Upcoming Changes to Universal Credit Payment Rates and Their Impact on Recipients

It’s a topic that affects many and often raises questions about how changes in support systems influence people’s lives. The enhancements in financial provisions can significantly ease the burden for families and individuals facing challenging circumstances. With all the discussions surrounding improvements, it’s vital to stay informed and understand what these changes entail for your everyday life.

Recent updates have sparked interest among those relying on government aid, as revisions can provide much-needed assistance to those navigating financial hardships. Understanding the timing and scale of these adjustments can be crucial for planning budgets and making informed decisions. Everyone deserves to know how these shifts can impact their day-to-day living.

In this article, we’ll dive into the specifics surrounding the upcoming adjustments to financial support programs. By shedding light on the details, our aim is to equip readers with the knowledge they need to manage their finances effectively during this transition. Stay tuned to discover what lies ahead and how it can benefit you or someone you know.

Understanding Adjustments to Financial Support

In this section, we’ll dive into how enhancements to financial assistance are determined and what factors come into play. It’s essential to grasp the underlying mechanics that influence variations in support amounts, as this can have a significant impact on individuals relying on these funds.

Factors influencing increases include inflation rates, changes in living costs, and government policies aimed at assisting those in need. These elements can lead to periodic evaluations and necessary modifications of the financial support mechanisms in place, ensuring people are not left behind in challenging times.

Moreover, it’s valuable to consider how these adjustments affect personal budgets. When assistance levels are altered, recipients often need to reassess their spending and savings strategies. Being proactive about financial planning can make a notable difference in managing daily expenses and overall well-being.

Overall, understanding these adjustments helps individuals navigate the complexities of financial aid, allowing for better preparedness and adaptability in an ever-changing economic landscape.

Factors Influencing Payment Increases

Several elements come into play when discussing the adjustments to assistance amounts. Numerous factors can impact how much support an individual receives over time. Changes in economic conditions, policy updates, and personal circumstances all play a crucial role in determining these financial adjustments.

Economic trends significantly affect funding decisions. Inflation rates, for instance, can lead to an increase in living costs, prompting authorities to reevaluate support levels. Additionally, government budget allocations and priorities shift with changing administrations, which can also influence financial provisions.

Policy changes are another vital aspect. New legislation or reforms aimed at social welfare can create opportunities for increased support. These modifications may stem from public advocacy, research findings, or shifts in societal needs, highlighting the importance of staying informed about policy discussions.

Finally, personal circumstances such as changes in employment status, family size, or health conditions can lead to alterations in financial support. Each individual’s situation is unique, and assessments often reflect these differences, ensuring that assistance is tailored to those in need.

Impacts of Benefit Adjustments

The changes in financial support systems can have a significant influence on people’s lives and overall wellbeing. These modifications often provoke a mix of responses, affecting not only individuals but also families and communities. Understanding the implications helps shed light on the broader social landscape.

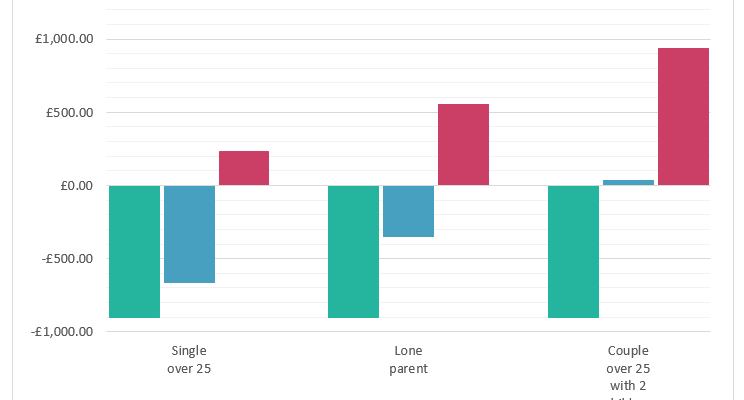

One major outcome of alterations in these assistance programs is the adjustment in household budgets. For many, these shifts mean the difference between a stable lifestyle and financial strain. Families may find themselves needing to reassess their spending habits, leading to crucial decisions about necessities versus luxuries.

Another noteworthy consequence revolves around mental health. Individuals facing uncertainty in their financial support can experience increased stress and anxiety. This emotional toll can impact not only the person directly affected but also extend to their loved ones, creating a ripple effect throughout the household.

The adjustments can also influence accessibility to essential services. When funds fluctuate, people may struggle to afford basic needs such as housing, food, and healthcare. This can lead to a cycle of disadvantage that is hard to escape, further complicating their situation.

Communities, too, feel the effects. Local economies might experience shifts as consumer spending varies with changes in financial aid. Businesses may adapt by altering the goods and services they offer, ultimately shaping the community’s character and resilience.