higher payments but lower overall costs.

- Grace Periods: Many loans offer a buffer period after graduation before you must start payments. Use this time wisely to plan your budget.

- Amortization: This refers to how your payments are distributed over the loan term. Knowing how this works can help you visualize your repayment strategy.

Taking the time to understand these elements can lead to smarter borrowing and long-term financial health. Being proactive about repayment and staying informed ensures you’re ready for what lies ahead.