Understanding Unsettled Credits in Zerodha and Their Impact on Trading

In the world of trading, managing your finances effectively is just as crucial as making the right investments. Sometimes, you may notice that a portion of your funds isn’t readily available for use. This phenomenon can be perplexing, especially if you’re accustomed to having continuous access to your resources. There could be several reasons behind this scenario, and grasping the underlying concepts can help you navigate your trading experience more smoothly.

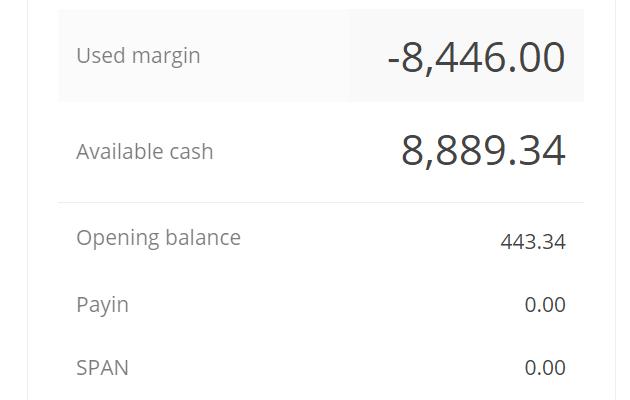

Imagine a situation where you’ve made a recent transaction, but the resulting amount hasn’t yet cleared. It can feel like you are in limbo, waiting for your money to become usable while you plan your next moves. Understanding how these transactions work and the timelines involved is essential for any trader aiming to optimize their financial strategies.

In this discussion, we will explore the intricacies of these delayed funds, shedding light on what influences their availability. By arming yourself with knowledge, you can make informed decisions and enhance your trading journey. Let’s dive into the details and clarify everything you need to know about this essential aspect of trading.

Understanding Unsettled Credits in Zerodha

In the world of trading, there’s often a bit of a waiting game involved, especially when it comes to transactions. This stage may lead to some confusion, as it represents a period where certain financial entries are in limbo. During this time, balances might appear, but they aren’t yet fully processed and could cause uncertainty for traders trying to manage their funds.

It’s crucial to grasp the mechanics behind this temporary stasis. Transactions that are still processing will impact your available balance and can sometimes lead to miscalculations in your trading strategy. Understanding how long these waiting periods last and what they entail is key for anyone looking to navigate the trading platform effectively.

Investors should note that the timing can vary based on the type of transaction and the underlying regulations. Familiarizing yourself with these details can help mitigate any confusion and empower you to make informed decisions. Keeping an eye on your account activity during these phases can ensure smoother trading experiences and financial planning.

Impact on Trading Strategy and Decisions

Navigating the world of trading can be quite a challenge, especially when certain situations arise that disrupt the normal flow of transactions. These disruptions can lead to unexpected consequences, influencing how traders approach their strategies and make critical decisions. Understanding these effects is essential for maintaining a competitive edge in the market.

First and foremost, the unpredictability caused by such disruptions can force traders to reassess their risk tolerance. When funds are momentarily in limbo, it can limit the ability to execute planned trades, compelling individuals to either hold off on their strategies or adapt quickly to the circumstances at hand. This shift can lead to a more cautious approach, where traders might opt for safer investments or come up with alternative strategies that align with their current financial standing.

Moreover, this situation can affect emotional decision-making. Traders may experience anxiety or frustration, prompting impulsive reactions that deviate from their original trading plans. It’s vital to recognize these feelings and maintain a rational mindset, as emotional trading can often lead to losses rather than gains. Establishing a disciplined framework for decision-making can help mitigate these risks.

Additionally, the impact on liquidity becomes a significant factor. Limited access to available resources can hinder opportunities for capitalizing on favorable market conditions. Traders might find themselves needing to adjust their strategies, perhaps by focusing on less capital-intensive trades or utilizing different financial instruments that require lower initial investments.

Ultimately, these disruptions can serve as a valuable lesson for traders. They highlight the necessity of having contingency plans and being prepared for unexpected hurdles. Building flexibility into strategies can prove beneficial, allowing traders to pivot as needed while maintaining a clear focus on their long-term objectives.

Steps to Resolve Pending Transactions

Encountering pending transactions can be frustrating, but worry not! There are straightforward steps you can take to clear things up. Addressing these situations promptly is essential to maintain a smooth trading experience.

Step 1: Check Your Account Statement

Start by reviewing your account statement for details surrounding the transaction in question. This will provide clarity on what has occurred and help identify the cause of the delay.

Step 2: Verify Transaction Status

Next, check the current status of the transaction within your trading platform. This will help you understand whether it’s still in processing or has encountered an issue.

Step 3: Contact Customer Support

If you’re uncertain about the status or need further assistance, reach out to customer support. They can provide specific information regarding your situation and guide you through resolving any issues.

Step 4: Follow Up

Keep track of your communications and ensure you follow up if the situation isn’t resolved in a timely manner. Persistence can lead to quicker solutions.

Step 5: Document Everything

Maintain a record of all correspondences related to the matter. This documentation can be helpful in case of future issues and provides a reference point for discussions with support.

By following these steps, you’ll be better equipped to tackle any complications and enhance your overall trading experience.