The Historical Timeline of Credit Mobilier and Its Significance

In the realm of finance, certain establishments have left an indelible mark on history, shaping economies and influencing the very fabric of banking. This particular institution, renowned in its field, emerged as a key player during a pivotal period. Its journey from inception to prominence is not just a tale of numbers and transactions but one enriched with ambition, innovation, and sometimes controversy.

Understanding the timeline surrounding this organization’s formation and evolution helps grasp the broader economic landscape of its time. It played a crucial role in facilitating investment and supporting infrastructural development, ultimately contributing to the prosperity of various sectors. Through strategic partnerships and visionary leadership, it navigated challenges that defined its legacy.

Joining us as we delve into the significant milestones that marked its establishment, we will uncover the circumstances that led to its creation. This exploration promises insight into the dynamics of a financial titan, revealing how historical events shaped its operations and ethos.

Historical Overview of Credit Mobilier

In the mid-19th century, a prominent financial institution emerged, playing a crucial role in the development of American infrastructure. This entity focused on funding various construction projects, especially within the railway sector. It quickly became synonymous with the rapid expansion of transportation networks, reflecting the economic ambitions of the time.

The organization’s establishment marked a significant shift in how investments were approached, combining private funds with large-scale public projects. This novel model attracted considerable attention, both for its successes and the controversies it sparked. As the railways expanded, so did the reach of this financial powerhouse, influencing a wide array of industries beyond just transportation.

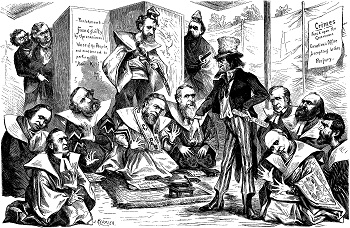

However, the story took a turn as the company became embroiled in political scandals. Allegations of unethical practices surfaced, leading to widespread criticism and ultimately shaking public trust. This tumultuous period underscored the complexities and challenges faced by investors and policymakers alike, highlighting the intersection of finance, politics, and public interest.

Despite the controversies, this financial institution’s legacy endures, serving as a pivotal chapter in the narrative of economic growth in America. Its story reflects not only the triumphs of ingenuity but also the pitfalls of ambition, offering valuable lessons for contemporary financial ventures.

Significant Events in Its Timeline

Throughout its journey, this financial institution has experienced a series of pivotal moments that not only shaped its identity but also influenced the broader economic landscape. Each incident marked a turning point, contributing to its legacy while reflecting the dynamic environment of the times.

In the early days, a groundbreaking initiative pushed the boundaries of contemporary banking practices, setting a foundation for future innovations. As the years progressed, strategic partnerships emerged, leading to an expansion that reached far beyond initial expectations. This growth phase was marked by both triumphs and challenges, showcasing the resilience of its management.

The notorious scandal that rocked the organization in the latter half of the 19th century brought widespread attention. This event not only highlighted vulnerabilities within the financial system but also sparked reforms aimed at increasing transparency and accountability in banking operations.

Fast forward to the 20th century, and recovery from past missteps paved the way for renewed trust among investors and clients. The institution reinvented itself, embracing modern techniques and technologies that aligned with the evolving needs of society. This adaptation enabled it to thrive amidst competition and economic fluctuations.

As the present unfolds, continuing to navigate the complexities of the global market, the legacy built over decades remains a reference point. Reflecting on these significant milestones allows for a deeper understanding of its past and the pathways that led to current standing.

Impact on American Financial Landscape

The establishment of this financial institution reshaped the economic environment in the United States, introducing new levels of complexity and innovation. Its influence reverberated through various sectors, leading to increased investment and development opportunities. The ripple effects can still be felt today, underscoring its significance in the evolution of finance.

One of the primary outcomes of this establishment was the expansion of banking practices and investment strategies. It encouraged individuals and businesses to engage more actively in financial markets, fostering an entrepreneurial spirit. This shift contributed to the growth of a modern economy that embraced risk and sought higher rewards.

Moreover, the institution played a pivotal role in shaping regulatory frameworks. As its practices drew attention, lawmakers recognized the need for better oversight and consumer protection. This ultimately led to the creation of guidelines that aimed to stabilize the banking system and protect the public’s interests.

The emergence of new funding avenues was another significant impact. By facilitating easier access to capital, it allowed a myriad of projects–from infrastructure to industrial initiatives–to gain traction. This transformation not only bolstered local economies but also laid the groundwork for national development.

In summary, the influence of this financial powerhouse was profound. It instigated change that reshaped the banking sector and set the stage for modern financial practices, leaving a legacy that continues to inform and inspire the financial world.

Legacy and Lessons Learned Today

The impact of significant financial institutions from the past continues to echo in contemporary society. Their operations and the ensuing challenges offer a wealth of insights that remain relevant for today’s economic landscape. Understanding these historical contexts helps us navigate modern markets more wisely.

Here are some key takeaways that stand out:

- Transparency is Crucial: Clear communication and openness in financial dealings build trust and promote stability.

- Avoiding Over-Leverage: Biting off more than one can chew in terms of debt can lead to dire consequences, as history has shown.

- Regulatory Oversight: Strong regulations are essential to safeguard against potential exploitation and fraud.

- Public Sentiment Matters: Ignoring the needs and concerns of the community can trigger backlash and loss of credibility.

- Innovation Must Be Balanced: While progress is vital, it should be pursued with caution to prevent unforeseen pitfalls.

Reflecting on past experiences enables current and future financial leaders to devise strategies that not only foster growth but also ensure sustainability and integrity. Learning from mistakes can lead to more resilient systems that support everyone involved.